Get the free filable 1020 2010 form - pbadupws nrc

Show details

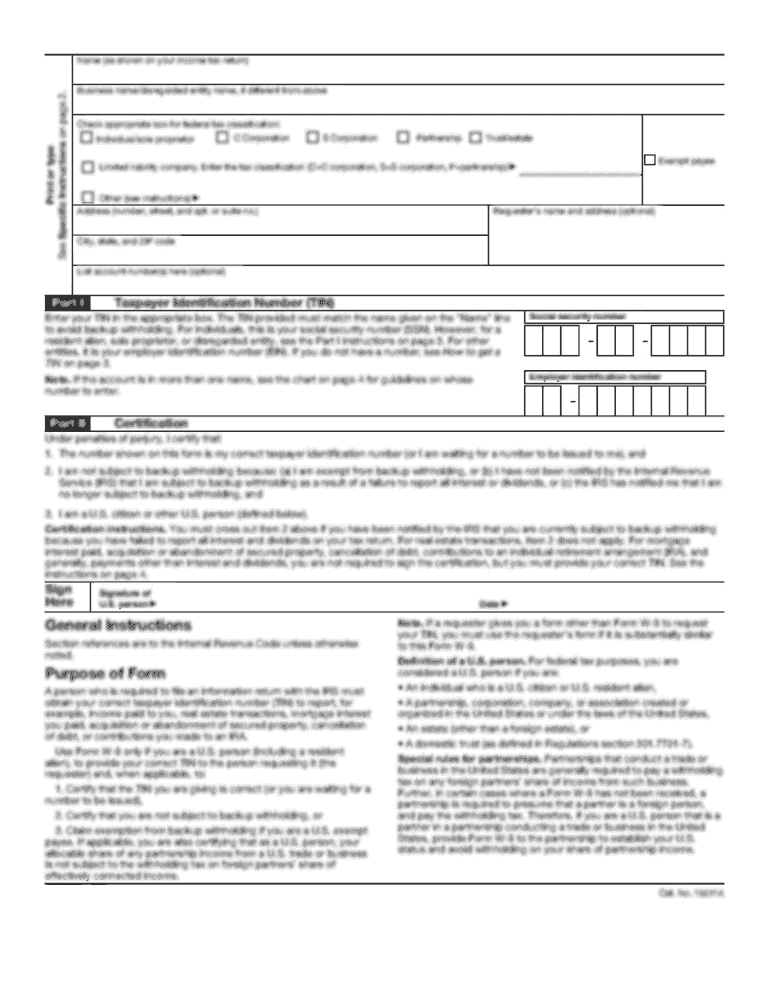

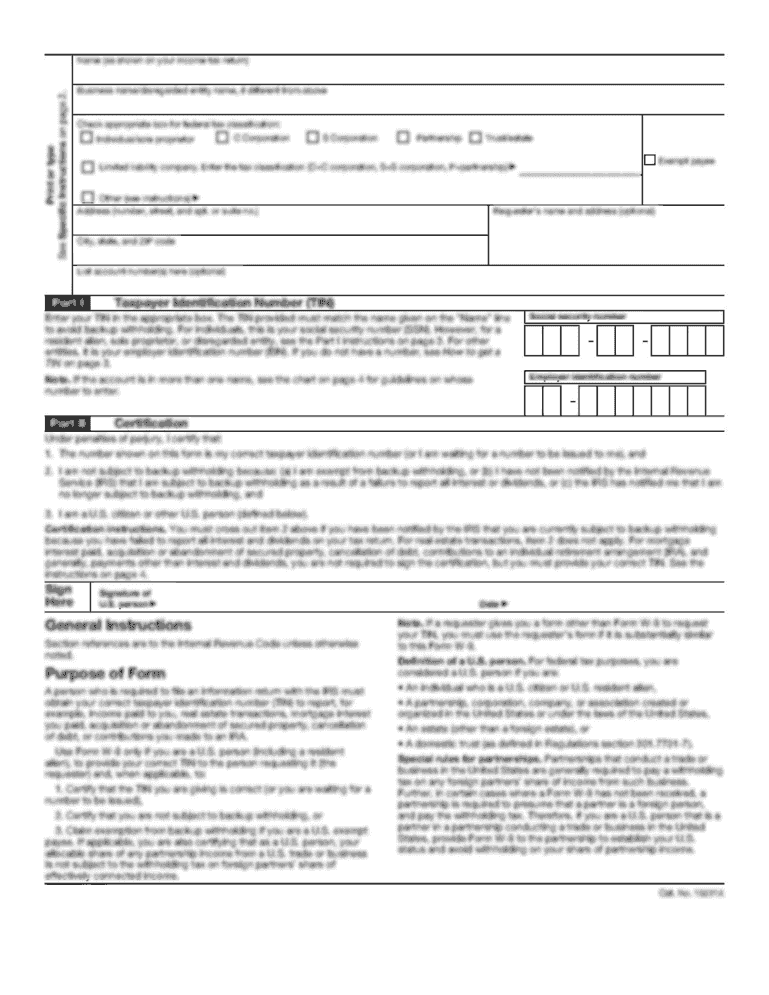

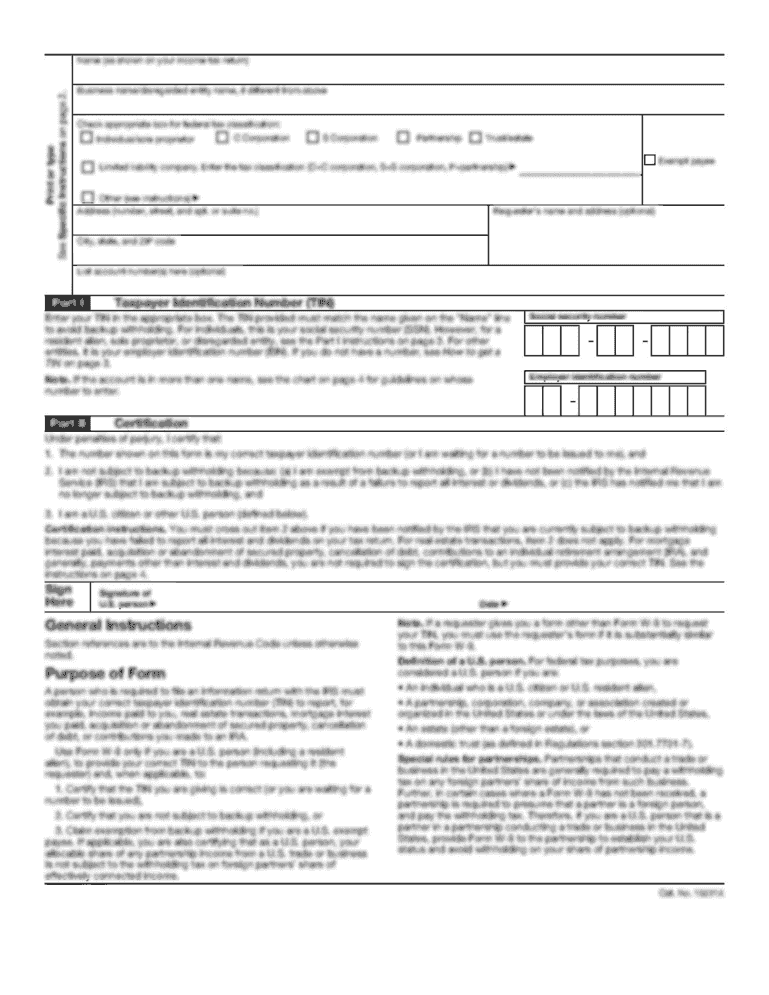

NRC FORM 591M PART 1

(06201 0)

10 CFR 2.201U. S NUCLEAR REGULATORY Commission, SAFETY INSPECTION REPORT AND COMPLIANCE Inspection was an examination of the activities conducted under your license

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your filable 1020 2010 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your filable 1020 2010 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing filable 1020 2010 form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit filable 1020 2010 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out filable 1020 2010 form

How to fill out filable 1020 2010 form:

01

Start by downloading the fillable 1020 2010 form from a trusted source.

02

Open the form using a compatible PDF reader on your computer or mobile device.

03

Begin filling out the form by entering your personal information in the designated fields, such as your name, address, and contact details.

04

Provide any additional information or details that are required for the specific purpose of the form. This may include financial information, employment history, or other relevant data.

05

If the form requires signatures, sign it electronically using the appropriate tool within the PDF reader, or print the form and sign it manually.

06

Review the completed form to ensure all information is accurate and complete.

07

Save a copy of the filled-out form on your device or computer for your records.

08

Submit the form as required, either by mailing it to the appropriate recipient or submitting it online, if applicable.

Who needs fillable 1020 2010 form:

01

Individuals who are required to provide specific personal or financial information for a particular purpose may need to fill out the fillable 1020 2010 form.

02

This form may be requested by various entities, such as government agencies, employers, or financial institutions, depending on the specific requirements of the situation.

03

The fillable 1020 2010 form is often used for official purposes, such as tax filings, loan applications, or government benefit claims. Individuals in these situations may be required to complete the form to comply with legal or procedural requirements.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is filable 1020 form?

