Get the free Gift Administration - University of Maine System - maine

Show details

ADMINISTRATIVE PRACTICE LETTER SUBJECT: GIFT ADMINISTRATION Section: Issue: Page(s): Effective: VB 3 1 of 9 2/12/07 GUIDELINES: The following guidelines are established to help maintain the integrity

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gift administration - university form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift administration - university form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gift administration - university online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gift administration - university. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

How to fill out gift administration - university

How to fill out gift administration - university:

01

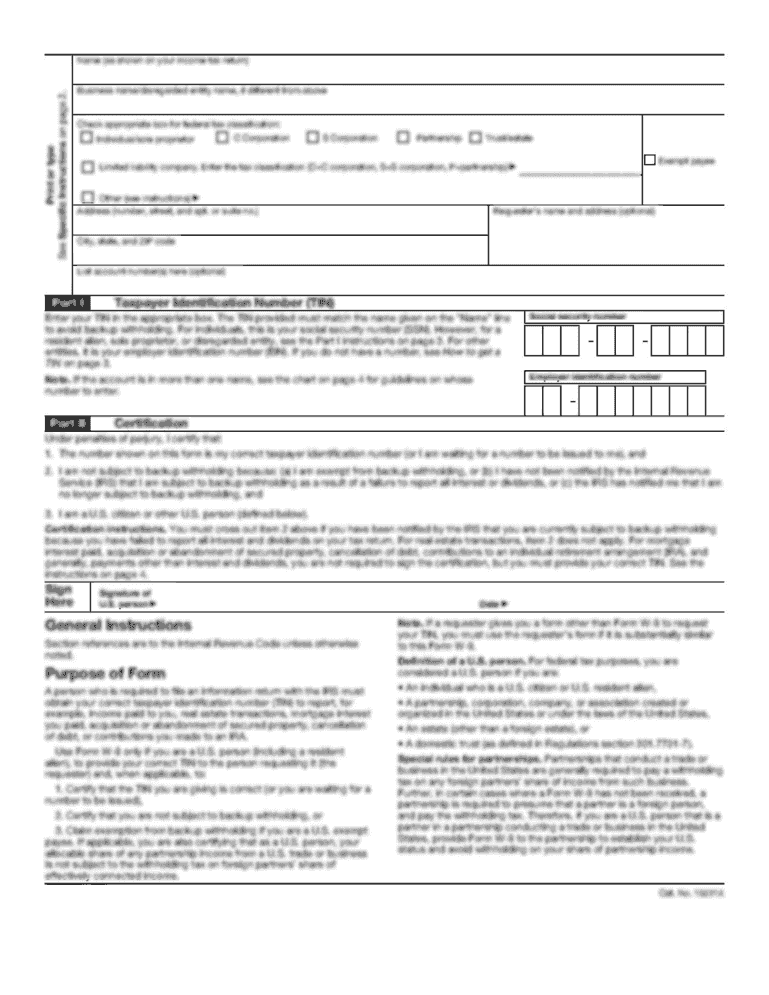

Begin by gathering all relevant information about the gift, including the donor's name, contact information, and the purpose of the gift.

02

Determine the appropriate department or individual within the university responsible for gift administration. This may vary depending on the size and structure of the university.

03

Fill out the necessary forms or documentation required by the university for gift administration. This may include gift acceptance policies, donor recognition guidelines, and gift agreement forms.

04

Ensure that all legal and ethical considerations are taken into account when accepting and administering the gift. This may involve consulting with legal counsel or the university's development office.

05

Communicate with the donor throughout the gift administration process, providing updates on how their gift is being used and expressing gratitude for their generosity.

Who needs gift administration - university:

01

Universities and other educational institutions that receive gifts or donations.

02

Development offices within the university responsible for fundraising and managing donor relationships.

03

Financial and legal departments within the university that handle gift administration and compliance with relevant laws and regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gift administration - university?

Gift administration - university refers to the management and oversight of charitable gifts received by a university. It involves monitoring and distributing funds, ensuring compliance with applicable laws and regulations, and establishing policies and procedures for handling donations.

Who is required to file gift administration - university?

The university or educational institution receiving the charitable gifts is responsible for filing the gift administration forms and fulfilling their reporting obligations.

How to fill out gift administration - university?

To fill out gift administration forms for a university, the institution needs to gather relevant information about the gifts received, such as the donor's name, contact details, donation amount, purpose of the gift, and any restrictions or special instructions from the donor. This information should be recorded accurately on the applicable forms provided by the university or the relevant governing body.

What is the purpose of gift administration - university?

The purpose of gift administration - university is to ensure proper stewardship of charitable gifts received by the university. It involves managing and allocating funds according to the donor's intentions, maintaining accountability, and ensuring compliance with legal and ethical standards.

What information must be reported on gift administration - university?

The information that must be reported on gift administration forms for a university typically includes details about the donor (name, contact information), the gift amount, purpose or designation of the gift, any restrictions or conditions imposed by the donor, and any relevant documentation supporting the gift.

When is the deadline to file gift administration - university in 2023?

The deadline to file gift administration forms for a university in 2023 may vary depending on the specific reporting requirements of the institution and the relevant regulatory bodies. It is advisable to consult the university's gift administration office or refer to the official guidelines for the exact deadline.

What is the penalty for the late filing of gift administration - university?

The penalties for late filing of gift administration forms by a university can vary depending on applicable laws and regulations. They may include financial penalties, loss of tax-exempt status, reputational damage, and potential legal consequences. It is important for universities to comply with filing deadlines to avoid these penalties.

How do I complete gift administration - university on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your gift administration - university from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I edit gift administration - university on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute gift administration - university from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I fill out gift administration - university on an Android device?

Use the pdfFiller app for Android to finish your gift administration - university. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your gift administration - university online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.