PA DoR REV-183 EX 2004 free printable template

Show details

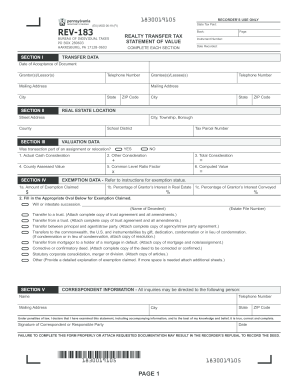

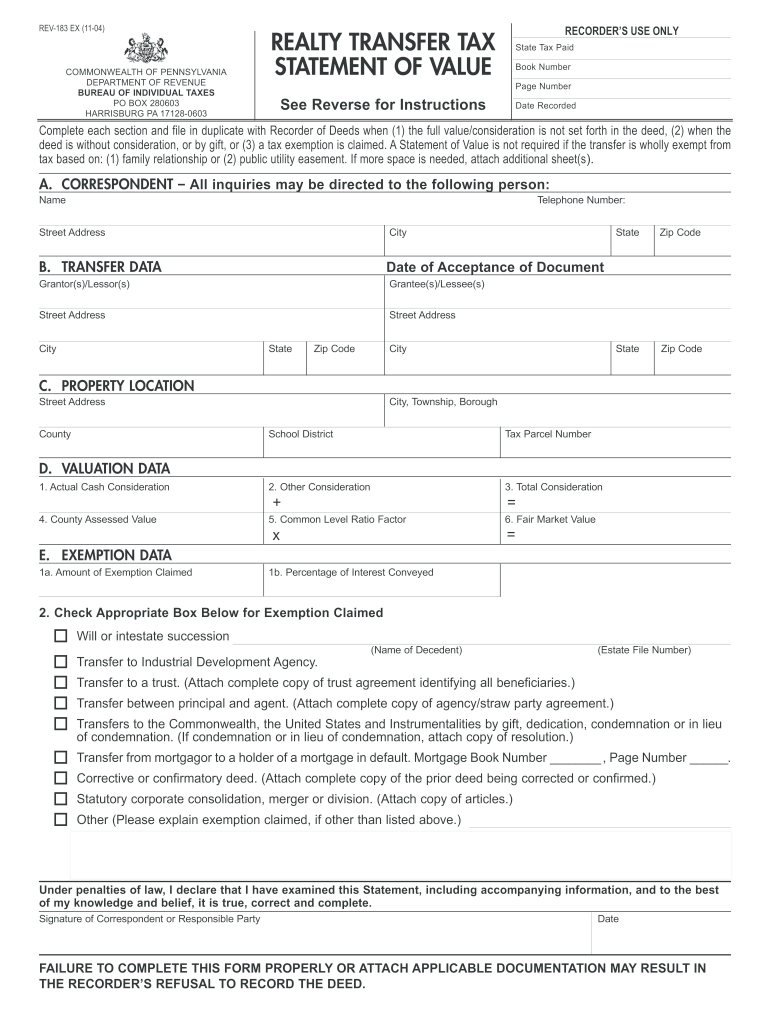

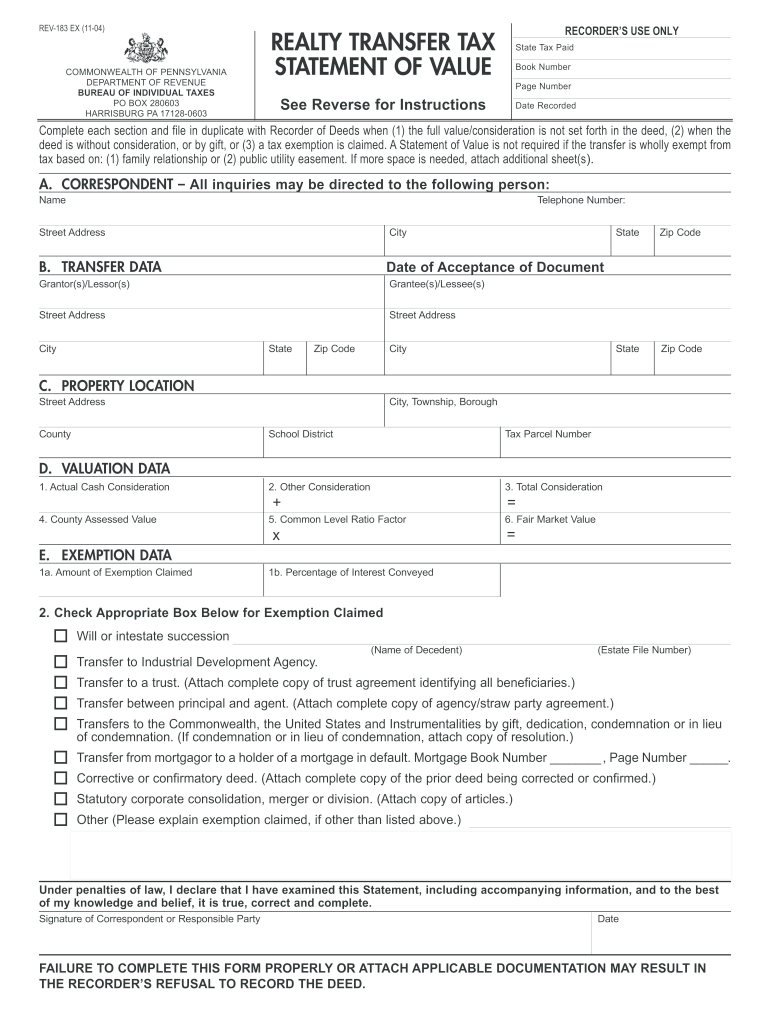

REV-183 EX 11-04 COMMONWEALTH OF PENNSYLVANIA DEPARTMENT OF REVENUE BUREAU OF INDIVIDUAL TAXES PO BOX 280603 HARRISBURG PA 17128-0603 RECORDER S USE ONLY REALTY TRANSFER TAX STATEMENT OF VALUE State Tax Paid Book Number Page Number See Reverse for Instructions Date Recorded Complete each section and file in duplicate with Recorder of Deeds when 1 the full value/consideration is not set forth in the deed 2 when the deed is without consideration or...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your rev 183 ex 2004 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rev 183 ex 2004 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rev 183 ex 2004 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rev 183 ex 2004. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

PA DoR REV-183 EX Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out rev 183 ex 2004

Point by point instructions on how to fill out rev 183 ex 2004:

01

Start by gathering all the necessary information and documents required to complete the form.

02

Carefully read through the instructions provided on rev 183 ex 2004 to understand the process and requirements.

03

Begin filling out the form by entering your personal information in the designated fields, such as name, address, and contact details.

04

Provide any additional information or details that are specifically asked for in the form, such as employment history or financial information.

05

Double-check your entries to ensure accuracy and completeness before moving on to the next section.

06

If there are any specific sections or questions that you do not understand or need further clarification on, seek guidance from the form's instructions or consult a professional.

07

Once you have completed all the necessary sections, review the entire form one more time to catch any potential errors or omissions.

08

Sign and date the completed form as required.

09

Make copies of the filled-out form for your own records.

10

Submit the filled-out rev 183 ex 2004 form through the designated channels specified in the instructions.

Who needs rev 183 ex 2004?

01

Individuals who are required to provide certain information or documentation for a specific purpose.

02

Those who must comply with the legal regulations or requirements associated with rev 183 ex 2004.

03

Certain organizations or entities that may request rev 183 ex 2004 as part of their own internal processes or documentation.

Fill form : Try Risk Free

People Also Ask about rev 183 ex 2004

What family members are exempt from transfer tax in PA?

Who is exempt from PA realty transfer tax?

How much does it cost to transfer a deed in PA?

Who pays transfer tax in PA buyer or seller?

What is a PA Rev 183?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is rev 183 ex form?

There is not enough context provided to accurately determine what "rev 183 ex form" refers to. It could potentially be a revision (rev) of a certain document or a form with a specific identification number (183 ex). Without further information, it is difficult to give a more specific answer.

Who is required to file rev 183 ex form?