The filable 1020 form is a document used by individuals, partnerships, corporations, and fiduciaries to report their income tax liability to the tax authorities.

Who is required to file filable 1020 form?

Anyone who meets certain income thresholds or has specific types of income, deductions, credits, or tax situations is required to file the filable 1020 form. It applies to individuals, businesses, and estates of deceased individuals.

How to fill out filable 1020 form?

To fill out the filable 1020 form, you need to provide personal information, income details, deductions, credits, and any other relevant information required by the tax authorities. It is recommended to use tax software, consult a tax professional, or refer to the official instructions provided by the tax authorities.

What is the purpose of filable 1020 form?

The main purpose of the filable 1020 form is to calculate and report an individual or entity's taxable income and determine the amount of tax owed or refund due for a specific tax year.

What information must be reported on filable 1020 form?

The filable 1020 form requires information such as personal details, income sources, deductions, credits, and any other relevant financial information. It may vary depending on the individual or entity's tax situation.

When is the deadline to file filable 1020 form in 2023?

The specific deadline to file the filable 1020 form in 2023 will be determined by the tax authorities. It is advisable to refer to the official tax schedule or consult with a tax professional to ensure timely filing.

What is the penalty for the late filing of filable 1020 form?

The penalties for late filing of the filable 1020 form can vary depending on the tax jurisdiction. Common penalties may include monetary fines, interest charges on owed taxes, and potential loss of certain tax benefits. It is recommended to review the official tax guidelines or consult with a tax professional for specific penalty information.

How can I edit filable 1020 2010 form from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like filable 1020 2010 form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I complete filable 1020 2010 form online?

pdfFiller has made it easy to fill out and sign filable 1020 2010 form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for signing my filable 1020 2010 form in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your filable 1020 2010 form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your filable 1020 2010 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.