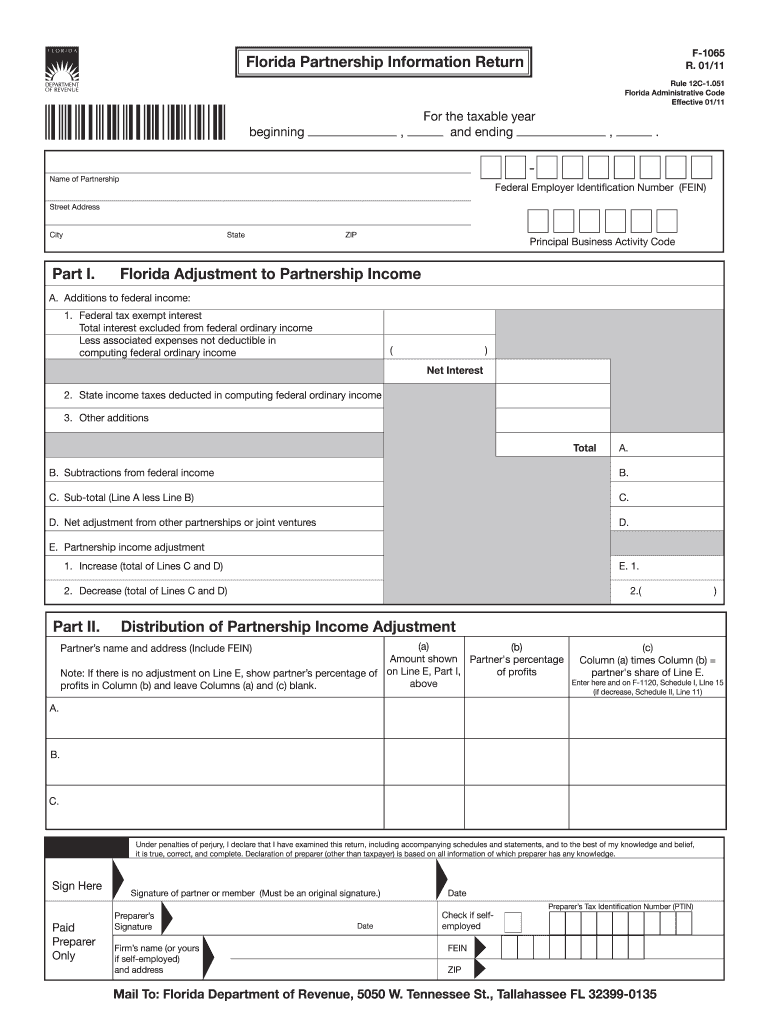

FL DoR F-1065 2011 free printable template

Show details

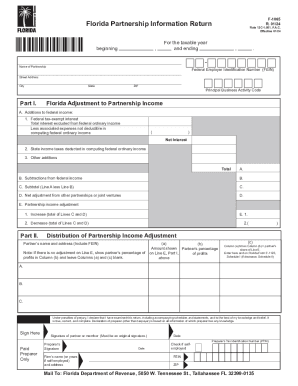

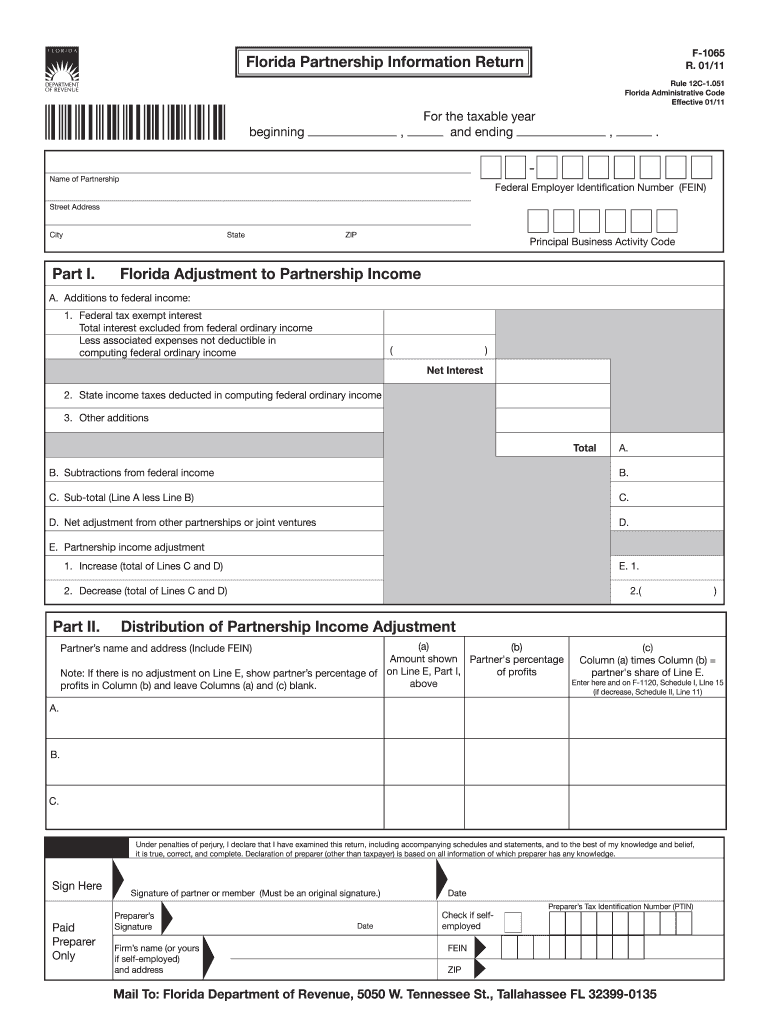

Florida Partnership Information Return For the taxable year and ending F-1065 R. 01/11 Rule 12C-1.051 Florida Administrative Code Effective 01/11 beginning, Name of Partnership Street Address.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your florida form f 1065 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your florida form f 1065 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

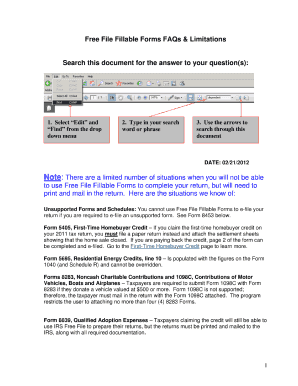

Editing florida form f 1065 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit florida form f 1065. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

FL DoR F-1065 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out florida form f 1065

How to fill out Florida form F 1065:

01

Gather all necessary information and documents before starting the form. This includes the partnership's name, address, federal employer identification number (FEIN), and the names and addresses of all partners.

02

Provide the required information in the appropriate sections of the form. This includes the beginning and ending dates of the partnership's taxable year and the principal business activity.

03

Report the partnership's income and expenses in the designated sections. Include any deductions, credits, or adjustments that apply.

04

Allocate the income, deductions, and credits among the partners according to the partnership agreement. This should be done using Schedule K-1, which must be attached to the form.

05

Calculate the partnership's total tax liability and make any necessary payments. This can be done by referring to the instructions provided with the form.

06

Complete all required schedules and forms that are applicable to your partnership. This may include Schedule B for interest and dividends, Schedule D for capital gains and losses, and Schedule K for analyzing partner contributions and distributions.

07

Review the completed form for any errors or missing information. Make sure all calculations are accurate and all required attachments are included.

08

Sign and date the form, both as the preparer and as the partner, if applicable. Keep a copy of the completed form and all supporting documents for your records.

Who needs Florida form F 1065:

01

Partnerships that are engaged in a trade or business and have at least one partner that is an individual, a corporation, a Limited Liability Company (LLC), or a non-resident entity.

02

Partnerships that have income, deductions, or credits to report for the taxable year.

03

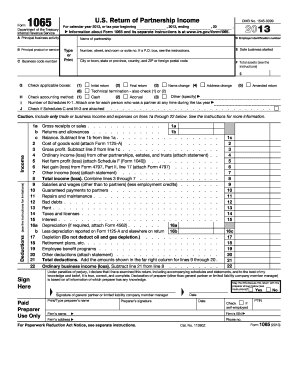

Partnerships that are required to file a federal partnership return (Form 1065) with the Internal Revenue Service (IRS).

