Get the free Ms fillable annual return report form

Show details

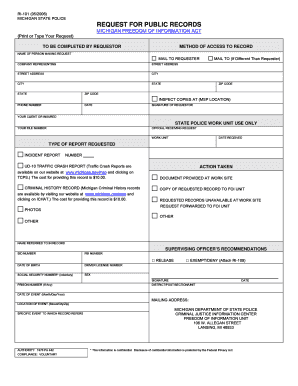

THIS REPORT IS DUE ON OR BEFORE NOVEMBER 30, 2010FORM DM1

Revised 8/2010STATE HEALTH PLANNING AND DEVELOPMENT AGENCY

MAILING ADDRESS (U.S. Postal Service)STREET ADDRESS (Commercial Carrier)PO BOX

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ms annual return report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ms annual return report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ms annual return report online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ms annual return report. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out ms annual return report

How to fill out MS annual return report:

01

Gather all necessary information and documents, such as company details, financial statements, and shareholder information.

02

Use the provided form or template to input the required information. Ensure accuracy and completeness.

03

Include relevant details about the company's activities, finances, and shareholders.

04

Double-check the completed report for any errors or missing information.

05

Submit the report within the specified deadline to the appropriate authority or regulatory body.

Who needs MS annual return report:

01

Companies registered in MS (example jurisdiction).

02

Companies required to comply with the regulations of the jurisdiction.

03

Stakeholders, including government authorities, investors, and creditors, who need accurate and up-to-date information about the company's financial and operational performance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ms annual return report?

The annual return report in MS refers to a document filed by businesses to report their financial performance and related information for a specific year.

Who is required to file ms annual return report?

All registered businesses in MS are required to file the annual return report, including corporations, LLCs, partnerships, and sole proprietorships.

How to fill out ms annual return report?

To fill out the ms annual return report, businesses need to gather their financial statements, income details, expense records, and any other required financial information. Then, they can complete the designated sections of the report with accurate and up-to-date information.

What is the purpose of ms annual return report?

The purpose of the ms annual return report is to provide a comprehensive overview of a business's financial activities and performance during a specific year. It enables authorities, stakeholders, and investors to assess the financial health, compliance, and overall business operations of the entity.

What information must be reported on ms annual return report?

The required information on the ms annual return report typically includes the business's income, expenses, assets, liabilities, equity, taxes paid, number of employees, changes in ownership, and any other relevant financial details as mandated by the applicable laws or regulations.

When is the deadline to file ms annual return report in 2023?

The deadline to file the ms annual return report in 2023 will depend on the specific state and local regulations. It is recommended to consult the official MS government websites or contact the relevant authorities to obtain the accurate filing deadline.

What is the penalty for the late filing of ms annual return report?

The penalties for the late filing of the ms annual return report can vary depending on the jurisdiction and circumstances. Common penalties may include monetary fines, late fees, suspension of business privileges, and potential legal consequences. It is important for businesses to file the report by the designated deadline to avoid such penalties.

Can I create an electronic signature for the ms annual return report in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your ms annual return report in seconds.

How do I fill out the ms annual return report form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign ms annual return report and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit ms annual return report on an iOS device?

Use the pdfFiller mobile app to create, edit, and share ms annual return report from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your ms annual return report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.