Get the free mo 1041 form

Show details

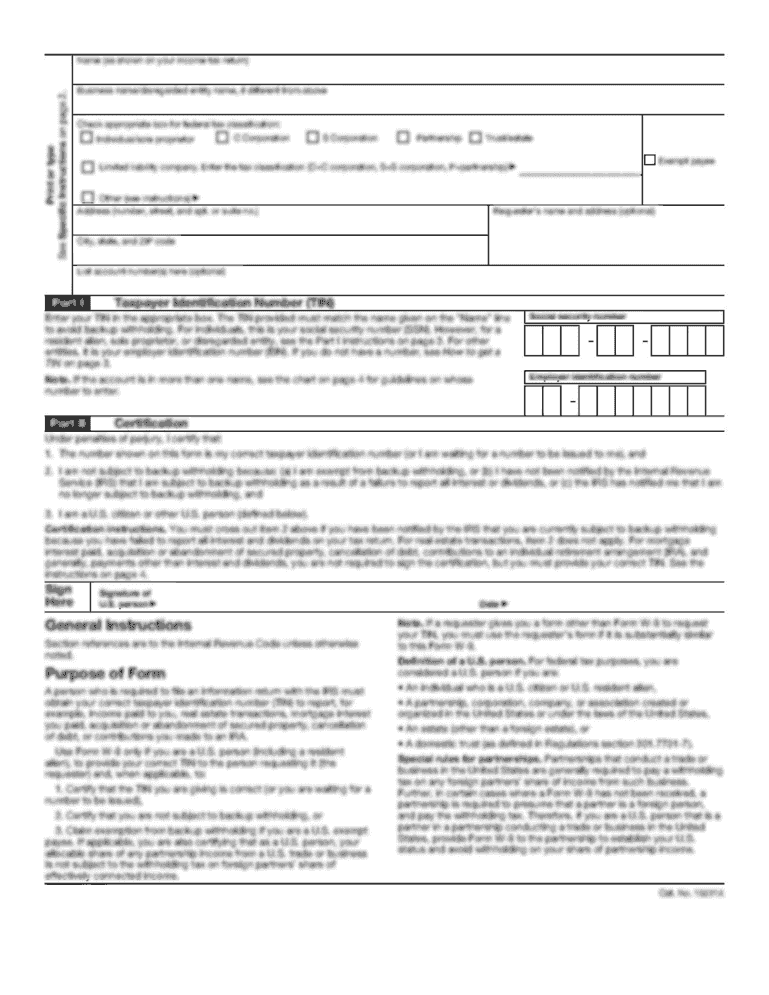

Reset Form MISSOURI DEPARTMENT OF REVENUE FIDUCIARY INCOME TAX RETURN FORM MO-1041 FOR THE CALENDAR YEAR 2005 OR FISCAL YEAR BEGINNING Print Form ATTACH COPY OF FEDERAL FORM 1041 AND SUPPORTING SCHEDULES INCLUDING SCHEDULE K-1. K. If a nonresident estate or trust with income from both Missouri and non-Missouri sources omit Lines 1 11 attach Form MO-NRF check this box and skip to Line 12. INCOME 1. Federal taxable income from Federal Form 1041 Li...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

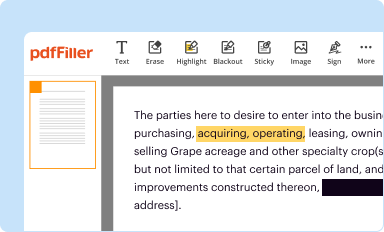

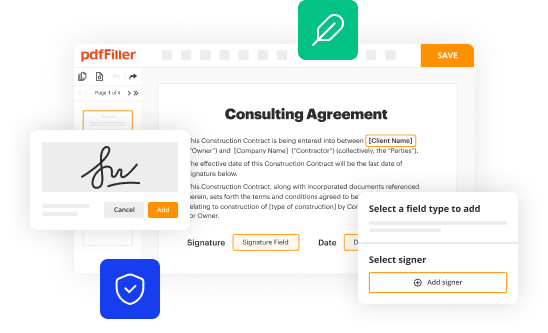

Edit your mo 1041 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

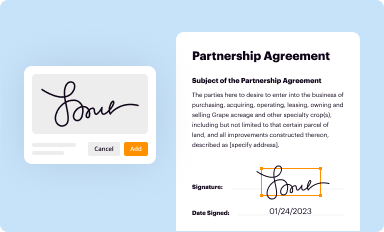

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mo 1041 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mo 1041 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit missouri form 1041. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

How to fill out mo 1041 form

How to fill out mo 1041:

01

Begin by gathering all necessary information, including the decedent's personal information, estate information, and any income or expenses related to the estate.

02

Fill out the top section of Form MO-1041, providing the estate's name, address, and federal employer identification number (FEIN).

03

Proceed to Part 1 of the form, where you will provide the income details for the estate. This includes reporting any income received, such as dividends, interest, rents, or capital gains.

04

In Part 2, report any deductions and expenses related to the estate. This may include attorney fees, administrative expenses, and charitable contributions.

05

Move on to Part 3, where you will calculate the taxable income and determine the tax liability for the estate.

06

Complete the remaining sections of the form, including Part 4 for calculating the credits and payments, and Part 5 for determining the final tax due or overpayment.

07

Sign the form, include any required attachments or schedules, and mail it to the appropriate address provided in the form's instructions.

Who needs mo 1041:

01

Executors or personal representatives of a deceased person's estate are typically required to file Form MO-1041. This includes individuals who are responsible for managing and distributing the assets of the estate.

02

Estates that generate more than $600 in gross income or have taxable income are required to file Form MO-1041.

03

Even if an estate is not required to file, it may still be beneficial to do so in order to claim certain deductions or credits, or to provide a record for beneficiaries.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mo 1041?

MO 1041 is a tax form used by federal and state authorities to report income, deductions, and credits for estates and trusts.

Who is required to file mo 1041?

Trustees or executors of estates and trusts are required to file MO 1041 if the estate or trust has gross income of $600 or more.

How to fill out mo 1041?

To fill out MO 1041, you need to gather information about the estate or trust's income, deductions, and credits. This includes details about any beneficiaries and their distributions. The form can be completed manually or using tax preparation software.

What is the purpose of mo 1041?

The purpose of MO 1041 is to calculate the taxable income of estates and trusts and determine the associated tax liability.

What information must be reported on mo 1041?

MO 1041 requires reporting of the estate or trust's income, deductions, credits, and tax payments. Additionally, details about the beneficiaries and their distributions may be required.

When is the deadline to file mo 1041 in 2023?

The deadline to file MO 1041 in 2023 is typically April 17th, but it may be extended if that date falls on a weekend or holiday. It's always advisable to check with the IRS or your state's tax agency for the exact deadline.

What is the penalty for the late filing of mo 1041?

The penalty for the late filing of MO 1041 can vary depending on the circumstances. Generally, a penalty of 5% of the unpaid tax liability per month, up to a maximum of 25%, may be imposed. However, specific penalties and interest rates may apply in certain situations. It is recommended to consult the IRS or a tax professional for accurate and up-to-date penalty information.

How can I edit mo 1041 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including missouri form 1041. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an electronic signature for signing my mo 1041 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your missouri form 1041 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit mo 1041 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute missouri form 1041 from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your mo 1041 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.