Get the free PERSONAL EXPENDITURES REPORT - sos state co

Show details

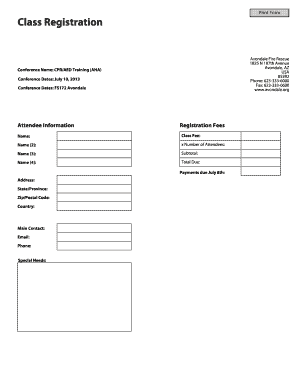

Unaffiliated Candidate Statement of Intent for Vice President Complete, sign, and return this form to the Colorado Secretary of State. Please type or print legibly. Office Use Only: Office Information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your personal expenditures report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal expenditures report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal expenditures report online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit personal expenditures report. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out personal expenditures report

How to fill out a personal expenditures report:

01

Gather all relevant financial documents such as receipts, invoices, credit card statements, and bank statements.

02

Categorize your expenses into different categories such as food, transportation, housing, entertainment, and others.

03

Create a spreadsheet or use online budgeting tools to record your expenses for a specific time period, such as a month or a year.

04

Input the date, description of the expense, the amount spent, and the category it belongs to in the spreadsheet.

05

Total up your expenses for each category and calculate the total amount spent.

06

Double-check your calculations to ensure accuracy.

07

Review your personal expenditures report to gain insights into your spending patterns and identify areas where you can save money.

08

Adjust your budget or spending habits accordingly to reach your financial goals.

Who needs a personal expenditures report:

01

Individuals who want to gain better control over their finances and track their spending habits.

02

People who are looking to create a realistic budget and identify areas where they can cut back on unnecessary expenses.

03

Individuals who need to provide reports of their personal expenditures for work purposes, such as freelancers, contractors, or those who are self-employed.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is personal expenditures report?

A personal expenditures report is a document that tracks and records an individual's personal expenses and financial transactions. It provides a comprehensive overview of an individual's spending habits and helps in budgeting and financial planning.

Who is required to file personal expenditures report?

The requirement to file a personal expenditures report varies by jurisdiction and applicable laws. In some cases, individuals with high net worth or specific professions may be required to file such reports. It is advisable to consult local regulations or consult with a financial advisor or tax professional to determine whether you are obligated to file a personal expenditures report.

How to fill out personal expenditures report?

Filling out a personal expenditures report typically involves gathering relevant financial information such as bank statements, credit card statements, receipts, and other financial documents. This information is then entered into the report form or a designated software or application. It is recommended to categorize expenses and provide detailed information for each transaction to ensure accuracy and completeness of the report. Seeking assistance from a professional accountant or using personal finance management tools can also simplify the process.

What is the purpose of personal expenditures report?

The purpose of a personal expenditures report is to gain insights into individual spending patterns, identify areas of excessive spending, track financial progress, and make informed decisions regarding budgeting and saving goals. It also helps in assessing and managing personal finances effectively, enabling individuals to maintain financial stability and plan for future financial needs and objectives.

What information must be reported on personal expenditures report?

The specific information required to be reported on a personal expenditures report may vary based on jurisdiction and reporting requirements. Generally, it includes details of income sources, expenditure categories, transaction dates, transaction amounts, and any other relevant financial information. It is advisable to consult local regulations or seek professional advice to ensure compliance with specific reporting guidelines.

When is the deadline to file personal expenditures report in 2023?

The specific deadline to file a personal expenditures report in 2023 is dependent on the jurisdiction and relevant regulations. Deadlines can vary and may be subject to change. It is important to refer to the official guidelines or consult with a financial advisor or tax professional to determine the exact deadline applicable to your situation.

What is the penalty for the late filing of personal expenditures report?

Penalties for late filing of personal expenditures reports can differ depending on jurisdiction and applicable laws. These penalties may include financial fines, late fees, interest on unpaid amounts, or other consequences as determined by governing authorities. To avoid penalties, it is crucial to file personal expenditures reports within the specified deadline. It is advisable to consult local regulations or seek professional advice to understand the specific penalty structure for late filing.

How do I modify my personal expenditures report in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your personal expenditures report and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I execute personal expenditures report online?

pdfFiller has made filling out and eSigning personal expenditures report easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out personal expenditures report on an Android device?

On an Android device, use the pdfFiller mobile app to finish your personal expenditures report. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your personal expenditures report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.