Get the free Credit limit increase written invitation consent form (PDF - ANZ

Show details

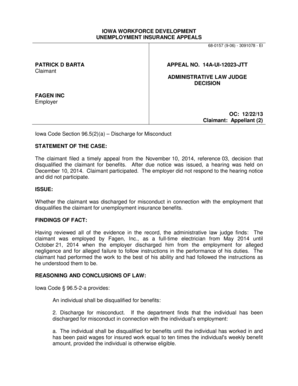

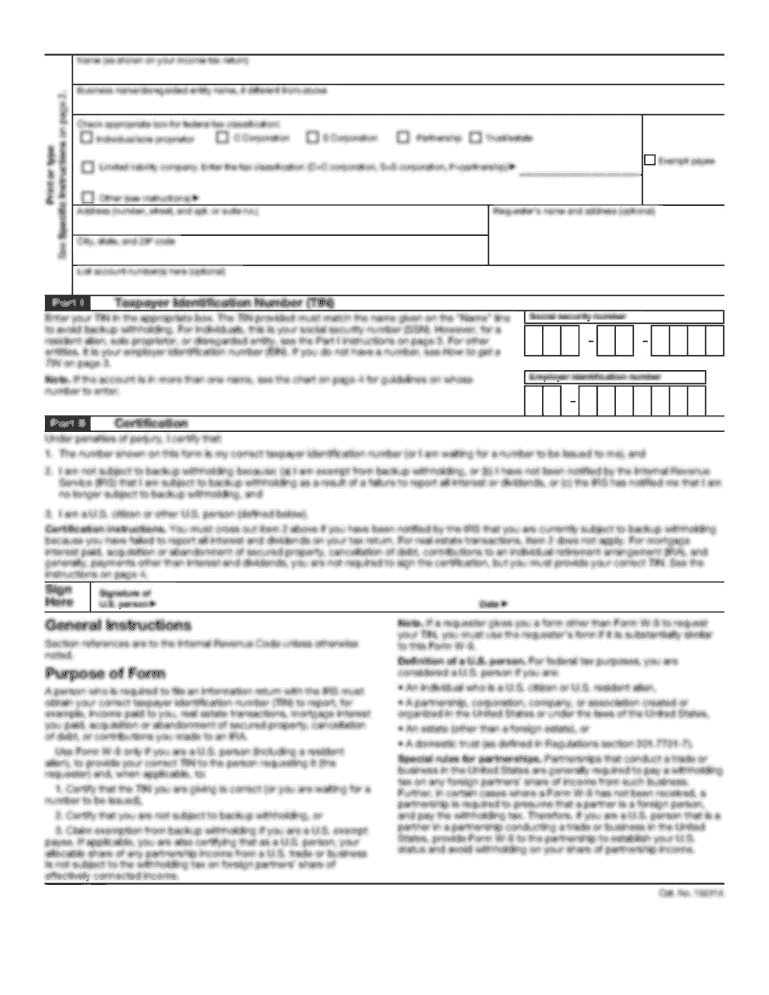

Credit Limit Increase Written Invitation Consent Form Please complete this form in black or blue pen using CAPITALS. 1. PRIMARY CARDHOLDER DETAILS Account Number 1 Account Name (exactly as it appears

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your credit limit increase written form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit limit increase written form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit limit increase written online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit limit increase written. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

How to fill out credit limit increase written

How to fill out credit limit increase written?

01

Gather all necessary information: Before filling out the credit limit increase written, collect all the necessary information such as your current credit limit, the reason for the increase request, proof of income, and any additional documents requested by the credit card company.

02

Review the credit card terms and conditions: Familiarize yourself with the terms and conditions of your credit card to understand the potential implications and requirements for a credit limit increase. This may include factors such as a minimum account age or responsible credit behavior.

03

Contact the credit card company: Reach out to the respective credit card company through their customer service hotline or visit their website to inquire about the process for a credit limit increase. They will provide instructions on how to proceed, which may involve filling out a written request form.

04

Obtain the credit limit increase written form: If required, obtain the credit limit increase written form from the credit card company. This form may be available for download on their website or can be requested via mail or email.

05

Complete the form accurately: Fill out the credit limit increase written form accurately, providing all required information. Make sure to double-check the information entered to avoid any errors or omissions that could delay the process.

06

Attach supporting documents: If additional documents are required, ensure you have gathered and attached them along with the completed form. Examples of supporting documents may include recent pay stubs, tax returns, or proof of other sources of income.

07

Review and sign the form: Carefully review the completed credit limit increase written form, making sure all information is accurate and consistent. Sign and date the form as requested.

08

Submit the form: Follow the instructions provided by the credit card company to submit the form. This may involve mailing the form, uploading it through their online portal, or delivering it in person to a designated branch.

