Get the free DIVISION OF BANKING Return the Completed Call Report, on or ... - dbr ri

Show details

DIVISION OF BANKING 233 Richmond Street, Suite 231 Providence, Rhode Island 02903-4231 Telephone (401) 222-2405 Facsimile (401) 222-562 — TDD (401) 222-2999 INSURED-DEPOSIT-TAKING FINANCIAL INSTITUTION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

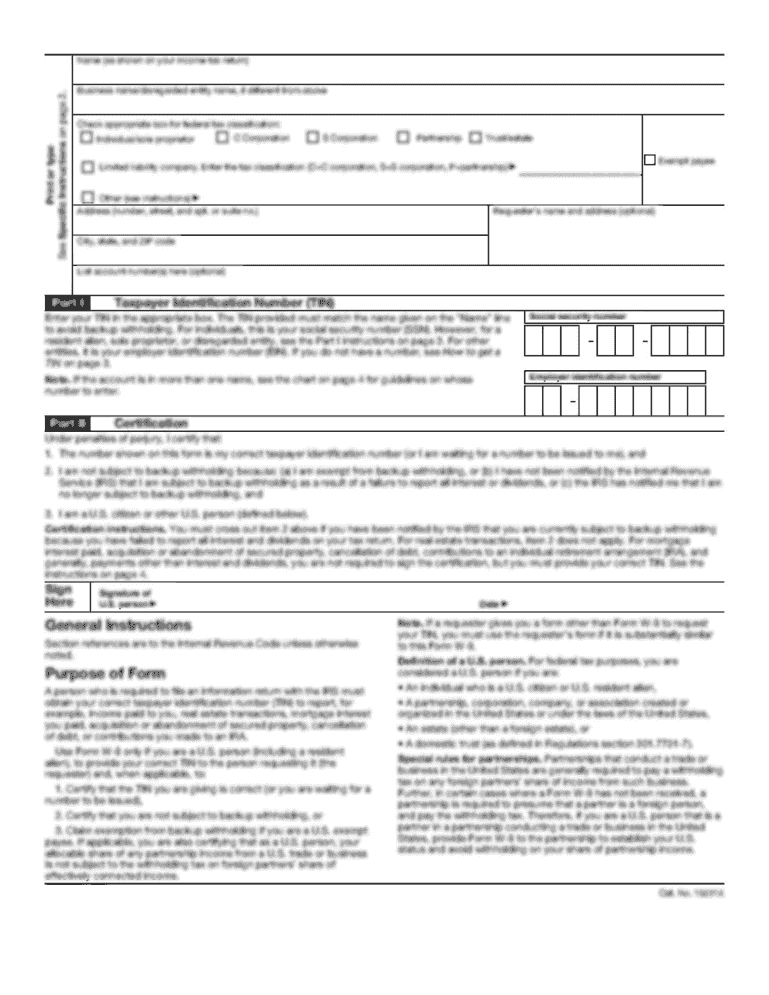

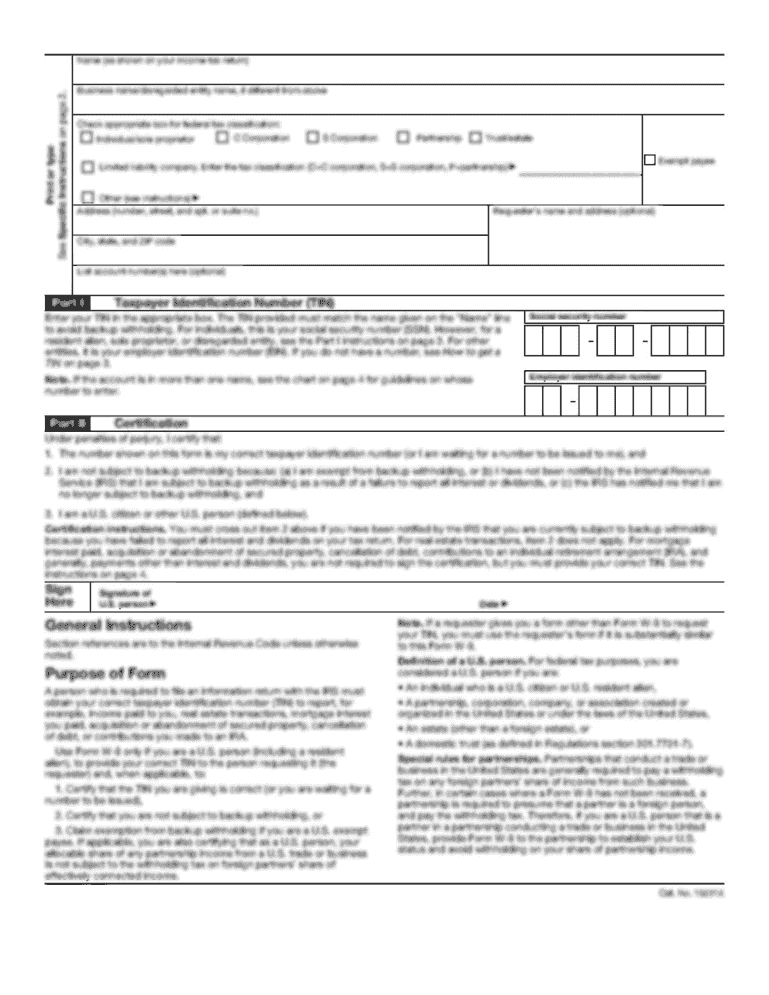

Edit your division of banking return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your division of banking return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing division of banking return online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit division of banking return. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out division of banking return

How to fill out division of banking return:

01

Gather all relevant financial documents such as bank statements, income statements, and expense records.

02

Review the instructions provided by the banking division to understand the required information and format for the return.

03

Complete the necessary sections or forms, providing accurate and up-to-date information.

04

Double-check all calculations and ensure that all required fields are filled out properly.

05

Attach any supporting documents as required by the banking division.

06

Review the completed return for any errors or omissions before submitting it.

Who needs division of banking return:

01

Individuals or businesses that are regulated by the banking division.

02

Financial institutions, such as banks or credit unions, that are required to report their activities to the banking division.

03

Organizations or individuals involved in banking and financial activities, including brokers, lenders, and loan servicers, that are subject to the jurisdiction of the banking division.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is division of banking return?

The division of banking return refers to the report submitted by banking institutions to provide information about their financial activities and compliance with regulatory requirements.

Who is required to file division of banking return?

All banking institutions, including commercial banks, savings and loan associations, and credit unions, are required to file division of banking return.

How to fill out division of banking return?

