Get the free Dividend Reinvestment and Stock Purchase Form

Show details

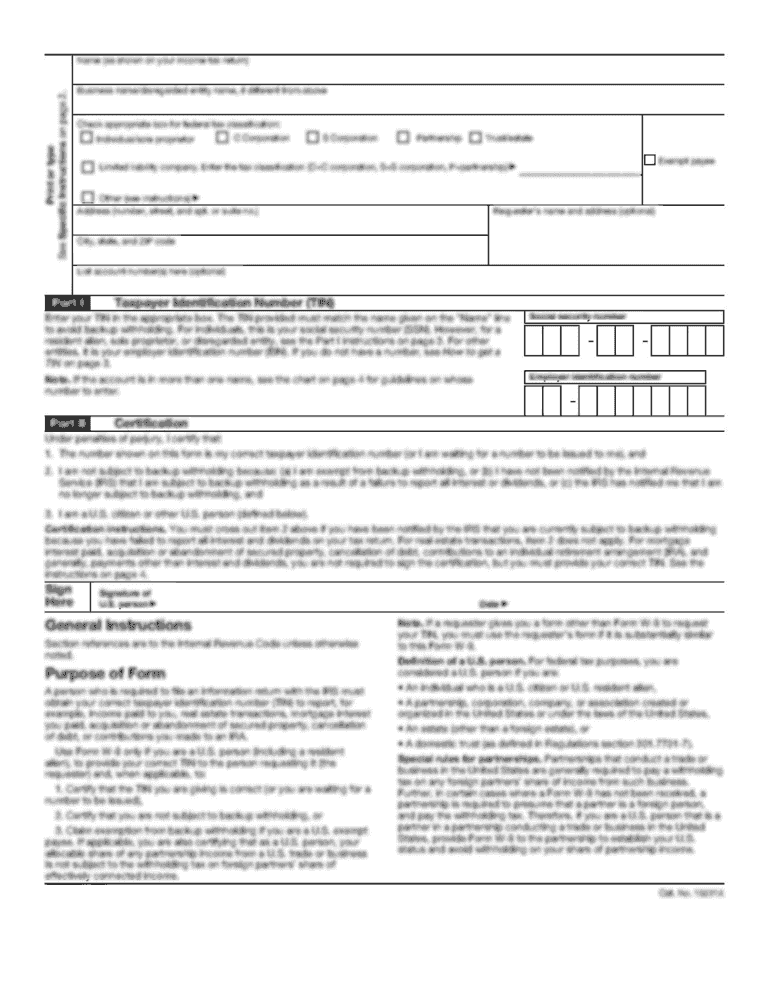

Dividend Reinvestment and Stock Purchase Plan as described in the brochure which accompanied this Enrollment. Authorization Form. INSTRUCTIONS. 1. ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your dividend reinvestment and stock form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dividend reinvestment and stock form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dividend reinvestment and stock online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dividend reinvestment and stock. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out dividend reinvestment and stock

How to fill out dividend reinvestment and stock:

