Get the free Credit Card Processing and Security Policy - ferris

Show details

This document outlines the policies and guidelines for handling credit and debit card transactions at Ferris State University, ensuring compliance with Payment Card Industry Security Standards.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card processing and

Edit your credit card processing and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card processing and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

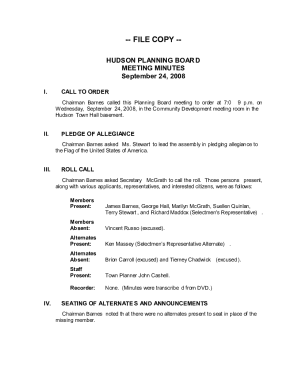

How to edit credit card processing and online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit card processing and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card processing and

How to fill out Credit Card Processing and Security Policy

01

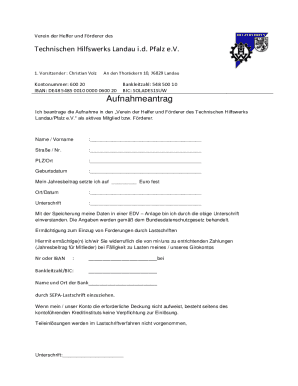

Begin with your business information: Include your company name, address, and contact details.

02

Define the scope: Specify the types of transactions that will be covered under the policy.

03

Outline security measures: Detail the encryption methods, firewalls, and access controls you will implement to protect cardholder data.

04

Describe data processing methods: Explain how credit card transactions will be processed and stored securely.

05

Include compliance requirements: State how you will comply with PCI DSS and other regulatory requirements.

06

Establish monitoring procedures: Define how you will monitor transactions and secure systems for any suspicious activities.

07

Develop employee training protocols: Outline training programs for staff regarding credit card security practices.

08

Create a response plan: Detail the steps to take in case of a data breach or security incident.

09

Review and update regularly: Mention the frequency of policy reviews and updates to maintain compliance with new regulations.

Who needs Credit Card Processing and Security Policy?

01

Any business that accepts credit card payments, including retail stores, online merchants, and service providers.

02

Companies that handle sensitive customer information and want to ensure data protection.

03

Organizations needing to comply with PCI DSS regulations.

04

Businesses aiming to build customer trust by demonstrating commitment to security.

Fill

form

: Try Risk Free

People Also Ask about

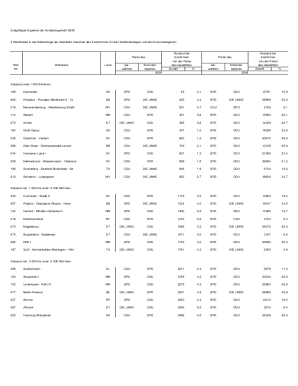

What are the 4 levels of PCI compliance?

Level 1: Merchants processing over 6 million card transactions per year. Level 2: Merchants processing 1 to 6 million transactions per year. Level 3: Merchants handling 20,000 to 1 million transactions per year. Level 4: Merchants handling fewer than 20,000 transactions per year.

What is the credit card processing security standard?

The Payment Card Industry Data Security Standard (PCI DSS) was developed to encourage and enhance payment card account data security and facilitate the broad adoption of consistent data security measures globally. PCI DSS provides a baseline of technical and operational requirements designed to protect account data.

What is the PCI acceptable use policy?

Creating an effective acceptable use policy (AUP) is a cornerstone of PCI DSS Requirement 12.2. This policy governs how end-user technologies are utilised within your organisation, ensuring that their use does not compromise cardholder data security.

Can I do my own PCI compliance?

To become PCI compliant, small businesses typically must fill out a self-assessment form in addition to meeting the requirements listed above. Larger businesses usually need to hire third-party auditors to assess them.

How to write a PCI DSS policy?

A PCI DSS policy must address the 12 core requirements, ranging from a firewall to security testing. It also must have a section on the organization's PCI scope, a list of important company roles and responsibilities, and a basic overview.

How to write a PCI compliance policy?

Write clear and concise templates Writers must avoid confusion at all costs. Link security controls to PCI requirements. Show how controls protect cardholder data, and include clear information about auditing and assessments. Outline the steps that employees must take when using security systems.

What are the 12 PCI requirements?

PCI Compliance Requirements Use and Maintain Firewalls. Proper Password Protections. Protect Cardholder Data. Encryption of Transmitted Cardholder Data. Utilize Antivirus and Anti-malware Software. Properly Updated Software. Restrict Data Access. Unique IDs Assigned to Those with Access to Data.

What is PCI compliance policy?

Payment card industry compliance refers to the technical and operational standards businesses follow to secure and protect credit card data provided by cardholders and transmitted through card processing transactions. PCI standards for compliance are developed and managed by the PCI Security Standards Council.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Credit Card Processing and Security Policy?

Credit Card Processing and Security Policy outlines the procedures and guidelines that businesses must follow to securely process credit card transactions and protect sensitive payment information.

Who is required to file Credit Card Processing and Security Policy?

All businesses that accept credit card payments, including merchants, online retailers, and service providers, are required to file a Credit Card Processing and Security Policy.

How to fill out Credit Card Processing and Security Policy?

To fill out the policy, businesses should gather relevant information about their payment processing systems, implement security measures, and document their procedures related to transaction processing, data protection, and compliance with standards such as PCI DSS.

What is the purpose of Credit Card Processing and Security Policy?

The purpose of this policy is to ensure the security of cardholder data, reduce the risk of fraud, and comply with legal and industry standards for payment processing.

What information must be reported on Credit Card Processing and Security Policy?

The policy should include details about the payment processing methods used, security measures in place (such as encryption), employee training on data security, incident response procedures, and compliance with applicable regulations.

Fill out your credit card processing and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Processing And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.