Banking institutions need to carefully review the instructions provided by the regulatory authority and complete the required forms accurately. They must include detailed financial information, such as assets, liabilities, income, and expenses.

What is the purpose of division of banking return?

The purpose of division of banking return is to provide regulators with a comprehensive understanding of the financial condition and performance of banking institutions. It helps ensure compliance with banking regulations and allows regulators to assess the overall stability of the banking industry.

What information must be reported on division of banking return?

Banking institutions must report various financial data, including balance sheet information, income statement items, loan portfolio information, and details about capital adequacy. Additionally, they may need to provide information on off-balance sheet activities, risk management practices, and compliance with regulatory requirements.

When is the deadline to file division of banking return in 2023?

The exact deadline to file division of banking return in 2023 can vary depending on the regulatory requirements and jurisdiction. Banking institutions should refer to the specific guidelines and instructions provided by the regulatory authority to determine the deadline.

What is the penalty for the late filing of division of banking return?

The penalty for the late filing of division of banking return can also vary depending on the regulatory authority and jurisdiction. Typically, banking institutions may face financial penalties or other regulatory consequences for failing to submit the required reports on time. It is important to comply with the filing deadlines to avoid any potential penalties.

How do I execute division of banking return online?

With pdfFiller, you may easily complete and sign division of banking return online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out the division of banking return form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign division of banking return and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit division of banking return on an iOS device?

Create, modify, and share division of banking return using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your division of banking return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.