If you have a business with only one owner, and you are married, and you file a joint tax return, then your spouse is the primary liable for income tax, the spouse of any nonresident of NY who is required to file a joint tax return is liable for tax on the same basis as the other nonresident, and the NY State Controller is the final authority to determine if there is any discrepancy between NY state rate for income tax and business tax; See Tax Bulletin CT-32-A (2009) for further information. Tax Bulletin CT-32-A (2009) can be downloaded from the New York State Division of Taxation website at or faxed. The NY State Controller is no longer accepting new business tax returns. Therefore, any previously paid tax will be processed and the amount due will be refunded. Any taxes you owe now will need to be paid directly to the NY Division of Taxation at the address, which can be found on or with your tax return and other documentation. However, you are always free to submit your tax refund by phone or by mail, provided that the refund check must be received by the date of the due date. The controller can also accept your prior year's tax return if applicable. See Form RT-36 (2009) for further information. If you have not paid any other taxes in NY, then you are not required to file a return for the year. If you owe the NY State corporation tax or gross receipts tax, then you may need to pay the tax by any means allowed under law, including a credit against your tax liability, through the NY State Department of Taxation or through the State Controller. If the amount payable is more than the correct tax, then a delinquency charge may apply to the tax. Please contact your local tax advisor for further information. Return to Contents New Jersey Tax Bulletin No. CT-32-B (2009) applies to businesses doing business in the state of New Jersey. For more information, please contact the New Jersey Department of Taxes and the New Jersey Division of Taxation at. Return to Contents New Mexico Tax Bulletin No. CT-32-B (2009) applies to businesses doing business in the state of New Mexico. For more information, please contact the New Mexico Tax Commission and the Tax Bureau at or by fax.

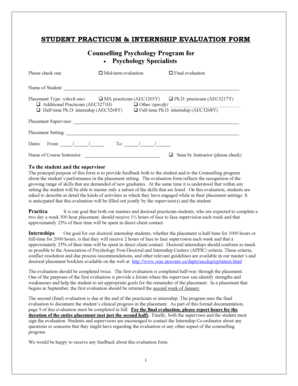

Get the free Foreign corporations: date began - tax ny

Show details

5 Combined franchise tax (amount from line 1, 2, 3, or 4, whichever is greatest) .... .................................. 5. .... at www.nystax.gov and look for the change my address ... Make payable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your foreign corporations date began form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreign corporations date began form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing foreign corporations date began online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit foreign corporations date began. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is foreign corporations date began?

The date began refers to the date when a foreign corporation started its operations or business activities.

Who is required to file foreign corporations date began?

Foreign corporations that are conducting business activities or operations within a specific jurisdiction are typically required to report their date began.

How to fill out foreign corporations date began?

The date began can usually be filled out on the required forms or documents provided by the relevant government agency or regulatory body. It may involve specifying the day, month, and year when the corporation began its operations.

What is the purpose of foreign corporations date began?

The purpose of reporting the date began is to provide regulatory authorities with information about when a foreign corporation commenced its operations in a particular jurisdiction. This helps in tracking the duration of their business activities and complying with legal requirements.

What information must be reported on foreign corporations date began?

The information required to be reported on the foreign corporations date began typically includes the specific date (day, month, and year) when the corporation started conducting business in the jurisdiction.

When is the deadline to file foreign corporations date began in 2023?

The specific deadline to file the foreign corporations date began in 2023 would depend on the regulations and requirements of the jurisdiction. It is advisable to consult the relevant government agency or regulatory body for the exact deadline.

What is the penalty for the late filing of foreign corporations date began?

The penalty for late filing of the foreign corporations date began may vary depending on the jurisdiction and its regulations. It is recommended to refer to the applicable laws or consult with the relevant authorities to determine the specific penalties.

How do I modify my foreign corporations date began in Gmail?

foreign corporations date began and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I create an eSignature for the foreign corporations date began in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your foreign corporations date began and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out foreign corporations date began using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign foreign corporations date began and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your foreign corporations date began online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.