Get the free Income Clarification Form - lec

Show details

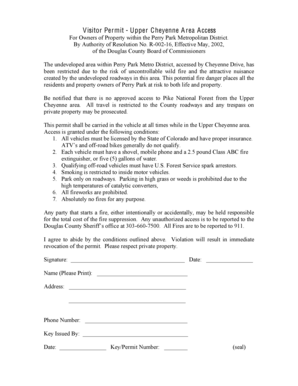

Office of Financial Aid 391 W. Washington Street Painesville, OH 44077 440-375-7100 Income Clarification Form 2012-2013 Name: Student ID: We are in the process of awarding your financial aid for the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your income clarification form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income clarification form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit income clarification form online

Follow the steps below to benefit from the PDF editor's expertise:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit income clarification form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

How to fill out income clarification form

How to fill out income clarification form:

01

Start by reading the instructions on the form carefully to understand what information is required.

02

Gather all the necessary documents such as pay stubs, bank statements, and tax returns that prove your income.

03

Begin filling out the form by providing your personal details such as name, address, and social security number.

04

Follow the instructions to provide accurate information about your employment status, including your current job and any additional sources of income.

05

Provide details about your income, including your salary or hourly wage, any bonuses or commissions, and any deductions or withholdings.

06

If you have self-employment income, carefully fill out the section that requires you to provide information about your business or freelance work.

07

Be prepared to provide additional supporting documents if requested, such as proof of assets, investments, or other financial information.

08

Double-check all the information you have provided to ensure accuracy and completeness.

09

Sign and date the form where indicated.

10

Keep a copy of the completed form and any supporting documents for your records.

Who needs income clarification form:

01

Individuals or households applying for government assistance programs that require verification of income.

02

Employees applying for loans or mortgages who need to provide proof of their income.

03

Individuals involved in legal matters, such as divorce or child support cases, where income verification is necessary.

04

Students applying for financial aid or scholarships that require income verification.

05

Individuals or businesses undergoing a financial audit or investigation where income documentation is required.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is income clarification form?

Income clarification form is a document used to provide additional information about one's income in order to clarify any discrepancies or uncertainties.

Who is required to file income clarification form?

Individuals who have certain types of income or who need to clarify inconsistencies in their income reporting may be required to file an income clarification form.

How to fill out income clarification form?

To fill out the income clarification form, you typically need to provide detailed information about your income sources, such as employment income, investment income, and any other relevant income sources. The form may also require you to explain any discrepancies or provide supporting documents for your reported income.

What is the purpose of income clarification form?

The purpose of the income clarification form is to ensure accurate reporting of income and to address any discrepancies or uncertainties that may arise during the income verification process.

What information must be reported on income clarification form?

The information that must be reported on the income clarification form typically includes details about various income sources, such as wages, tips, bonuses, self-employment income, rental income, investment income, and any other relevant sources of income. Additionally, any discrepancies or inconsistencies in the reported income should be explained or clarified in the form.

When is the deadline to file income clarification form in 2023?

The specific deadline to file the income clarification form in 2023 may vary depending on the jurisdiction or organization requiring the form. It is recommended to refer to the official guidelines or instructions provided by the relevant authority to determine the exact deadline.

What is the penalty for the late filing of income clarification form?

The penalty for the late filing of the income clarification form may vary depending on the jurisdiction or organization. Common penalties can include fines, interest charges, or other consequences specified in the relevant rules and regulations. It is advisable to consult the official guidelines or seek professional advice to understand the specific penalties in your situation.

How do I fill out the income clarification form form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign income clarification form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How can I fill out income clarification form on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your income clarification form. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I edit income clarification form on an Android device?

You can make any changes to PDF files, such as income clarification form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your income clarification form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.