Get the free Certificate of Eligible Stock Option Agreements – Employee Summary - fin gov on

Show details

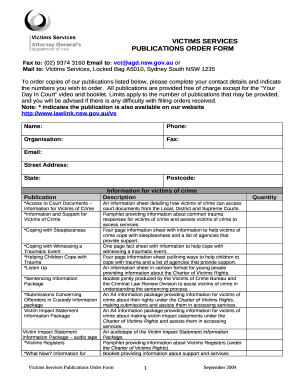

This document is used by corporations to certify eligible employees with whom they entered into eligible stock option agreements, relevant for the Ontario Research Employee Stock Option Credit.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of eligible stock

Edit your certificate of eligible stock form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of eligible stock form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certificate of eligible stock online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit certificate of eligible stock. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of eligible stock

How to fill out Certificate of Eligible Stock Option Agreements – Employee Summary

01

Obtain the Certificate of Eligible Stock Option Agreements – Employee Summary form from your HR department or company website.

02

Fill in your personal information, including your name, employee ID, and contact details.

03

Provide details about the stock options being granted, including the number of options, type, and grant date.

04

Complete any necessary sections regarding the vesting schedule and expiration date of the options.

05

Sign and date the form to confirm your understanding and agreement to the terms outlined.

06

Submit the completed form to your HR department for processing.

Who needs Certificate of Eligible Stock Option Agreements – Employee Summary?

01

Employees who are granted stock options as part of their compensation package.

02

HR personnel who manage the stock option plans within the organization.

03

Legal and compliance teams reviewing employee agreements related to stock options.

Fill

form

: Try Risk Free

People Also Ask about

What is employee stock option details?

An employee stock option (ESO) is a type of equity compensation granted by companies to their employees and executives. Rather than granting shares of stock directly, the company gives options on the stock instead.

How do you explain stock options?

Stock options allow holders to buy or sell a specific number of shares of an underlying asset at the strike price on or before the expiration date. You're not obligated to trade the underlying asset, such as if the stock price doesn't move in your favor and you don't want to take possession of the stock.

What is the $100,000 rule for stock options?

The 100K Rule[1] states that employees cannot receive more than $100K worth of exercisable incentive stock options (ISOs) in a calendar year.

What is the employee stock option award?

Employee stock options are an equity award that gives the holder the opportunity to exercise (i.e. purchase) shares in the company at a pre-set price at a future date, as opposed to directly granting them actual shares. That pre-set price is called the exercise price or strike price.

How do stock options from an employer work?

Stock options plan Under this type of plan, an employer grants the employee the option to purchase a specified number of securities, at a pre-determined price within a specified period. During the vesting period, the options partially vest over a five year period.

What are the disadvantages of employee stock options?

Potential ESOP Disadvantages and Their Counterarguments ESOPs can be expensive… … ESOPs are often complex… … An ESOP can't pay above fair market value and can't match the higher price a synergistic buyer can offer… … ESOPs are inflexible in some respects… …

What is the $100,000 rule for stock options?

The 100K Rule[1] states that employees cannot receive more than $100K worth of exercisable incentive stock options (ISOs) in a calendar year.

How to explain stock options to employees?

Stock options, once vested, give you the right to purchase shares of your company's stock at a specified price, usually called the strike or exercise price. Each option allows you to purchase one share of stock. The value of a stock option depends on the price of the company's shares, which fluctuates over time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Certificate of Eligible Stock Option Agreements – Employee Summary?

The Certificate of Eligible Stock Option Agreements – Employee Summary is a document that outlines the details of stock options granted to employees, including the terms and conditions under which they can exercise these options.

Who is required to file Certificate of Eligible Stock Option Agreements – Employee Summary?

Employers who grant stock options to their employees are required to file the Certificate of Eligible Stock Option Agreements – Employee Summary to ensure compliance with applicable tax and reporting obligations.

How to fill out Certificate of Eligible Stock Option Agreements – Employee Summary?

To fill out the Certificate, one must provide accurate details about the employee, the stock options granted, the terms of the agreement, and any relevant tax information. It typically requires the completion of specific sections as outlined in the form instructions.

What is the purpose of Certificate of Eligible Stock Option Agreements – Employee Summary?

The purpose of the Certificate is to provide a clear record of the stock options granted to employees for transparency and regulatory compliance, helping both the employer and employees understand their rights and obligations concerning those options.

What information must be reported on Certificate of Eligible Stock Option Agreements – Employee Summary?

The information that must be reported includes the employee's name, the grant date of the option, the total number of options granted, the exercise price, vesting schedule, and any relevant tax implications associated with the options.

Fill out your certificate of eligible stock online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Eligible Stock is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.