Get the free Application for Compulsory Professional Liability Insurance for Part-time Practice -...

Show details

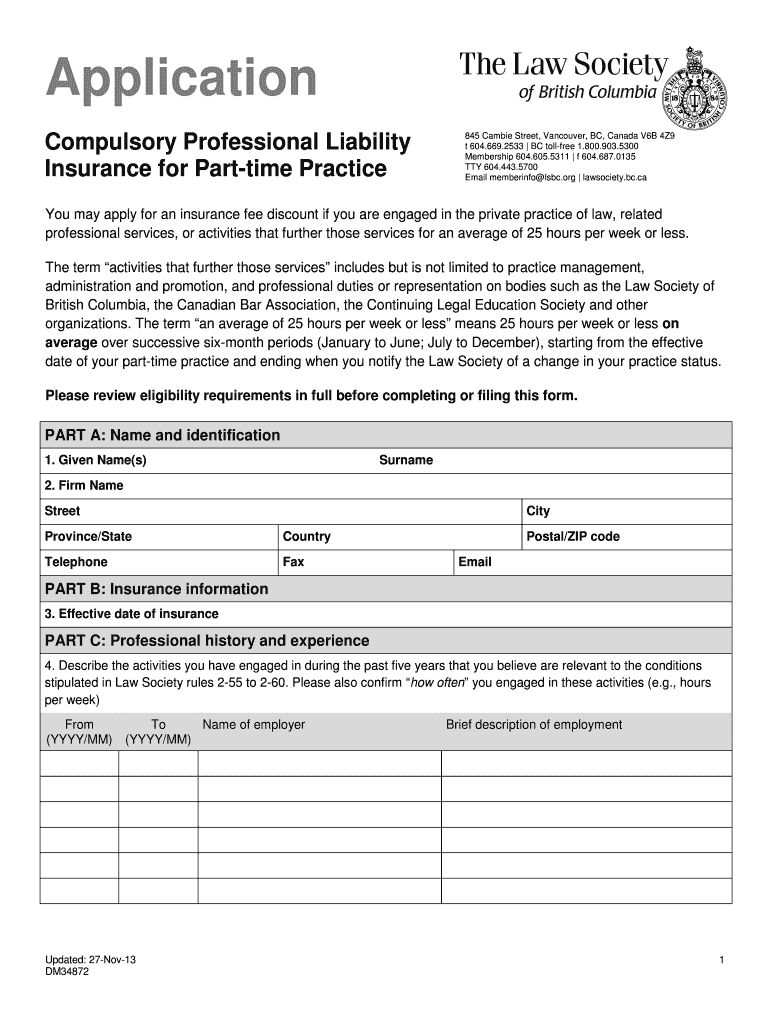

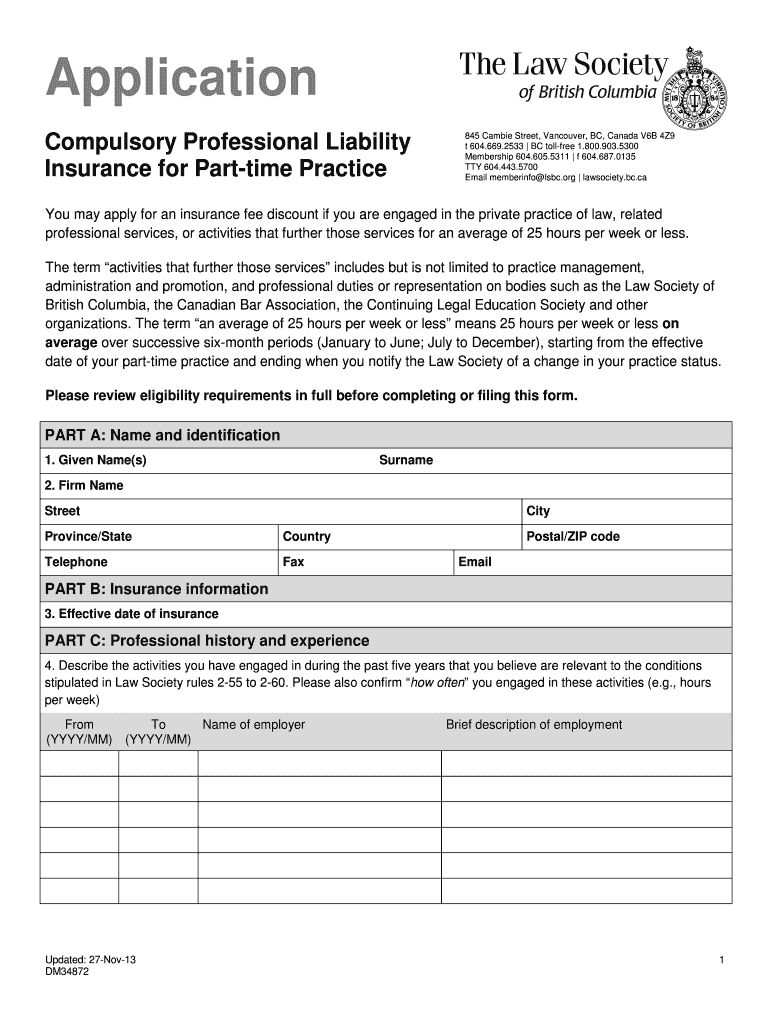

This document is an application form for lawyers seeking a discount on compulsory professional liability insurance based on part-time practice.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for compulsory professional

