Get the free Massachusetts Property Insurance Underwriting Association 2009 Rate Filings

Show details

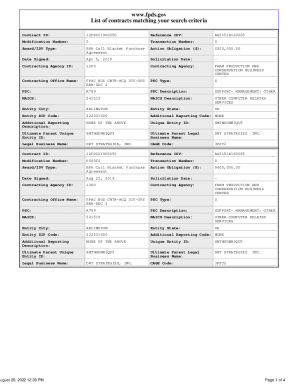

This document outlines the decision regarding proposed revisions to the rates and rules for various insurance types submitted by the Massachusetts Property Insurance Underwriting Association, including

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign massachusetts property insurance underwriting

Edit your massachusetts property insurance underwriting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your massachusetts property insurance underwriting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit massachusetts property insurance underwriting online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit massachusetts property insurance underwriting. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out massachusetts property insurance underwriting

How to fill out Massachusetts Property Insurance Underwriting Association 2009 Rate Filings

01

Gather the necessary documentation related to the property being insured.

02

Access the Massachusetts Property Insurance Underwriting Association (MPIUA) website or relevant forms.

03

Fill out the application form with accurate property details, including location, structure type, and year built.

04

Provide information about the current insurance coverage and claims history.

05

Calculate the rate based on MPIUA guidelines and include any necessary supporting data.

06

Review the completed application for accuracy and completeness.

07

Submit the application along with any required fees to the MPIUA.

Who needs Massachusetts Property Insurance Underwriting Association 2009 Rate Filings?

01

Individuals or businesses seeking property insurance in Massachusetts, especially those in underserved markets.

02

Insurance agents and brokers looking to provide options for their clients.

03

Property owners facing challenges in obtaining coverage due to high-risk locations or property conditions.

Fill

form

: Try Risk Free

People Also Ask about

What is the phone number for Massachusetts property insurance claims?

To report a new claim by phone during regular business hours, please call 617-723-3800 or 1-800-392-6108 (MA) or 1-800-851-8978 (USA). To report an emergency claim during non-business hours please call 1-800-297-3554 and follow the instructions.

What is the fair insurance plan in Massachusetts?

The FAIR Plan offers homeowner insurance to consumers who have been declined coverage in the voluntary insurance market. You can contact the FAIR PLAN directly by calling (617) 723-3800 or 1-800-392-6108.

What is a FAIR Plan in insurance?

The FAIR Plan exists to provide insurance to Californians who cannot find coverage through no fault of their own. The FAIR Plan serves as a temporary safety net for property owners until traditional insurance coverage becomes available.

What does the mpiua stand for?

The Massachusetts Property Insurance Underwriting Association.

How much does the FAIR Plan insurance cost?

Chubb and Amica are among the best home insurance companies in Massachusetts, ing to our analysis. We analyzed data from more than 30 insurance companies to help you find the best home insurance in Massachusetts.

What is the mpiua rate increase?

The MPIUA seeks statewide overall rate changes for three types of coverage, as follows: 1) +13.2 percent for Homeowners Multi-Peril, which includes policy forms issued to owners and renters of residential property and iniums; 2) +8.0 percent for Dwelling Fire and Extended Coverage; and 3) 0.0 percent for

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Massachusetts Property Insurance Underwriting Association 2009 Rate Filings?

The Massachusetts Property Insurance Underwriting Association 2009 Rate Filings refers to the formal submission of proposed rates and accompanying documentation by the Massachusetts Property Insurance Underwriting Association (MPIUA) for property insurance policies, which was established to provide coverage for properties that are unable to obtain insurance in the standard market.

Who is required to file Massachusetts Property Insurance Underwriting Association 2009 Rate Filings?

Insurance companies that are members of the Massachusetts Property Insurance Underwriting Association are required to file these rate filings as part of their regulatory obligation to ensure adequate and fair pricing for property insurance in the state.

How to fill out Massachusetts Property Insurance Underwriting Association 2009 Rate Filings?

To fill out the Massachusetts Property Insurance Underwriting Association 2009 Rate Filings, insurers must follow the specific instructions provided by the MPIUA, which typically include completing a standardized rate filing form, providing data regarding loss history, and justifying the proposed rates based on actuarial analysis.

What is the purpose of Massachusetts Property Insurance Underwriting Association 2009 Rate Filings?

The purpose of the Massachusetts Property Insurance Underwriting Association 2009 Rate Filings is to establish appropriate rates for property insurance coverage, ensuring that the rates reflect the risk associated with insuring properties that are typically hard to insure, while also maintaining a stable and viable insurance market.

What information must be reported on Massachusetts Property Insurance Underwriting Association 2009 Rate Filings?

The information that must be reported on the Massachusetts Property Insurance Underwriting Association 2009 Rate Filings includes details on historical loss data, proposed rate changes, actuarial justification for the rates, administrative expenses, and any relevant market analysis that supports the filing.

Fill out your massachusetts property insurance underwriting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Massachusetts Property Insurance Underwriting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.