Get the free mu3 idaho form - finance idaho

Show details

Mail: Idaho Department of Finance P.O. Box 83720 Boise, Idaho 83720-0031 208/332-8000 Overnight: Idaho Department of Finance 800 Park Blvd., Ste 200 Boise, Idaho 83712 IDAHO REGULATED CONSUMER LENDER

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your mu3 idaho form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mu3 idaho form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

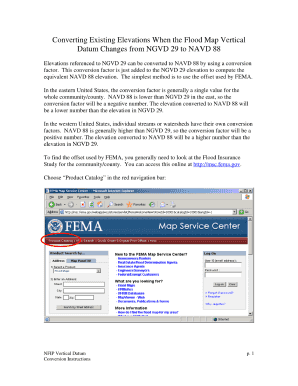

Editing mu3 idaho form online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mu3 idaho form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

How to fill out mu3 idaho form

How to fill out mu3 Idaho form:

01

Start by gathering all the necessary information and documents such as your personal details, financial information, and any relevant identification numbers.

02

Carefully read and understand the instructions provided with the mu3 Idaho form. Make sure you are aware of any specific requirements or additional documentation that may be needed.

03

Begin filling out the form by providing your personal information accurately. This may include your full name, address, contact details, and social security number.

04

Move on to the financial section of the form where you will be required to provide details about your income, assets, and liabilities. Make sure to provide accurate and up-to-date information.

05

If applicable, fill out any additional sections or forms that may be included with the mu3 Idaho form. This could include sections on tax deductions, health insurance, or any other relevant topics.

06

Double-check all the information you have provided to ensure accuracy and completeness. Any mistakes or missing information could delay the processing of your form.

07

Sign and date the completed mu3 Idaho form. If you are filling out the form electronically, follow the instructions provided for electronic signatures.

Who needs mu3 Idaho form:

01

Individuals who have financial activities or interests in the state of Idaho may need to fill out the mu3 Idaho form. This includes residents, non-residents, and businesses operating within the state.

02

The mu3 Idaho form is typically required for reporting purposes, such as tax filings or financial disclosures. It helps ensure compliance with state regulations and allows the government to track and monitor financial activities within the state.

03

The specific circumstances in which someone may need to fill out the mu3 Idaho form can vary. It is essential to consult with a tax professional or refer to the instructions provided with the form to determine if you are required to file it.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mu3 idaho form?

The mu3 Idaho form is a tax form used by businesses in Idaho to report and remit their quarterly sales and use taxes.

Who is required to file mu3 idaho form?

Any business that sells goods or services subject to sales tax in Idaho is required to file the mu3 Idaho form.

How to fill out mu3 idaho form?

To fill out the mu3 Idaho form, businesses need to provide information about their sales and use tax collections, deductions, and any credits or exemptions claimed. This information should be accurately reported in the designated sections of the form.

What is the purpose of mu3 idaho form?

The purpose of the mu3 Idaho form is to facilitate the reporting and collection of sales and use taxes from businesses operating in Idaho. It allows the state to track taxable sales, ensure compliance with tax laws, and calculate the appropriate amount of tax owed.

What information must be reported on mu3 idaho form?

The mu3 Idaho form requires businesses to report their total taxable sales, deductions, exemptions, credits, and the amount of tax due for the specified reporting period.

When is the deadline to file mu3 idaho form in 2023?

The deadline to file the mu3 Idaho form in 2023 is April 30th for the first quarter, July 31st for the second quarter, October 31st for the third quarter, and January 31st for the fourth quarter.

What is the penalty for the late filing of mu3 idaho form?

The penalty for the late filing of the mu3 Idaho form is 2% of the tax due for each month or fraction of a month that the return is filed late, up to a maximum penalty of 20% of the tax due.

How can I manage my mu3 idaho form directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your mu3 idaho form and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I sign the mu3 idaho form electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your mu3 idaho form in seconds.

How do I edit mu3 idaho form on an iOS device?

You certainly can. You can quickly edit, distribute, and sign mu3 idaho form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your mu3 idaho form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.