There is also a great number of other persons, professors, students, journalists and the public who contributed on an individual basis and in different countries with which I communicated with. I have also received support from colleagues at the Federal Office for Migration and Refugees (BARF) that is located in the Federal Ministry of the Interior. This department, also headed by Minister Lamina Limite-Garonne, had my interest of investigating migrant labor markets seriously. I am especially thankful to my PhD supervisors and the Director of the School of Economics of BARF Maria Bianchi, for their trust, encouragement and support during my PhD. During my research I was supported by the Federal Ministry for Regional Affairs and the Federal Ministry of Labor. I also received financial support from the Italian Council for Scientific Research and Technology (CSF) and from the European Community. For the production of this monograph I was supported by the German Research Foundation and the Austrian Ministry of Economic Relations. I am especially grateful to the Ministry of Employment and the Federal Ministry of Labor for this support. Special thanks go to Prof. Marilyn Grains, Head Department of Economics at the University of Lugano, for her interest, patience and guidance. I am especially thankful to my friends at the Italian Council for Scientific Research and Technology (CSF) that gave me access to their data for this data set. All the data set with which I can provide data for this research is publicly available in the open data portal at. I am also very thankful to Prof. Marilyn Grains for making me aware of the need for more data on migrant labor movements in Italy. I would like to thank my wife and the members of my family. Thanks to all Italian academics, economists and businesspeople that provided me with access to their data.

References Guglielmo, G., H. C. Jost-Reichmann, D. F. Letting, R. Ginsberg, and J. Eichstaedt. 2004. “Migrant Labor Markets: Analysis by the EU's Social Fund.” The New European 15 (2): 21-40.

Guglielmo, G., G. Jusufakci, and R. Martini. 2010. “Migrant and Seasonal-Employee Labor Markets.” Journal of Economic Perspectives 25(4): 17-25.

Get the free Wage differential of a trans border labor market, a quantitative ... - ire eco usi

Show details

Wage DI essential of a transborder labor market, a quantitative analysis by Oscar Gonzalez Submitted for the degree of PhD. in Economics University of Lugano, Switzerland Committee in charge: Professor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your wage differential of a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wage differential of a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wage differential of a online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wage differential of a. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is wage differential of a?

Wage differential of a refers to the difference in wages earned by an employee before and after a work-related injury or illness. It is typically calculated based on the employee's pre-injury wages and the wages they are able to earn after the injury or illness.

Who is required to file wage differential of a?

The employer or the workers' compensation insurance carrier is typically responsible for filing the wage differential of a form. However, the specific filing requirements may vary depending on the jurisdiction and the rules of the workers' compensation system in place.

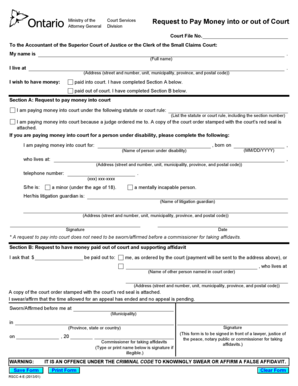

How to fill out wage differential of a?

To fill out wage differential of a, you will typically need to provide information about the employee's pre-injury wages, the nature and extent of the work-related injury or illness, and any current wages earned by the employee. You may need to use specific forms or follow guidelines provided by the relevant workers' compensation authority.

What is the purpose of wage differential of a?

The purpose of wage differential of a is to ensure that employees who have suffered work-related injuries or illnesses are appropriately compensated for any loss of earning capacity caused by these incidents. It aims to provide a fair and equitable system for determining the difference in wages earned by an employee before and after the injury or illness.

What information must be reported on wage differential of a?

The specific information that must be reported on wage differential of a may vary depending on the jurisdiction and the rules of the workers' compensation system. However, common information that may need to be reported includes the employee's pre-injury wages, the date of the injury or illness, the nature and extent of the injury or illness, and any current wages earned by the employee.

When is the deadline to file wage differential of a in 2023?

The deadline to file wage differential of a in 2023 may vary depending on the jurisdiction and the specific rules in place. It is recommended to consult the relevant workers' compensation authority or legal counsel for accurate and up-to-date information regarding the filing deadlines.

What is the penalty for the late filing of wage differential of a?

The penalty for the late filing of wage differential of a may vary depending on the jurisdiction and the rules of the workers' compensation system. It is advisable to consult the relevant workers' compensation authority or legal counsel to understand the specific penalties applicable for late filings.

How do I make changes in wage differential of a?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your wage differential of a and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit wage differential of a in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing wage differential of a and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I edit wage differential of a on an iOS device?

Create, edit, and share wage differential of a from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your wage differential of a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.