Get the free Long-Term Care Insurance Application, Forms and Outline of Coverage For the State of...

Show details

Next Print... Long-Term Care Insurance Application, Forms and Outline of Coverage For the State of Mississippi (This booklet contains the forms necessary to apply for New York Life s Long-Term Care

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your long-term care insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long-term care insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing long-term care insurance application online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit long-term care insurance application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out long-term care insurance application

How to fill out long-term care insurance application:

01

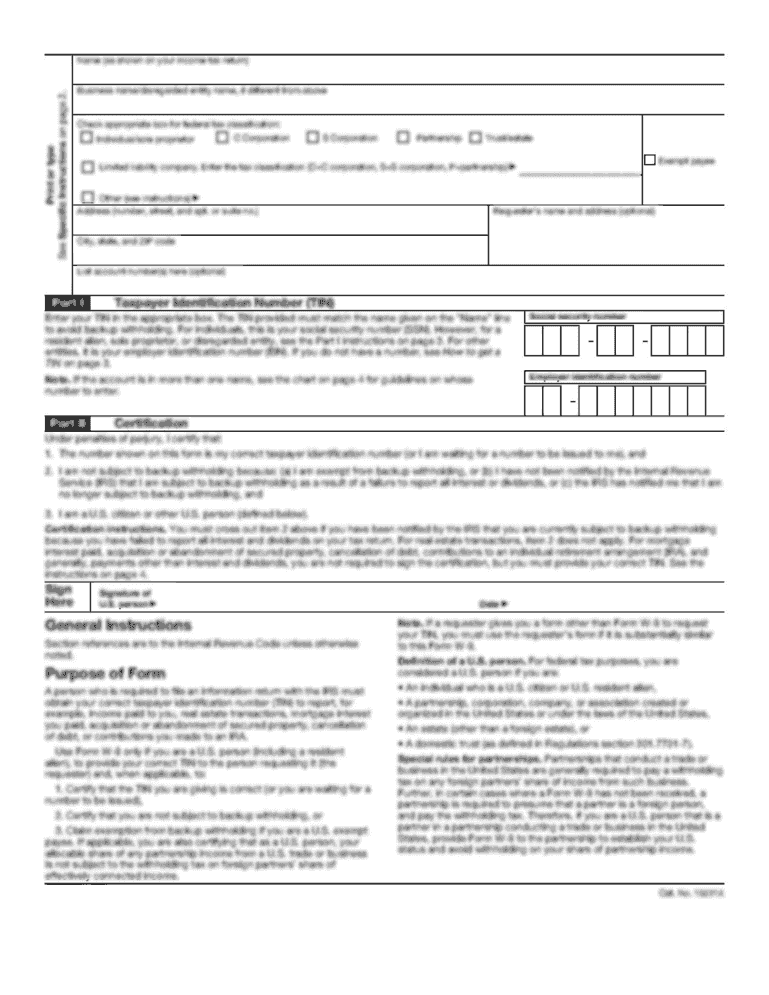

Gather necessary personal information: Start by collecting all the personal information required to complete the application. This may include your name, address, contact details, Social Security number, and date of birth.

02

Provide health and medical history: Be prepared to disclose your medical history, including any pre-existing conditions, surgeries, medications, and treatments. You may also need to provide information about your family's medical history.

03

List current medications: Make a detailed list of all the medications you are currently taking. Include the name, dosage, frequency, and purpose of each medication. This information helps insurance companies assess your health and potential risks.

04

Evaluate your daily activities: Long-term care insurance focuses on helping individuals with activities of daily living (ADLs). Assess your ability to perform tasks like bathing, dressing, eating, toileting, transferring, and continence. This evaluation will help determine the level of care you might need in the future.

05

Assess your financial situation: Long-term care insurance premiums can vary based on factors such as age, coverage amount, and waiting period. Review your financial situation and decide on a premium and coverage that aligns with your budget and long-term care needs.

06

Seek professional assistance, if needed: If you find the application confusing or overwhelming, consider seeking assistance from an insurance agent or financial advisor specializing in long-term care. They can guide you through the process, answer your questions, and ensure you complete the application accurately.

Who needs long-term care insurance application:

01

Individuals planning for their future: Long-term care insurance is beneficial for individuals who want to secure their financial future and be prepared for potential long-term care needs as they age. It provides a way to cover the costs associated with nursing homes, assisted living facilities, and in-home care.

02

Individuals with a family history of health issues: If your family has a history of medical conditions that require long-term care, obtaining long-term care insurance can be a prudent decision. It offers financial protection against the potential costs of such care and ensures you receive the desired level of assistance.

03

Individuals with assets to protect: Long-term care can be expensive, and it can quickly deplete your savings and assets. If you have accumulated significant assets over your lifetime, long-term care insurance can help protect them from being exhausted on care expenses, allowing you to leave a legacy for your loved ones.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is long-term care insurance application?

A long-term care insurance application is a form that individuals or their representatives need to fill out in order to apply for long-term care insurance coverage.

Who is required to file long-term care insurance application?

Any individual who wishes to obtain long-term care insurance coverage is required to file a long-term care insurance application.

How to fill out long-term care insurance application?

To fill out a long-term care insurance application, you will need to provide personal information such as name, date of birth, address, and contact details. You may also need to provide details about your medical history, current health conditions, and any existing long-term care needs.

What is the purpose of long-term care insurance application?

The purpose of a long-term care insurance application is to collect relevant information about an individual's health and long-term care needs in order to assess their eligibility for long-term care insurance coverage.

What information must be reported on long-term care insurance application?

The information required on a long-term care insurance application may include personal details, medical history, current health conditions, any existing long-term care needs, and financial information.

When is the deadline to file long-term care insurance application in 2023?

The deadline to file a long-term care insurance application in 2023 may vary depending on the insurance provider and policy. It is advised to check with your specific insurance provider for the exact deadline.

What is the penalty for the late filing of long-term care insurance application?

The penalty for the late filing of a long-term care insurance application may depend on the insurance provider and policy. It is recommended to review the terms and conditions of your insurance policy or consult with your insurance provider for information on any penalties for late filing.

Where do I find long-term care insurance application?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific long-term care insurance application and other forms. Find the template you need and change it using powerful tools.

How do I edit long-term care insurance application online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your long-term care insurance application to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete long-term care insurance application on an Android device?

Complete long-term care insurance application and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your long-term care insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.