Get the free Continuing Professional Education (CPE) Requirements - boa virginia

Show details

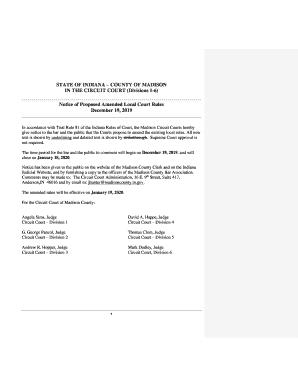

This document outlines the Continuing Professional Education (CPE) requirements for obtaining and maintaining CPA licensure in Virginia, including specific hours required for different licensure statuses.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign continuing professional education cpe

Edit your continuing professional education cpe form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your continuing professional education cpe form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing continuing professional education cpe online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit continuing professional education cpe. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out continuing professional education cpe

How to fill out Continuing Professional Education (CPE) Requirements

01

Check the specific CPE requirements set by your licensing or certifying agency.

02

Determine the total number of CPE hours required for your reporting period.

03

Identify the categories of CPE activities accepted by your agency (e.g., courses, workshops, seminars).

04

Select relevant courses or programs that meet the requirements.

05

Register for and complete the selected CPE activities.

06

Document and keep records of your CPE certificates or proof of completion.

07

Submit your CPE documentation to your licensing or certifying agency by the deadline.

Who needs Continuing Professional Education (CPE) Requirements?

01

Licensed professionals in fields such as accounting, finance, healthcare, and education.

02

Professionals seeking to maintain certifications or licenses.

03

Individuals looking to enhance their skills and stay updated with industry standards.

Fill

form

: Try Risk Free

People Also Ask about

How many hours of CPE are required in a rolling 3 year period?

LICENSE RENEWAL INFORMATION: 120 hours / 3 years (this is a rolling 3 year period, meaning that every year that the licensee registers, they must show 120 hours of CPE over the previous 3 year period ending with their license expiration date) Minimum of 20 hours / year.

What are NASBA CPE requirements?

CPE Requirements Requires NASBA Registry approval (1) Requires NASBA Registry or State Board approval (5) Requires NASBA Registry, State Board or special category approval (14) Requires QAS approval for all or certain self study courses (6) Requires Provider approval for Ethics courses (17)

What qualifies for CPE hours?

Qualifying Professional Education Activities. Activities that qualify for CPE include technical and managerial training. This training must be directly applicable to the job practice areas associated with the certification(s) to ensure a proper balance of professional development is attained.

What are the AICPA CPE requirements?

AICPA CPAs must complete 120 hours of CPE every 3 years. How many credits can AICPA CPAs complete via Self Study courses? AICPA CPAs can complete all 120 credits via Self Study courses.

What are the new requirements for AICPA?

The major accounting trade associations' newly revamped “third licensure pathway” would instead require a bachelor's degree, the passage of the CPA exam and two years of professional experience, effectively substituting an extra year of work for the competencies component.

How many hours is 1 CPE credit?

What Are CPE Credits Quick Facts. CPAs must complete 40 hours of CPE every year. 1 CPE credit is equal to 50 minutes of approved learning. Each State Board of Accountancy can set its own additional CPE requirements or stipulations.

What are the CPE requirements for AICPA?

AICPA CPE requirements Regardless of your state, if you belong to the AICPA, you also need to meet their CPE requirements to maintain your membership. They stipulate that all members must complete 120 hours of continuing professional education during each three-year reporting period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Continuing Professional Education (CPE) Requirements?

Continuing Professional Education (CPE) Requirements refer to the mandatory ongoing education that professionals must complete to maintain their licenses or certifications. It ensures that individuals stay updated with the latest industry practices, regulations, and advancements in their field.

Who is required to file Continuing Professional Education (CPE) Requirements?

Professionals in various fields such as accounting, law, healthcare, and education are often required to file CPE Requirements. This typically includes certified public accountants (CPAs), attorneys, and licensed educators, among others, depending on regulatory requirements in their respective professions.

How to fill out Continuing Professional Education (CPE) Requirements?

To fill out CPE Requirements, individuals usually need to complete a designated number of hours of education or training in relevant subjects. They must document these hours, including details of the courses taken, dates, and providers, and report them to their licensing body or organization according to its specific submission guidelines.

What is the purpose of Continuing Professional Education (CPE) Requirements?

The purpose of CPE Requirements is to ensure that professionals maintain their competence and stay informed about developments in their field. It promotes continuous learning, enhances skills, and fosters professional growth, ultimately benefiting the professionals and the clients or communities they serve.

What information must be reported on Continuing Professional Education (CPE) Requirements?

The information that must be reported on CPE Requirements typically includes the course title, provider name, date of completion, number of credit hours earned, and a brief description of the content covered. Some jurisdictions may require additional documentation or verification of completion.

Fill out your continuing professional education cpe online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Continuing Professional Education Cpe is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.