Get the free Estimated Tax Payment 2006 - mass

Show details

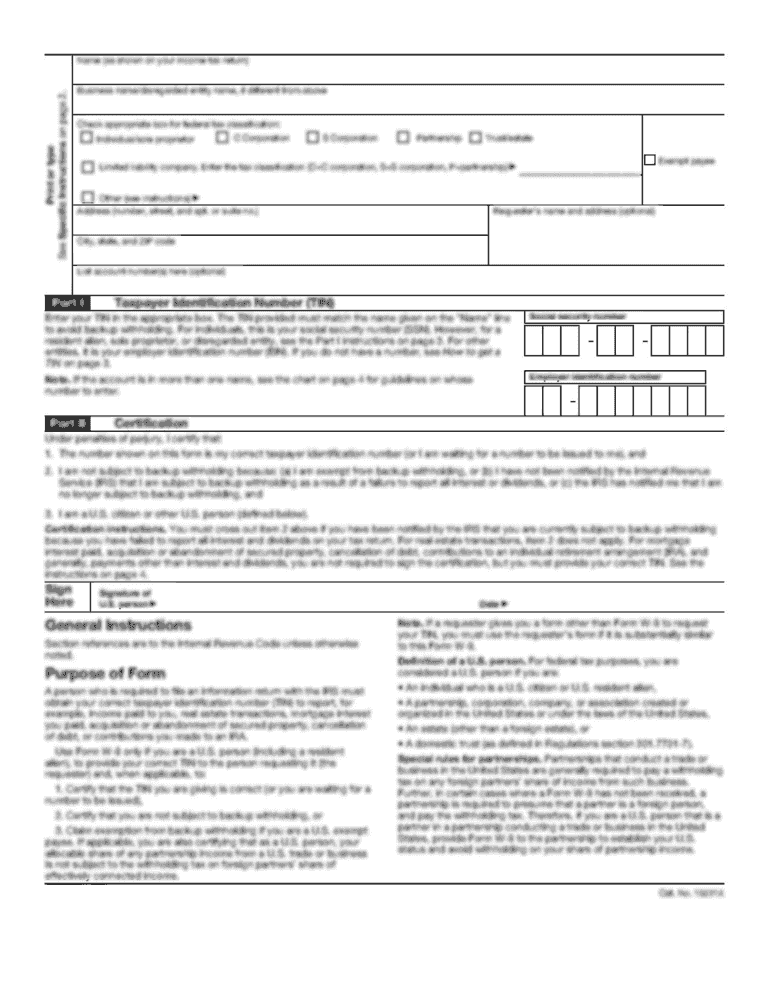

2-ES Massachusetts Department of Revenue Federal Identification number Estimated Tax Payment 2006 Voucher 1 For filers of Forms 2, 3F and 3M Be sure this return covers correct period Due date Voucher

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your estimated tax payment 2006 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estimated tax payment 2006 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing estimated tax payment 2006 online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit estimated tax payment 2006. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out estimated tax payment 2006

How to fill out estimated tax payment 2006:

01

Gather all necessary documents, such as your previous year's tax returns, income statements, and any relevant deductions or credits.

02

Calculate your estimated tax for the year. This can be done using Form 1040-ES or electronic payment options available on the IRS website.

03

Determine the payment schedule. The deadlines for estimated tax payments in 2006 were April 17, June 15, September 15, and January 16 of the following year. Make sure to pay the correct amount by each due date.

04

Complete Form 1040-ES or the appropriate electronic payment form. Provide accurate personal information, estimate your income, deductions, and credits, and calculate the estimated payment amount.

05

Send your payment to the IRS. You can choose to pay online, by phone, through the Electronic Federal Tax Payment System (EFTPS), or by mailing a check or money order. Make sure to include your payment voucher, which can be found on Form 1040-ES or generated through the electronic payment system.

Who needs estimated tax payment 2006:

01

Individuals who expect to owe more than $1,000 in federal taxes for the year, after subtracting any withholding or refundable credits.

02

Self-employed individuals, freelancers, and independent contractors who expect to owe more than $500 in self-employment tax.

03

Partnerships, S corporations, and other entities that pass through income to their owners, who expect to owe at least $500 in taxes.

Note: It is important to consult with a tax professional or refer to IRS guidelines for specific eligibility and requirements for estimated tax payments in 2006.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is estimated tax payment?

Estimated tax payment is a method of paying taxes on income that is not subject to withholding tax, such as self-employment income, rental income, and investment income. It is a way for individuals and businesses to make quarterly payments to the IRS to cover their tax liability throughout the year.

Who is required to file estimated tax payment?

Individuals and businesses are required to file estimated tax payments if they expect to owe a certain amount in taxes at the end of the year and their income is not subject to withholding tax. This includes self-employed individuals, freelancers, landlords, and small business owners.

How to fill out estimated tax payment?

To fill out estimated tax payment, individuals and businesses need to use Form 1040-ES provided by the IRS. This form helps calculate the amount of tax owed and provides instructions on how to make the payment. It is important to accurately estimate income and deductions in order to avoid underpayment penalties.

What is the purpose of estimated tax payment?

The purpose of estimated tax payment is to ensure that individuals and businesses pay their taxes throughout the year rather than waiting until tax filing season. By making quarterly payments, taxpayers can avoid penalties and interest for underpayment of taxes.

What information must be reported on estimated tax payment?

When making estimated tax payments, taxpayers need to report their estimated total income, deductions, and tax credits for the year. This helps calculate the appropriate amount of tax to be paid each quarter. Additionally, taxpayers need to provide their name, address, and Social Security number or Employer Identification Number.

When is the deadline to file estimated tax payment in 2023?

The deadline to file estimated tax payment in 2023 is April 18th for the first quarter, June 15th for the second quarter, September 15th for the third quarter, and January 15th, 2024 for the fourth quarter.

What is the penalty for the late filing of estimated tax payment?

The penalty for the late filing of estimated tax payment is calculated based on the amount of underpayment and the duration of the delay. The penalty rate is set by the IRS and may be subject to interest as well. It is important to file and pay estimated taxes on time to avoid penalties.

How do I fill out estimated tax payment 2006 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign estimated tax payment 2006 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit estimated tax payment 2006 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as estimated tax payment 2006. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I complete estimated tax payment 2006 on an Android device?

Complete estimated tax payment 2006 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your estimated tax payment 2006 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.