Get the free Form W-4 (2006) W-4 - nwcg

Show details

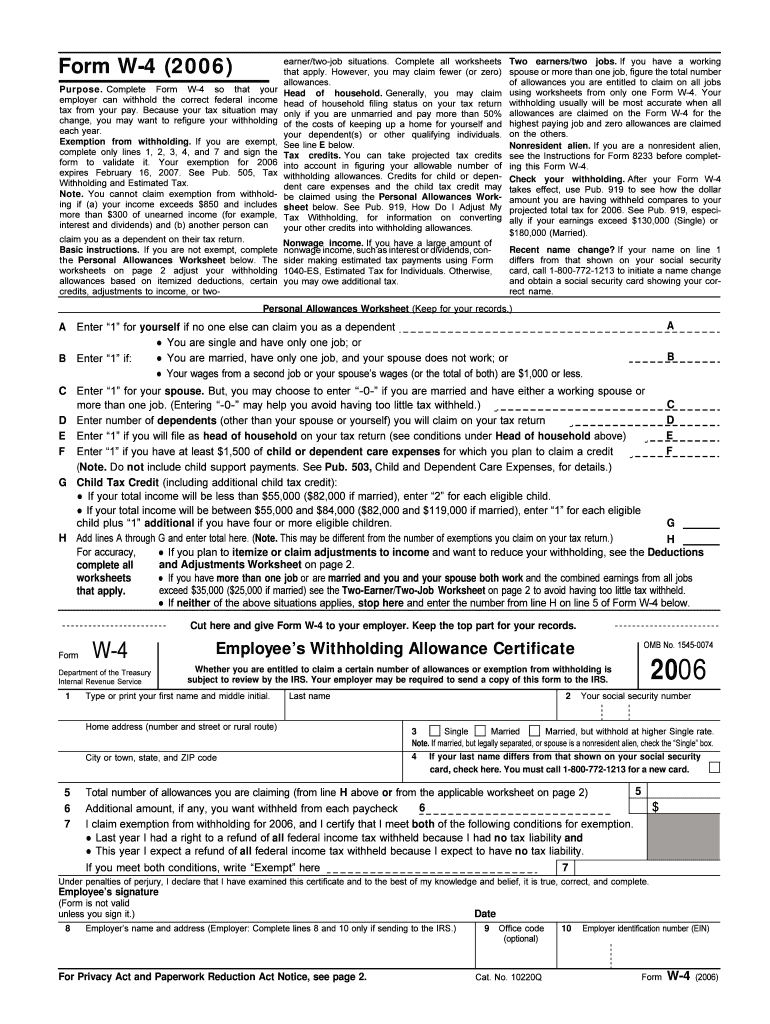

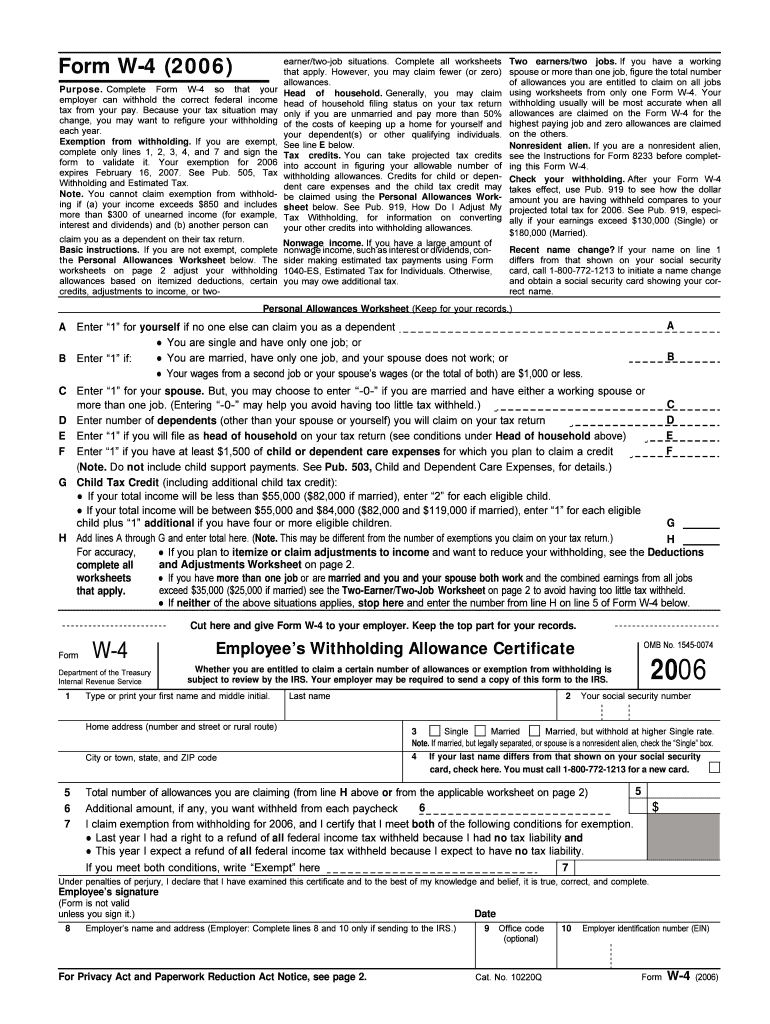

Form W-4 (2006) Purpose. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Because your tax situation may change, you may want to prefigure your withholding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form w-4 2006 w-4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form w-4 2006 w-4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form w-4 2006 w-4 online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form w-4 2006 w-4. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out form w-4 2006 w-4

How to fill out form W-4 2006 W-4:

01

Start by entering your personal information in the spaces provided. This includes your name, address, social security number, and filing status.

02

Indicate the number of allowances you want to claim on line 5. The higher the number, the less tax will be withheld from your paycheck. It is important to choose the appropriate number of allowances to ensure you are not over or underwithholding.

03

If you have multiple jobs or a working spouse, refer to the worksheets included with the form to determine the additional amount to withhold. This will help you avoid owing taxes at the end of the year.

04

If you have any additional income or deductions that you would like to account for, refer to the worksheets provided and follow the instructions to ensure accurate withholding.

05

Complete the signature section at the bottom of the form, certifying that the information you provided is true and accurate to the best of your knowledge.

06

Submit the completed form to your employer.

Who needs form W-4 2006 W-4:

01

Employees who are starting a new job and need to provide their employer with their withholding tax information.

02

Individuals who have experienced a change in their personal or financial circumstances and need to update their withholding information.

03

