Get the free FORM 10-Q - Investor Relations - Google

Show details

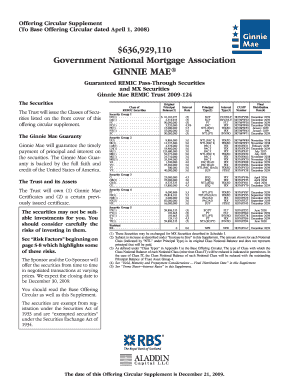

Table of Contents 2004. EDGAR Online, Inc. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q (Mark One) QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 10-q - investor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 10-q - investor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 10-q - investor online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 10-q - investor. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out form 10-q - investor

How to fill out form 10-q - investor:

01

Start by reviewing the instructions provided by the U.S. Securities and Exchange Commission (SEC) for filing form 10-Q. These instructions will provide important guidance on how to accurately complete the form.

02

Ensure that you have all the required financial information and supporting documentation. This may include financial statements, disclosures, and any other relevant information related to the reporting period covered by the form.

03

Begin by completing the basic information section of the form, which includes details such as the company's name, address, and reporting period. Double-check that all the entered information is accurate and up-to-date.

04

Proceed to the financial statements section of the form. This may include information such as balance sheets, income statements, and cash flow statements. Carefully input the financial figures, making sure to follow any specific formatting or presentation requirements outlined in the SEC instructions.

05

Include any necessary disclosures or explanatory notes to provide additional context or clarification to the financial statements. These disclosures may include information on significant events, risks, or uncertainties that may impact the company's financial performance.

06

Complete any other sections of the form that pertain to your specific company or industry. This may include sections on market risk, management's discussion and analysis (MD&A), or any other relevant information required by the SEC.

07

Review the completed form for accuracy and completeness. Ensure that all figures and information are correctly entered and that there are no mistakes or omissions. It's advisable to have a second set of eyes review the form as well to catch any potential errors.

08

Once satisfied with the accuracy of the form, sign and date it as required. This may involve obtaining signatures from the appropriate company officials or individuals responsible for the filing.

09

Submit the completed form 10-Q to the SEC before the specified filing deadline. Ensure that all required filing fees are paid, if applicable.

10

Keep a copy of the filed form and any supporting documentation for your records.

Who needs form 10-Q - investor:

01

Investors: Form 10-Q provides important financial information about a company, such as quarterly financial statements, disclosures, and management's discussion and analysis. Investors may use this information to evaluate a company's financial performance, assess risks, and make informed investment decisions.

02

Regulators: The SEC and other regulatory bodies require companies to file form 10-Q to provide timely and accurate financial information to the public. This helps ensure transparency and regulatory compliance in the financial markets.

03

Analysts and Research Firms: Analysts and research firms rely on form 10-Q filings to gather data and insights on companies they cover. They may use this information to update their financial models, issue research reports, and provide recommendations to their clients.

04

Creditors and Lenders: Creditors and lenders may review form 10-Q to assess a company's financial health and creditworthiness. This information helps them evaluate the risk associated with extending credit or providing loans to the company.

05

Other Stakeholders: Suppliers, customers, competitors, and other stakeholders may also review form 10-Q to gain insights into a company's financial performance, market trends, and overall business outlook. This information can impact their decision-making processes and strategic planning.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 10-q - investor?

Form 10-Q is a quarterly report that provides unaudited financial statements and other relevant information about a company to the Securities and Exchange Commission (SEC) and investors.

Who is required to file form 10-q - investor?

Publicly traded companies in the United States are required to file Form 10-Q with the SEC.

How to fill out form 10-q - investor?

To fill out Form 10-Q, the company must provide financial statements, management's discussion and analysis (MD&A), and other relevant disclosures as required by the SEC.

What is the purpose of form 10-q - investor?

The purpose of Form 10-Q is to provide investors and the SEC with updated financial and operational information about a publicly traded company on a quarterly basis.

What information must be reported on form 10-q - investor?

Form 10-Q requires companies to report financial statements, including balance sheet, income statement, and cash flow statement, as well as disclose material events and risks that could impact the company's performance.

When is the deadline to file form 10-q - investor in 2023?

The specific deadline for filing Form 10-Q in 2023 will depend on the company's fiscal year-end. Generally, companies must file Form 10-Q within 45 days after the end of each fiscal quarter.

What is the penalty for the late filing of form 10-q - investor?

The penalty for the late filing of Form 10-Q can vary depending on the circumstances. The SEC may impose fines, issue cease-and-desist orders, or take legal action against companies that fail to meet the filing deadline.

How can I send form 10-q - investor for eSignature?

When your form 10-q - investor is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find form 10-q - investor?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the form 10-q - investor. Open it immediately and start altering it with sophisticated capabilities.

Can I edit form 10-q - investor on an Android device?

You can make any changes to PDF files, such as form 10-q - investor, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your form 10-q - investor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.