Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

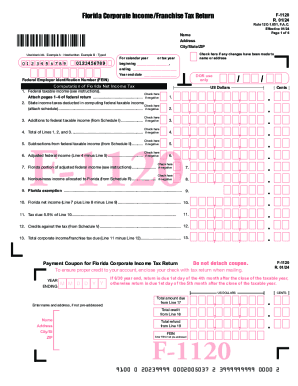

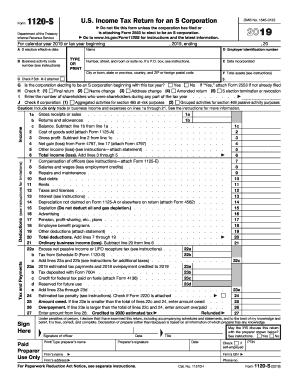

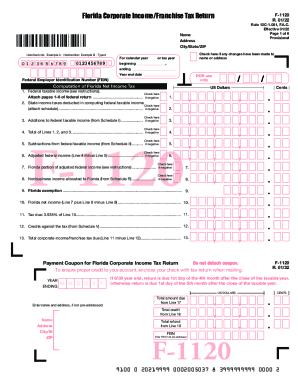

The F1120 form is a tax form used in the United States by corporations to report their income, deductions, and tax liability for federal income tax purposes. It is also known as the "U.S. Corporation Income Tax Return" or the "Form 1120 - U.S. Corporation Income Tax Return." Corporations are required to file this form annually to report their financial information to the Internal Revenue Service (IRS). The form includes various schedules and sections for reporting different aspects of a corporation's income, deductions, credits, and tax information.

Who is required to file f1120 form?

The Form 1120 is filed by C corporations, which are separate legal entities that are incorporated under state law and are subject to federal income tax.

How to fill out f1120 form?

Here is a step-by-step guide on how to fill out Form 1120:

1. Download the form: You can obtain Form 1120 from the Internal Revenue Service (IRS) website or request a copy from the nearest IRS office.

2. Provide basic information: Fill in your business name, address, Employer Identification Number (EIN), date of incorporation, and the taxable year you are reporting.

3. Check the correct box: Indicate the type of business entity by checking the appropriate box, such as a corporation, S corporation, or a personal service corporation.

4. Complete Schedule K: Schedule K is used to report your business's income, deductions, and tax liability. Fill out Part I, II, and III to detail your income, cost of goods sold, and expenses. Be sure to include all necessary supporting documentation such as profit and loss statements, financial statements, and receipts.

5. Complete Schedule L, M-1, and M-2: These schedules are used to report your business's balance sheet, reconciling items between accounting and tax records, and accumulated adjustments account.

6. Provide additional information: If applicable, you may need to fill out other schedules, forms, or attachments such as Schedule D (Capital Gains and Losses) or Form 4562 (Depreciation and Amortization).

7. Complete Schedule J: Schedule J is used to calculate your business's tax liability, including any alternative minimum tax. It also considers various deductions, credits, and adjustments.

8. Review and sign the form: Ensure all information provided is accurate, comprehensive, and properly supported. Review the form thoroughly before signing and dating it.

9. File the form: Send the completed Form 1120 to the appropriate IRS address. It is advisable to keep a copy for your records.

Please note that this guide serves as a general overview, and it is recommended to consult with a tax professional or CPA to ensure compliance with tax regulations specific to your business.

What is the purpose of f1120 form?

The purpose of Form 1120 is to report the income, deductions, and tax liabilities of a U.S. corporation or other qualifying entities. It is the tax return form used specifically by C corporations, including those with regular income, businesses with capital gains or losses, and certain other corporate entities. The information reported on Form 1120 is used to calculate the corporation's income tax liability for the given tax year.

What information must be reported on f1120 form?

Form 1120 is used by corporations to report income, gains, losses, deductions, and credits for a particular tax year. The information that must be reported on Form 1120 includes:

1. Company Information: This includes the legal name, address, employer identification number (EIN), and accounting period for the corporation.

2. Income: The corporation must report its total income from all sources, including sales, services, investments, rents, and royalties.

3. Cost of Goods Sold: If the corporation sells products or goods, it needs to report its cost of goods sold, which includes the cost of raw materials, direct labor, and overhead expenses.

4. Deductions: The corporation can deduct various expenses incurred in running its business, such as employee salaries and benefits, rent, utilities, advertising, and legal fees.

5. Depreciation and Amortization: Corporations need to report the depreciation of their fixed assets, such as buildings and equipment, over their respective useful lives.

6. Credits: There are several tax credits available to corporations, such as the Research and Development (R&D) credit or the Work Opportunity Tax Credit (WOTC). These credits can reduce the corporation's tax liability.

7. Estimated Tax Payments: If the corporation made estimated tax payments throughout the year, those payments must be reported on the form.

8. Taxes and Credits: The corporation needs to calculate its tax liability based on its taxable income and apply any applicable credits to determine the final amount owed.

9. Shareholder Information: If there are more than one shareholder or if the corporation had any changes in ownership during the tax year, that information must be reported.

10. Schedule K: Corporations also need to attach Schedule K, which provides a detailed breakdown of income, deductions, and tax liability.

It is important to note that this is a general overview, and the specific requirements and sections to be completed on Form 1120 can vary depending on the corporation's circumstances and election of certain tax treatments or deductions.

When is the deadline to file f1120 form in 2023?

The deadline to file Form 1120 for the tax year 2023 will likely be on March 15, 2024. However, it's important to note that the Internal Revenue Service (IRS) may occasionally change deadlines, so it's advisable to confirm the specific deadline closer to the time of filing.

What is the penalty for the late filing of f1120 form?

The penalty for the late filing of Form 1120 (U.S. Corporation Income Tax Return) can vary depending on the circumstances and duration of the delay. As per the Internal Revenue Service (IRS) guidelines, if an extension of time to file is not requested or granted, the penalty is generally calculated based on the number of days late multiplied by a specific dollar amount.

For smaller corporations (with average annual gross receipts of $1 million or less), the penalty is $205 for each month or part of a month the return is late, up to a maximum penalty of $2,450 or 12 months.

For larger corporations (with average annual gross receipts over $1 million), the penalty is generally higher. The IRS imposes a penalty of 5% of the unpaid tax amount for each month or part of a month the return is late, up to a maximum penalty of 25% of the unpaid tax amount.

It is important to note that if there is a reasonable cause for the late filing or if the corporation has been diligent in meeting its tax obligations, the IRS may waive or reduce the penalty. However, this would require providing an explanation and supporting documentation for the reasonable cause claim.

How do I modify my f1120 form in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your f1120 form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make edits in f 1120 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your f1120s, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit form f 1120 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share f1120 florida form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!