Who needs credit limit increase written?

01

Individuals who wish to have a higher credit limit on their credit card may need to fill out a credit limit increase written form. This allows them to request an increase in their existing credit limit.

02

People who have demonstrated responsible credit behavior and have a need for a higher credit limit, such as for large purchases or financial emergencies, may find it beneficial to submit a credit limit increase written form.

03

Those who have shown a strong repayment history, maintained a low credit utilization ratio, and have a stable source of income are more likely to be approved for a credit limit increase. Therefore, these individuals would need to complete the credit limit increase written process.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is credit limit increase written?

Credit limit increase written is a document that requests an increase in the maximum amount of credit available to an individual or entity.

Who is required to file credit limit increase written?

The party seeking a credit limit increase is generally required to file the credit limit increase written with the appropriate financial institution or credit card company.

How to fill out credit limit increase written?

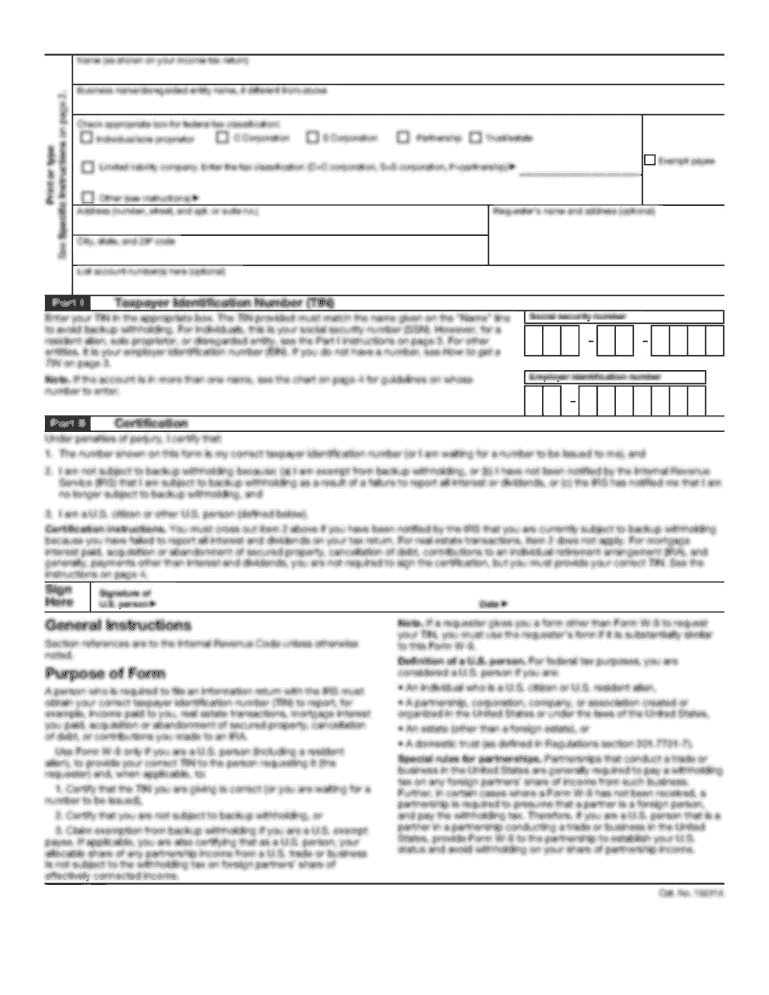

To fill out a credit limit increase written, one typically needs to provide personal or business information, current credit limit, desired credit limit, and reasons for requesting the increase. The specific requirements may vary depending on the financial institution.

What is the purpose of credit limit increase written?

The purpose of a credit limit increase written is to formally request an increase in the maximum amount of credit available to an individual or entity. This can provide greater financial flexibility and purchasing power.

What information must be reported on credit limit increase written?

The information that must be reported on a credit limit increase written usually includes personal or business information, current credit limit, desired credit limit, and reasons for requesting the increase. Additional financial information may be required depending on the financial institution's policies.

When is the deadline to file credit limit increase written in 2023?

The deadline to file a credit limit increase written in 2023 may vary depending on the financial institution or credit card company. It is recommended to directly contact the institution to determine the specific deadline.

What is the penalty for the late filing of credit limit increase written?

The penalty for the late filing of a credit limit increase written can vary depending on the policies of the financial institution or credit card company. It is advisable to check the terms and conditions or contact the institution directly to understand the potential penalties or consequences.

How do I edit credit limit increase written online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your credit limit increase written to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I make edits in credit limit increase written without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing credit limit increase written and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit credit limit increase written straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit credit limit increase written.

Fill out your credit limit increase written online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.