Get the free CERTIFICATION OF FOREIGN SOURCE INCOME - drexel

Show details

This document certifies that the personal services rendered for Drexel University were performed entirely outside the United States, implying that the income is sourced from outside the U.S.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certification of foreign source

Edit your certification of foreign source form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certification of foreign source form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certification of foreign source online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit certification of foreign source. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

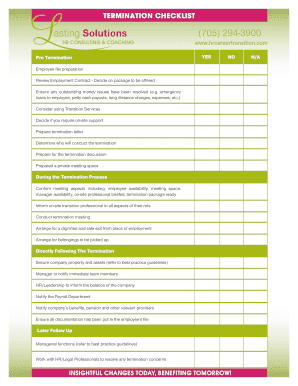

How to fill out certification of foreign source

How to fill out CERTIFICATION OF FOREIGN SOURCE INCOME

01

Obtain the Certification of Foreign Source Income form from the relevant tax authority.

02

Read the form instructions carefully to understand the requirements.

03

Fill in your personal information, including your name, address, and tax identification number.

04

Indicate the foreign source income you received during the tax year, specifying the amount and the country it originated from.

05

Attach any supporting documentation that verifies your foreign income, such as foreign tax returns or bank statements.

06

Review the filled form for accuracy and completeness.

07

Sign and date the certification to declare that the information provided is true and correct.

08

Submit the completed form to the designated tax authority by the specified deadline.

Who needs CERTIFICATION OF FOREIGN SOURCE INCOME?

01

Individuals who have received income from foreign sources and need to report it for tax purposes.

02

Taxpayers claiming foreign tax credits or deductions related to foreign income.

03

Business owners who operate or earn income from foreign activities.

Fill

form

: Try Risk Free

People Also Ask about

What is a foreign person's US source income?

A non-citizen is, in most cases, subject to U.S. tax on income from U.S. sources. Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding, is used to report amounts paid to foreign persons (including those presumed to be foreign) by a United States based institution or business.

How do I report income from a foreign source?

If you are a U.S. citizen or U.S. resident alien, you report your foreign income on your tax return where you report your U.S. income. That is, on line 1 of IRS Form 1040.

What qualifies as foreign source income?

The source of your earned income is the place where you perform the services for which you receive the income. Foreign earned income is income you receive for performing personal services in a foreign country. Where or how you are paid has no effect on the source of the income.

How do I know if I qualify for foreign earned income exclusion?

A U.S. citizen or a U.S. resident alien who is physically present in a foreign country or countries for at least 330 full days during any period of 12 consecutive months.

What is excluded from the term foreign earned income?

Not foreign earned income: Foreign earned income does not include the following amounts: Pay received as a military or civilian employee of the U.S. government or any of its agencies. Pay for services conducted in international waters or airspace (not a foreign country)

What is considered foreign source income?

Foreign source income is the amount that results from multiplying your total pay (including allowances, reimbursements, and noncash fringe benefits) by a fraction. The numerator (top number) is the number of days you worked within a foreign country.

What is a specified foreign sourced income?

Specified foreign-sourced income means any of the following income arising in or derived from a territory outside Hong Kong on or after the following dates: 1 January 2023 – interest, dividend, IP income, and equity interest disposal gain. 1 January 2024 – disposal gain other than equity interest disposal gain.

What is a foreign person's US source income?

A non-citizen is, in most cases, subject to U.S. tax on income from U.S. sources. Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding, is used to report amounts paid to foreign persons (including those presumed to be foreign) by a United States based institution or business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CERTIFICATION OF FOREIGN SOURCE INCOME?

CERTIFICATION OF FOREIGN SOURCE INCOME is a documentation required by tax authorities to verify income earned from foreign sources, typically for tax reporting purposes.

Who is required to file CERTIFICATION OF FOREIGN SOURCE INCOME?

Individuals and entities that earn income from foreign sources and need to report that income for tax compliance purposes are required to file CERTIFICATION OF FOREIGN SOURCE INCOME.

How to fill out CERTIFICATION OF FOREIGN SOURCE INCOME?

To fill out CERTIFICATION OF FOREIGN SOURCE INCOME, taxpayers must provide details about their foreign income, including the amount earned, the source of income, and any relevant tax treaties or agreements.

What is the purpose of CERTIFICATION OF FOREIGN SOURCE INCOME?

The purpose of CERTIFICATION OF FOREIGN SOURCE INCOME is to provide tax authorities with accurate information regarding foreign income, ensuring that taxpayers comply with tax laws and regulations.

What information must be reported on CERTIFICATION OF FOREIGN SOURCE INCOME?

On CERTIFICATION OF FOREIGN SOURCE INCOME, taxpayers must report details such as the type of income, the amount earned, the country of origin, and any foreign taxes paid on that income.

Fill out your certification of foreign source online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certification Of Foreign Source is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.