01

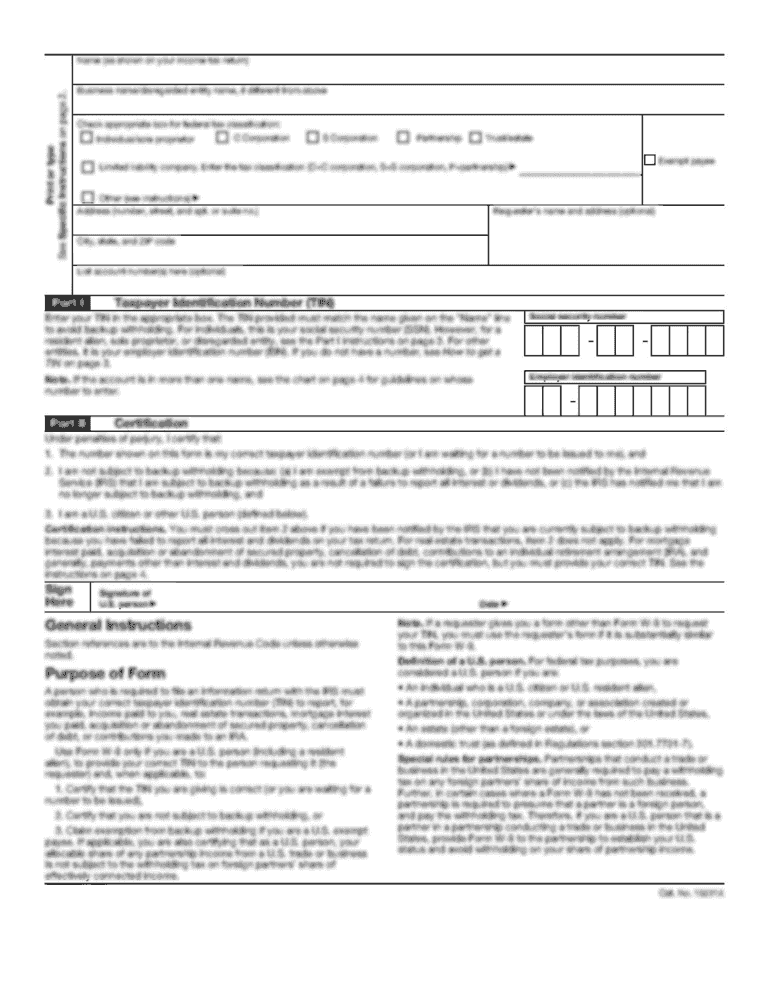

Gather the necessary documents: You will need your investment account information, including your account number and any relevant tax identification numbers. You may also need your bank account information if you plan to set up automatic reinvestment of dividends.

02

Review the instructions: Read through the instructions provided by your investment company or brokerage firm. Pay attention to any specific guidelines or requirements for filling out the forms.

03

Provide personal information: Fill in your personal details, including your name, address, and contact information. This information is essential for proper identification and communication.

04

Choose your dividend reinvestment options: Indicate whether you want to reinvest dividends or receive them as cash. If you choose to reinvest, you may need to specify how you want the dividends allocated across different stocks or funds.

05

Set up automatic reinvestment (if desired): If you want your dividends to be automatically reinvested, provide your bank account information for electronic funds transfer. This will ensure that your dividends are reinvested without any manual intervention.

06

Review and sign the form: Before submitting the form, carefully review all the information provided. Make sure there are no errors or omissions. Sign and date the form as required.

07

Submit the form: Follow the instructions on how and where to submit the completed form. This may involve mailing it, faxing it, or submitting it electronically through an online portal.

Who needs dividend reinvestment and stock:

01

Investors seeking long-term growth: Dividend reinvestment allows investors to take advantage of compounding by reinvesting dividends to purchase additional shares of stock. This can enhance the potential for long-term capital appreciation.

02

Income-oriented investors: Dividend reinvestment can be attractive for investors who rely on regular income from their investments. Reinvesting dividends can help them grow their income stream over time.

03

Those interested in diversification: By reinvesting dividends, investors can automatically diversify their portfolio by acquiring shares of different companies or funds. This can help spread risk and potentially improve overall returns.

04

Investors with a buy-and-hold strategy: Dividend reinvestment is often favored by investors who have a long-term perspective and prefer a passive approach to investing. By reinvesting dividends, they can stay invested in the market and potentially benefit from long-term gains.

05

Shareholders of companies offering dividend reinvestment plans (DRIPs): Some companies offer their own dividend reinvestment plans, allowing shareholders to reinvest dividends directly with the company. This can be an attractive option for investors who want to avoid brokerage fees or have a specific interest in the company's stock.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is dividend reinvestment and stock?

Dividend reinvestment is a strategy where shareholders use their dividends to purchase additional shares of the same company's stock. It allows investors to automatically reinvest their cash dividends into more shares of the underlying stock.

Who is required to file dividend reinvestment and stock?

Individual shareholders who participate in a dividend reinvestment plan (DRIP) are required to report their stock and dividend reinvestment activity on their tax returns.

How to fill out dividend reinvestment and stock?

To fill out dividend reinvestment and stock, you need to report the dividends received as regular income and any capital gains or losses from the sale of the reinvested shares. This information can usually be found on the Form 1099-DIV and the applicable Schedule D of your tax return.

What is the purpose of dividend reinvestment and stock?

The purpose of dividend reinvestment and stock is to allow investors to compound their investment returns over time by reinvesting their dividends back into the underlying company's stock, potentially increasing their total number of shares and future dividend payments.

What information must be reported on dividend reinvestment and stock?

The information that must be reported on dividend reinvestment and stock includes the amount of dividends received, the cost basis of the reinvested shares, any capital gains or losses from the sale of the reinvested shares, and any applicable taxes paid on dividends.

When is the deadline to file dividend reinvestment and stock in 2023?

The deadline to file dividend reinvestment and stock in 2023 is April 18, 2023, for most individual taxpayers.

What is the penalty for the late filing of dividend reinvestment and stock?

The penalty for the late filing of dividend reinvestment and stock depends on the specific circumstances and tax laws of the relevant jurisdiction. It is advisable to consult with a tax professional or refer to the appropriate tax authorities for accurate information on penalties.

Can I create an eSignature for the dividend reinvestment and stock in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your dividend reinvestment and stock directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit dividend reinvestment and stock on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing dividend reinvestment and stock.

How do I edit dividend reinvestment and stock on an Android device?

The pdfFiller app for Android allows you to edit PDF files like dividend reinvestment and stock. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your dividend reinvestment and stock online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.