Get the free Filing Your Tax Forms After Selling Your Employee Stock Purchase ...

Show details

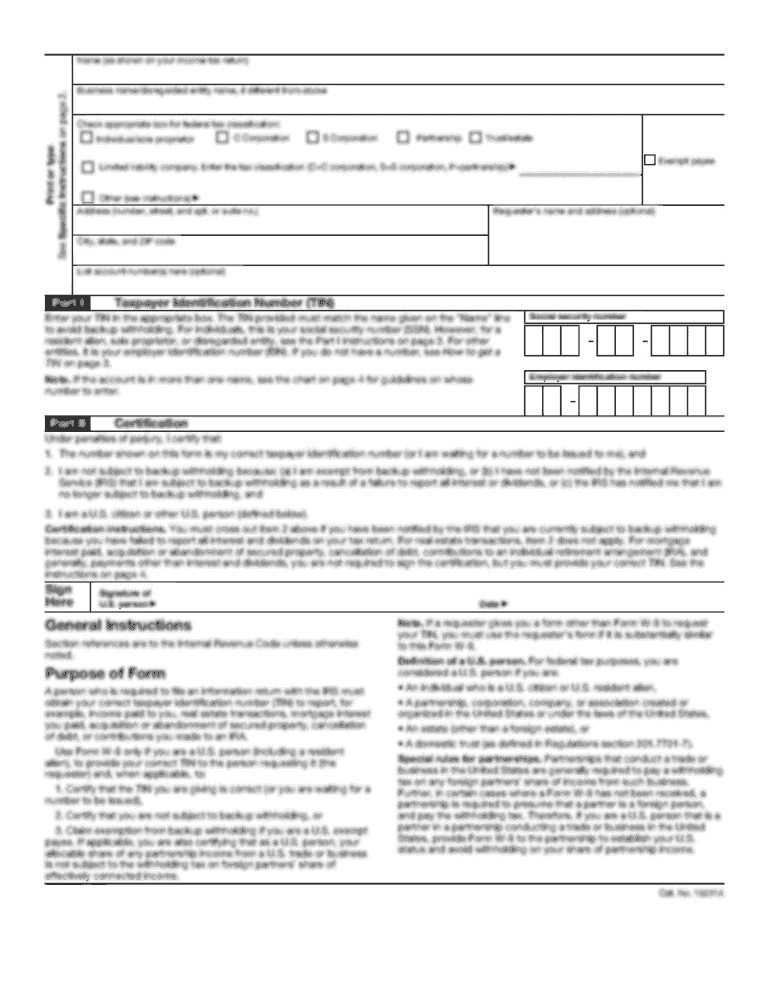

Taxes December 2012 Q. What information do I need to file my tax return? Q. What is a Non-qualified plan, and how does it work? Q. What is a Qualified 423 plan, and how does it work? Q. How can I

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your filing your tax forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your filing your tax forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit filing your tax forms online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit filing your tax forms. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

How to fill out filing your tax forms

How to fill out filing your tax forms:

01

Gather all necessary documents such as W-2 forms, 1099 forms, and any other income or deduction records.

02

Use tax software or online services to assist with filling out the forms. They will guide you through each step and help you calculate your tax liability.

03

Make sure to accurately report all your income, deductions, and credits. Double-check all the numbers and ensure they match your supporting documents.

04

Sign and date the forms before submitting them. If you're filing electronically, follow the instructions for e-signing.

05

Determine if you owe any taxes or if you're eligible for a refund. Follow the provided payment instructions if applicable.

06

Keep a copy of all your filed tax forms and supporting documents for future reference.

Who needs filing your tax forms:

01

Any individual who earns income during a tax year, above a certain threshold, is required to file tax forms.

02

Self-employed individuals, freelancers, independent contractors, and business owners must also file tax forms, even if their income is below the threshold.

03

Filing tax forms may also be necessary for those who have received income from other sources, such as investments or rental properties. It's important to consult with a tax professional or refer to the IRS guidelines to determine if you need to file.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is filing your tax forms?

Filing your tax forms refers to the process of submitting your tax information and financial details to the appropriate government agency, such as the Internal Revenue Service (IRS) in the United States.

Who is required to file filing your tax forms?

Individuals or entities who meet certain income thresholds or have specific tax obligations, as determined by the tax laws of their jurisdiction, are required to file their tax forms.

How to fill out filing your tax forms?

To fill out your tax forms, you will need to gather relevant financial documents, such as W-2s, 1099s, and receipts, and follow the instructions provided by the tax authority. These forms typically require you to report your income, deductions, and credits.

What is the purpose of filing your tax forms?

The purpose of filing your tax forms is to fulfill your legal obligation to report your income and pay any taxes owed to the government. Filing your tax forms also allows the tax authority to assess and collect the appropriate amount of tax from individuals and entities.

What information must be reported on filing your tax forms?

When filing your tax forms, you must report various types of information, including your income from different sources, deductions and credits you are eligible for, and any taxes already paid. The exact information required may vary depending on the tax laws of your jurisdiction.

When is the deadline to file filing your tax forms in 2023?

The deadline to file your tax forms in 2023 will depend on the tax laws of your jurisdiction. It is recommended to consult the tax authority or a tax professional for the specific deadline applicable to you.

What is the penalty for the late filing of filing your tax forms?

The penalty for late filing of your tax forms can vary depending on the tax laws of your jurisdiction. Common penalties may include a fixed amount per day of delay or a percentage of the tax owed. It is advisable to refer to the tax authority or a tax professional for accurate penalty information.

How can I edit filing your tax forms from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including filing your tax forms. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit filing your tax forms in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing filing your tax forms and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out filing your tax forms on an Android device?

Use the pdfFiller mobile app to complete your filing your tax forms on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your filing your tax forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.