Get the free CASH ADVANCE REPORT - biola

Show details

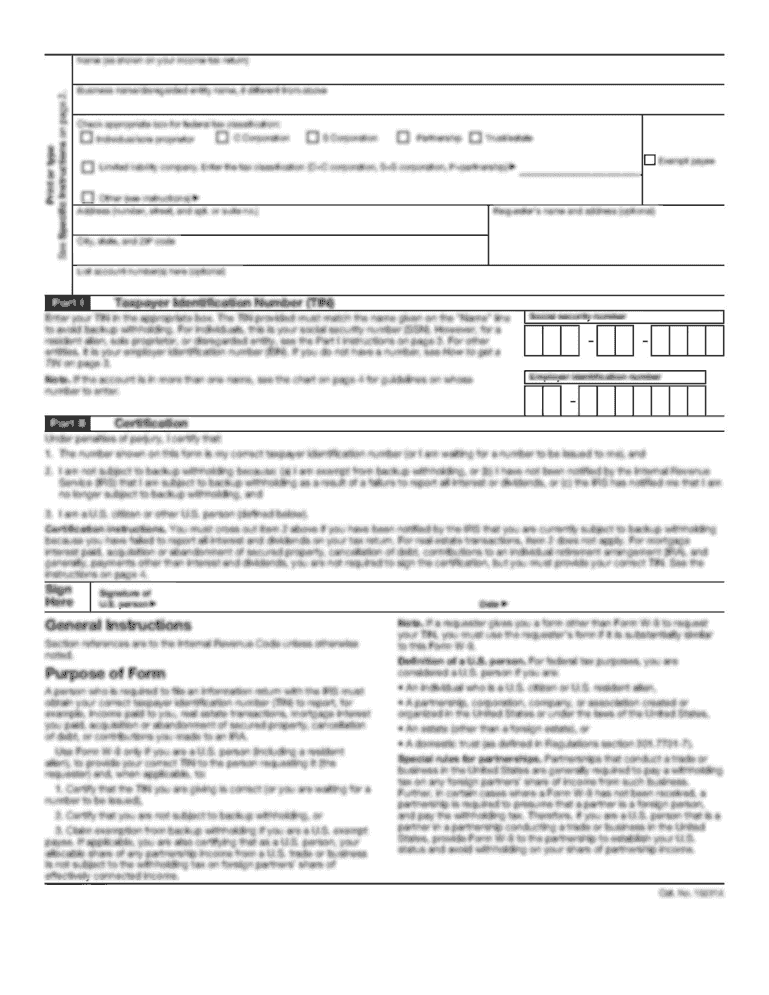

This document is used to report expenses related to cash advances at Biola University, including details on expenditures and request for reimbursement.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash advance report

Edit your cash advance report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash advance report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cash advance report online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cash advance report. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash advance report

How to fill out CASH ADVANCE REPORT

01

Begin by obtaining the CASH ADVANCE REPORT form from your department or online.

02

Fill in your name, employee ID, and department information at the top of the report.

03

Enter the date of the transaction in the specified field.

04

Provide a detailed description of the cash advance purpose.

05

List the amount of cash advanced and the currency used.

06

Include any receipts or supporting documentation as attachments.

07

Review all information for accuracy before submission.

08

Sign and date the report at the bottom.

Who needs CASH ADVANCE REPORT?

01

Employees who have received cash advances for business purposes.

02

Finance department personnel who process reimbursement claims.

03

Managers who oversee employee expenses.

Fill

form

: Try Risk Free

People Also Ask about

How do you explain a cash advance?

Key Takeaways A cash advance is the act of withdrawing cash against your credit card limit. You can complete a cash advance at an ATM, in person at a bank or — in some cases — over the phone.

What is the summary of cash disbursement?

A cash disbursement is a payment made from a cash account. A drawdown is money taken out that decreases the balance in an account. For example, a payment made from a retirement account disburses funds to the account owner through a drawdown from the retirement funds.

What is the summary of cash advance?

A cash advance is a small, short-term loan available through banks, credit cards, lending apps, and other sources. Cash advances can provide money in a hurry but often have high interest rates and fees.

What is the summary of a payday loan?

A payday loan is usually repaid in a single payment on the borrower's next payday, or when income is received from another source, such as a pension or Social Security. The due date is typically two to four weeks from the date the loan was made.

What is the purpose of the cash advance form?

The Request for Cash Advance form is used for several different purposes. They are as follows: To establish Change Funds with prior approval (long-term or short-term) To establish a Petty Cash Fund with prior approval (long-term or short-term)

What is cash advance in English?

Meaning of cash advance in English. an amount of money that someone borrows and on which they start to pay interest as soon as they receive it. The rate of interest for this type of loan is usually higher than for other types of loan: We can provide short term loans and cash advances until your next payday.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CASH ADVANCE REPORT?

A CASH ADVANCE REPORT is a document used to detail the amounts of cash advances received by an individual or organization, including the purpose of the advances and how they were used.

Who is required to file CASH ADVANCE REPORT?

Individuals or organizations that receive cash advances for business-related expenses are typically required to file a CASH ADVANCE REPORT to account for the use of those funds.

How to fill out CASH ADVANCE REPORT?

To fill out a CASH ADVANCE REPORT, provide necessary details such as the date of the advance, amount received, purpose of the advance, and any receipts or documentation of expenses incurred related to the advance.

What is the purpose of CASH ADVANCE REPORT?

The purpose of a CASH ADVANCE REPORT is to maintain transparency and accountability in financial transactions, ensuring that cash advances are properly documented and justified.

What information must be reported on CASH ADVANCE REPORT?

The information that must be reported includes the date of the cash advance, the amount, the purpose of the advance, any supporting documentation, and the details of how the funds were utilized.

Fill out your cash advance report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash Advance Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.