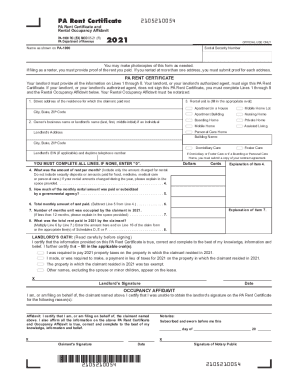

Line 1 is for the month of the renter s lease. Line 2 is for the month you move in for rent, and line 3 is for the month you move out for your lease, if applicable. Lines 3 and 4 are for the term of the lease. Line 5 is for the term of your rental. Line 6 is for your credit history. You may make photocopies of this form as needed. If you moved into the unit before the end of the year or if your landlord fails to sign or provide the required information, or your credit history does not qualify you as a low-income tenant, contact the PA Department of Revenue. The PA Department of Revenue is the agency responsible for providing financial assistance for low-income tenants to pay their rent and/or utility and other rental expenses. If you are a low-income tenant who receives rent assistance or a landlord who offers rent credits, you must keep a copy of this declaration on file with your landlord to prove your eligibility for rent and credit assistance. To find out if you qualify, you should contact the PA Department of Revenue at. Renters should keep track of their rent payments. Landlords may require the tenant to renew their tenancy certificate, even if the tenant has paid the rental amount in full. If the landlord asks the tenant to renew their Certificate, the tenant should be informed that the landlord will not allow the lease to be renewed if the tenant doesn't keep up the payment of rent. An application for the renewal should be submitted with the landlord when the tenant has paid the rental amount in full. Renewal must be requested at least 8 months in advance of the expiration date of the current tenancy. If the tenant cannot pay the full amount due, the tenant should be given the option to pay the balance, pay late, or vacate the unit. If a tenant refuses to pay rent due, the landlord may file the application for eviction. The landlord may request that the person requesting the renewal or renewal be evicted from the apartment. RENT HISTORY A copy of each of the monthly rent payments should be retained in the person s rental file, so that the landlord can obtain copies upon request. The landlord may make a copy of the certificate available for inspection by the tenant or anyone else the landlord chooses. This copy must be available to the tenant at all times to show proof of the current rentals and dates of payment.

PA PA-1000 RC 2004 free printable template

Show details

0400710059 PA-1000 RC Rent Certificate and Rental START Occupancy Affidavit PA Department of Revenue OFFICIAL USE ONLY Name as shown on PA-1000 Social Security Number You may make photocopies of this form as needed. If filing as a renter you must provide proof of the rent you paid. If you rented at more than one address you must submit proof for each address.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your pa 1000 rc 2015 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa 1000 rc 2015 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pa 1000 rc 2015 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pa 1000 rc 2015. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

PA PA-1000 RC Form Versions

Version

Form Popularity

Fillable & printabley

Fill form : Try Risk Free

People Also Ask about pa 1000 rc 2015

When can I file my 2021 rent rebate in pa?

How much is the rent rebate in pa?

How do I qualify for rent rebate in pa?

When can you apply for rent rebate in pa?

Is it too late to file for rent rebate in pa?

Does pa rent certificate need to be notarized?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pa 1000 rc form?

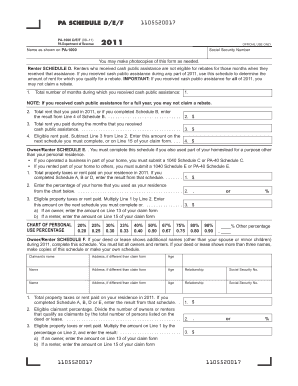

The PA 1000 RC form is a tax form used by taxpayers in Pennsylvania to report their rent and property tax paid for the purpose of claiming a rebate on property taxes.

Who is required to file pa 1000 rc form?

Pennsylvania residents who meet certain income and residency requirements may be required to file the PA 1000 RC form to claim a rebate on property taxes they have paid.

How to fill out pa 1000 rc form?

To fill out the PA 1000 RC form, taxpayers need to provide their personal information, details about their rental or property tax payments, and any additional supporting documentation required. The form can be completed online or on paper.

What is the purpose of pa 1000 rc form?

The purpose of the PA 1000 RC form is to allow eligible taxpayers to claim a rebate on property taxes they have paid, providing financial assistance to those who qualify.

What information must be reported on pa 1000 rc form?

The PA 1000 RC form requires taxpayers to report their personal information, including their name, address, and Social Security number. Additionally, they need to provide details about their rental or property tax payments, such as the amount paid and the property's assessed value.

When is the deadline to file pa 1000 rc form in 2023?

The deadline to file the PA 1000 RC form in 2023 has not been specified yet. Taxpayers are advised to check with the Pennsylvania Department of Revenue or consult a tax professional for the most up-to-date information.

What is the penalty for the late filing of pa 1000 rc form?

The penalty for the late filing of the PA 1000 RC form may vary. It is important for taxpayers to file their form before the deadline to avoid any potential penalties. The specific penalty amount can be determined by referencing the Pennsylvania Department of Revenue's guidelines or consulting with a tax professional.

How do I complete pa 1000 rc 2015 online?

pdfFiller makes it easy to finish and sign pa 1000 rc 2015 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit pa 1000 rc 2015 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your pa 1000 rc 2015 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete pa 1000 rc 2015 on an Android device?

Use the pdfFiller app for Android to finish your pa 1000 rc 2015. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your pa 1000 rc 2015 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.