Get the free CT-3-A/ATT - tax ny

Show details

This document is used for reporting investment capital and subsidiary capital for corporations filing the General Business Corporation Combined Franchise Tax Return in New York State.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ct-3-aatt - tax ny

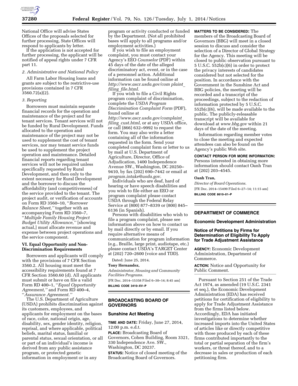

Edit your ct-3-aatt - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct-3-aatt - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct-3-aatt - tax ny online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ct-3-aatt - tax ny. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ct-3-aatt - tax ny

How to fill out CT-3-A/ATT

01

Begin by obtaining the CT-3-A/ATT form from the New York State Department of Taxation and Finance website.

02

Fill in your entity's name, address, and identification number at the top of the form.

03

Complete Part 1 by providing the necessary financial information for the reporting period.

04

Move to Part 2 to report any additional adjustments or credits applicable to your business.

05

In Part 3, attach required schedules that support the amounts reported in the previous sections.

06

Review the form for accuracy and completeness before signing and dating it.

07

Submit the completed CT-3-A/ATT form by the due date to avoid penalties.

Who needs CT-3-A/ATT?

01

Corporations and entities operating in New York State that are subject to the Article 9-A franchise tax.

02

Businesses that have tax attributes or adjustments that need to be reported for tax purposes.

03

Any company that needs to claim credits or deductions as permitted under New York tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a New York partnership tax return?

Income tax responsibilities must file Form IT-204, Partnership Return if it has either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York sources (see instructions).

Who must file a New York estate tax return?

Do You Need to File a New York Estate Tax Return? If the gross estate of a New York resident has a value of more than $7.16 million, the personal representative or executor of the estate must file a state estate tax return. (Smaller estates won't need to file a return.)

What is NYS form CT 3 S?

Form CT-3-S is used to pay the entity level franchise tax under Article 9-A. This tax is the fixed dollar minimum tax imposed under § 210.1(d).

Who must file a New York City return?

New York City residents must pay a personal income tax, which is administered and collected by the New York State Department of Taxation and Finance. Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127.

Who must file NY CT 3?

Corporate tax filing requirements All New York C corporations subject to tax under Tax Law Article 9-A must file using the following returns, as applicable: Form CT-3, General Business Corporation Franchise Tax Return. Form CT-3-A, General Business Corporation Combined Franchise Tax Return.

What is tax form CT-3?

Form CT-3, General Business Corporation Franchise Tax Return. Form CT-3-A, General Business Corporation Combined Franchise Tax Return (For information as to when a combined return is permitted or required, see Form CT-3-A-I, Instructions for Form CT-3-A.)

Who must file a CT return?

You must file a Connecticut income tax return if your gross income for the 2024 taxable year exceeds: $12,000 and you are married filing separately; $15,000 and you are filing single; $19,000 and you are filing head of household; or.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CT-3-A/ATT?

CT-3-A/ATT is a form used by corporations in New York State to report additional tax information and to apply credits.

Who is required to file CT-3-A/ATT?

Corporations that file the CT-3 form and need to claim specific credits or provide additional information related to their tax obligations are required to file CT-3-A/ATT.

How to fill out CT-3-A/ATT?

To fill out CT-3-A/ATT, you need to provide details such as your corporation's name, employer identification number, and the specific credits or additional information applicable to your tax situation, following the instructions provided in the form.

What is the purpose of CT-3-A/ATT?

The purpose of CT-3-A/ATT is to allow corporations to report additional tax information and claim certain credits that can reduce their tax liability.

What information must be reported on CT-3-A/ATT?

CT-3-A/ATT requires the reporting of your corporation's basic information, the amount of credits being claimed, and any necessary calculations related to those credits.

Fill out your ct-3-aatt - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct-3-Aatt - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.