Edit your application for compulsory professional form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for compulsory professional form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for compulsory professional online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for compulsory professional. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for compulsory professional

How to fill out Application for Compulsory Professional Liability Insurance for Part-time Practice

01

Obtain the Application form for Compulsory Professional Liability Insurance for Part-time Practice from the relevant insurance provider or their website.

02

Read the form carefully to understand the sections that need to be filled out.

03

Fill in your personal information, including your name, address, contact details, and any relevant professional qualifications.

04

Provide details about your part-time practice, including the type of services you offer and the duration of your practice.

05

Include information about the clients you serve, ensuring to mention how often you engage in professional activities.

06

Disclose any prior claims or incidents related to professional liability, if applicable.

07

Review the completed application for accuracy, ensuring all sections are filled out completely.

08

Sign and date the application form as required.

09

Submit the application form along with any required documentation and payment, if applicable, to the insurance provider.

Who needs Application for Compulsory Professional Liability Insurance for Part-time Practice?

01

Part-time professionals in fields such as healthcare, consulting, legal services, or any other profession that requires liability coverage.

02

Individuals engaging in freelance or contractual professional activities on a part-time basis.

03

Professionals transitioning from full-time to part-time work who need to maintain insurance coverage.

04

Any professional who wishes to protect themselves against potential claims resulting from their part-time practice.

Fill

form

: Try Risk Free

People Also Ask about

Why is my client asking for a certificate of liability insurance?

A certificate of insurance is requested when liability and large losses are a concern. For example, if you own a landscaping business, a client may require a certificate of insurance to prove that certain liabilities will be covered during the course of the project.

How much does PL cost?

On average, small business owners can expect to pay around $39 per month* for Public Liability insurance. Public Liability insurance is one of the most popular types of insurance for businesses. Public Liability insurance can cover a wide range of industries and occupations, and the cost of it can vary greatly.

What is a good price for liability insurance?

Liability insurance costs an average $69 per month nationwide. But you can find cheap liability insurance for around $43 per month or less. Liability-only insurance is the cheapest coverage you can get. It must include at least the minimum coverage required by your state.

What is typical professional liability coverage?

Professional liability policies typically cover legal defense costs associated with defending against claims of professional negligence. These costs can include attorney fees, court costs, and expert witness fees.

How much does professional liability insurance typically cost?

What is the average cost of professional liability insurance? Small businesses pay an average premium of $61 per month, or about $735 annually, for professional liability insurance. Our figures are sourced from the median cost of policies purchased by Insureon customers from leading insurance companies.

What is the average cost of a professional liability policy?

Professional liability insurance covers claims against a business asserting that it made mistakes in professional services, even if the claim has no merit. The average cost of professional liability insurance is $61 per month. Professional liability insurance is also called errors and omissions insurance.

Can you practice without liability insurance?

Notwithstanding several attempts at mandating malpractice insurance, you are not required to carry professional liability insurance.

What is public liability insurance in English?

Public liability insurance covers the cost of claims made by members of the public for incidents that occur in connection with your business activities. Public liability insurance covers the cost of compensation for: personal injuries. loss of or damage to property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Compulsory Professional Liability Insurance for Part-time Practice?

The Application for Compulsory Professional Liability Insurance for Part-time Practice is a formal request that part-time practitioners must submit to obtain mandatory liability insurance coverage that protects them against claims arising from their professional activities.

Who is required to file Application for Compulsory Professional Liability Insurance for Part-time Practice?

Part-time professionals who engage in practices that involve risk of professional liability, such as healthcare providers, legal advisors, and financial consultants, are required to file this application to ensure they have adequate insurance coverage.

How to fill out Application for Compulsory Professional Liability Insurance for Part-time Practice?

To fill out the application, individuals need to accurately provide personal information, details of their part-time practice, specified coverage amounts desired, and any prior claims history. It's essential to read the instructions carefully before submission.

What is the purpose of Application for Compulsory Professional Liability Insurance for Part-time Practice?

The purpose of the application is to ensure that part-time practitioners have sufficient professional liability insurance, which protects them financially in the event of a legal claim stemming from their professional activities, thus ensuring both practitioner and client safety.

What information must be reported on Application for Compulsory Professional Liability Insurance for Part-time Practice?

The application must report personal identification details, business structure, nature of professional services provided, previous insurance coverage details, claims made against the practitioner (if any), and desired coverage limits.

Fill out your application for compulsory professional online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Compulsory Professional is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.