Note: It is recommended to consult with a tax professional or refer to the instructions provided with the form for more specific guidance on filling out Florida form F 1065 based on your partnership's unique circumstances.

Fill form : Try Risk Free

People Also Ask about florida form f 1065

Does Florida have a state income tax for residents?

Who must file Florida F-1065?

What is the penalty for filing F-1065 late in Florida?

Can Florida F-1065 be filed electronically?

Do Florida residents need to file a state tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is florida form f 1065?

Florida Form F-1065 is the Partnership Information Return form for partnerships in the state of Florida.

Who is required to file florida form f 1065?

Any partnership that conducts business or earns income in Florida is required to file Florida Form F-1065.

How to fill out florida form f 1065?

To fill out Florida Form F-1065, you will need to provide information about the partnership, including its name, address, and federal employer identification number (EIN), as well as information about the partners and their distributive shares of income, deductions, and credits.

What is the purpose of florida form f 1065?

The purpose of Florida Form F-1065 is to report the income, deductions, and credits of a partnership to the state of Florida for tax purposes.

What information must be reported on florida form f 1065?

On Florida Form F-1065, you must report the partnership's income, deductions, credits, and other information related to the operations of the partnership.

When is the deadline to file florida form f 1065 in 2023?

The deadline to file Florida Form F-1065 in 2023 is usually April 15th, but it may vary depending on different circumstances. It is advisable to check with the Florida Department of Revenue for the exact deadline.

What is the penalty for the late filing of florida form f 1065?

The penalty for the late filing of Florida Form F-1065 is typically calculated based on the number of days past the due date multiplied by the partnership's total tax liability. The exact penalty amount may vary depending on the specific circumstances.

How can I send florida form f 1065 to be eSigned by others?

When you're ready to share your florida form f 1065, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out the florida form f 1065 form on my smartphone?

Use the pdfFiller mobile app to complete and sign florida form f 1065 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How can I fill out florida form f 1065 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your florida form f 1065 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your florida form f 1065 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.