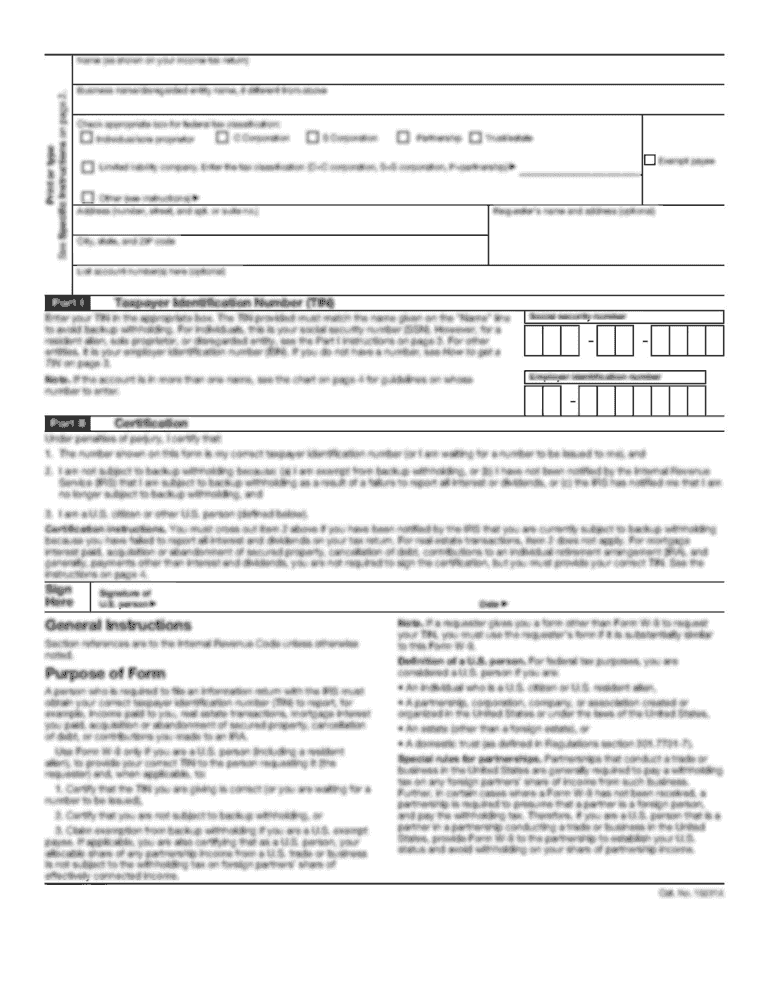

A document is a record that serves as an authorization for the IRS to obtain disclosure of information from persons using the information, and it makes that information available to the public. Information is considered “used” by a person when a disclosure requirement is imposed under a statute or regulation (such as 18 U.S.C. § 6103(c)(1)(D)) or under an agreement under section 6104 (such as 18 U.S.C. § 6105(c)(2)). The “Use” of information is also determined by using statutory phrases or rules applicable to transactions that are reasonably calculated to create a disclosure requirement. For example, if a person is required to report his tax liability on Form 1040, using an electronic payment system, his Use of information under section 6106(1) would be determined by applying his transaction code to the payment or other transaction that created the disclosure requirement.

The IRS publishes a list of all tax publications to be made available to the public by publication of a notice in the Federal Register or by mailing a copy. This list also provides a method to obtain information about any particular publication. The IRS publishes the list of disclosure notices on its web page at.

See Notice 2004-12, 2006-4 I.R.B. 803, available at. For information on the use and disclosure of a disclosure notice, see Instructions for Use of Tax Publications.

Note: If you are not required to report, do not make a disclosure under an item of information because the IRS has not imposed a disclosure requirement. Such a statement is a response to the notice of requirement that a disclosure requirement applies to the information you are making known. For instance, if on January 2, 2009, you had income, and you could have made an interest rate adjustment in an application form, you would not be required to make such an adjustment because you had not been required to report the income previously under a disclosure notice. See the discussion of Publication 642 (available at) regarding information available in connection with an IRS rule change.

Get the free How to Apply for a Certificate of Subordination - eFile

Show details

A list of IRS Tax Publications: file Tax Publications and Tax Information ... How to Apply for a Certificate of Subordination of Federal .... Publication 784 (Rev.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your how to apply for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to apply for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit how to apply for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit how to apply for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is how to apply for?

How to apply for is a process to submit an application for a particular purpose or benefit.

Who is required to file how to apply for?

The individuals or entities who are eligible and interested in obtaining a specific benefit or fulfilling a certain requirement are required to file how to apply for.

How to fill out how to apply for?

To fill out how to apply for, follow the instructions provided in the application form, provide accurate and complete information, and submit any required documents or supporting evidence.

What is the purpose of how to apply for?

The purpose of how to apply for is to allow individuals or entities to formally request a specific benefit, service, or meet a requirement by providing necessary information and supporting documents.

What information must be reported on how to apply for?

The specific information required to be reported on how to apply for can vary depending on the purpose of the application, but it commonly includes personal or organizational details, contact information, relevant qualifications, and supporting documentation.

When is the deadline to file how to apply for in 2023?

The deadline to file how to apply for in 2023 will depend on the specific application or requirement. Please refer to the instructions or official announcements for the accurate deadline.

What is the penalty for the late filing of how to apply for?

The penalty for the late filing of how to apply for can vary based on the specific application or requirement. It could result in a rejection of the application, delayed processing, or a potential loss of the intended benefit. It is important to adhere to the stated deadlines to avoid any penalties or negative consequences.

How can I modify how to apply for without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including how to apply for. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send how to apply for to be eSigned by others?

When your how to apply for is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for signing my how to apply for in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your how to apply for right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your how to apply for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.