Form REV-183EX, also known as the Sales and Use Tax Exemption Certificate, is used by businesses or organizations to claim exemption from sales and use tax on certain purchases. Generally, entities that have been granted tax-exempt status by the Internal Revenue Service (IRS) are required to file this form to avail of the tax exemption. This includes nonprofit organizations, government agencies, and certain educational institutions. Ultimately, the specific requirements for filing this form could vary based on state laws, so it is essential to consult with the appropriate tax authority or seek professional advice to determine the exact filing requirements for your situation.

How to fill out rev 183 ex form?

Form REV-183EX is the Application for Extension of Time to File Pennsylvania Taxes. Here is a step-by-step guide on how to fill out this form:

1. Begin by entering your name, social security number, spouse's social security number (if applicable), address, and telephone number in the first section of the form.

2. In Part I, indicate the type of tax return you are requesting an extension for by checking the appropriate box. You can select from individual income tax, fiduciary income tax, or corporate tax.

3. If you are requesting an extension for corporate tax, complete Part II by providing the employer identification number (EIN) and the name and address of the corporation.

4. In Part III, you need to enter your estimated tax liability for the tax year. If you are unsure about the exact amount, make a reasonable estimate based on the information available to you.

5. Part IV is for corporations only. If you are an individual or fiduciary taxpayer, skip this section. Corporations must complete this part by providing the percentage of ownership each individual has in the company.

6. Next, you need to fill out Part V. This section requires you to provide a brief explanation for the extension request. State why you need additional time to file your tax return.

7. Finally, you should sign and date the form at the bottom of the page. If you are filing a joint return with your spouse, both of you should sign the form.

Note: It's important to check with the Pennsylvania Department of Revenue for any specific instructions or requirements related to Form REV-183EX. Additionally, be aware of the deadline for submitting the extension request, as it may vary depending on the type of tax return.

What information must be reported on rev 183 ex form?

I cannot find any specific information regarding a form labeled "rev 183 ex." It is possible that you might be referring to a specific tax or financial form that is not widely recognized or known. Please provide additional context or clarification so that I can assist you better.

How can I modify rev 183 ex 2004 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including rev 183 ex 2004, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Where do I find rev 183 ex 2004?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the rev 183 ex 2004 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out the rev 183 ex 2004 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign rev 183 ex 2004 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your rev 183 ex 2004 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.