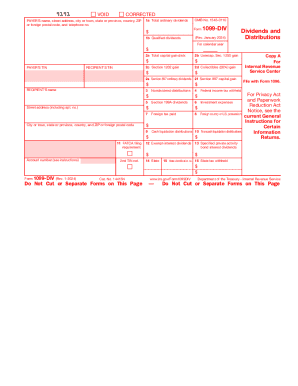

IRS 1099-DIV 2010 free printable template

FAQ about IRS 1099-DIV

What should I do if I realize I made an error after filing the 2010 form 1099 div?

If you discover a mistake after submitting the 2010 form 1099 div, you should file a corrected form. This involves completing a new 1099 div with the correct information and marking it as 'corrected.' Ensure you provide proper documentation that supports the change to avoid any processing delays.

How can I verify that my 2010 form 1099 div was received by the IRS?

To confirm that the IRS received your 2010 form 1099 div, you can check the status through your e-filing software, which often provides a tracking feature. If you submitted the form via mail, consider using a delivery confirmation service to verify its arrival.

Are there specific privacy measures to consider when filing the 2010 form 1099 div?

Yes, when filing the 2010 form 1099 div, it is crucial to ensure that sensitive information is secured. This includes using e-filing systems that comply with data protection regulations and retaining records in a secure environment to prevent unauthorized access to personal data.

What if a foreign payee is involved when filing the 2010 form 1099 div?

When dealing with a foreign payee on the 2010 form 1099 div, it's essential to determine their tax status and whether any tax treaties apply. In some cases, additional forms may be required to report payments accurately while ensuring compliance with tax regulations for foreign entities.

See what our users say