Employees who want to adjust the amount of taxes withheld from their paycheck to meet their tax liability or desired refund amount.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form w-4 w-4?

Form W-4 is an IRS tax form used by employees to indicate their withholding allowances for federal income tax purposes.

Who is required to file form w-4 w-4?

All employees who receive wages subject to income tax withholding are required to file Form W-4.

How to fill out form w-4 w-4?

Employees need to provide personal information, such as their name, address, and social security number, and indicate their marital status and withholding allowances on Form W-4.

What is the purpose of form w-4 w-4?

The purpose of Form W-4 is to inform employers how much federal income tax to withhold from an employee's paycheck based on their personal circumstances.

What information must be reported on form w-4 w-4?

Form W-4 requires employees to report their personal information, such as their name, address, and social security number, as well as their marital status and withholding allowances.

When is the deadline to file form w-4 w-4 in 2023?

The deadline to file Form W-4 in 2023 is usually by the date of the employee's first paycheck in that tax year or within 10 days of a change in their personal circumstances that would affect their withholding.

What is the penalty for the late filing of form w-4 w-4?

There is no specific penalty for the late filing of Form W-4. However, failure to provide a properly completed Form W-4 may result in the employer using the default withholding rate for the employee, which may not accurately reflect their actual tax liability.

How can I manage my form w-4 2006 w-4 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your form w-4 2006 w-4 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit form w-4 2006 w-4 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing form w-4 2006 w-4 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for the form w-4 2006 w-4 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your form w-4 2006 w-4.

Fill out your form w-4 2006 w-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.