Get the free Confidential Application for COMMERCIAL Credit

Show details

Este documento es una solicitud confidencial para crédito comercial, que incluye información sobre la empresa, referencias bancarias y comerciales, así como una garantía personal.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign confidential application for commercial

Edit your confidential application for commercial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your confidential application for commercial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing confidential application for commercial online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit confidential application for commercial. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out confidential application for commercial

How to fill out Confidential Application for COMMERCIAL Credit

01

Start by downloading the Confidential Application for COMMERCIAL Credit form from the lender's website or request a copy from them.

02

Fill in the business name and contact information including address, phone number, and email.

03

Provide details about the business structure (e.g., sole proprietorship, partnership, LLC, corporation).

04

Enter the business tax identification number (TIN) or social security number if applicable.

05

Include information on the owners or key stakeholders, such as names, titles, and ownership percentages.

06

Describe the nature of the business and its operations, including industry and duration in business.

07

Detail the financial information required, such as income statements, balance sheets, and tax returns for the previous years.

08

Indicate the amount of credit being requested and the purpose for which it will be used.

09

Review all information for accuracy and completeness before submission.

10

Submit the completed application along with any required supporting documents to the lender.

Who needs Confidential Application for COMMERCIAL Credit?

01

Businesses seeking financing to support their operations, such as purchasing Inventory, equipment, or real estate.

02

Companies looking to expand or improve cash flow.

03

Startups needing initial funding to establish their business.

04

Established businesses requiring working capital for day-to-day operations.

Fill

form

: Try Risk Free

People Also Ask about

Who fills out the credit application form?

As the name indicates, a credit application form is a form that is filled out and completed by a business or a person who wants to apply for a line of credit with a lending institution.

What is a commercial credit application form?

A Credit Application for Business Account Form is a form template designed to facilitate the establishment of credit accounts between businesses and their suppliers or vendors. Banking Forms.

What are the different types of credit applications?

Types of credit application forms include consumer credit applications for personal loans or credit cards, commercial credit applications for businesses seeking trade credit, and mortgage loan applications for real estate purchases.

Is a credit application a legal document?

Once signed, the credit application is legally binding, including all terms and conditions outlined within the agreement.

What are the different types of credit inquiries?

The three common types of credit — revolving, open-end and installment — can work differently when it comes to how you borrow and pay back the funds. And when you have a diverse portfolio of credit that you manage responsibly, you can improve your credit mix, which could boost your credit scores.

What are the 4 different types of credit?

Types of Credit Revolving Credit. A line of credit is one type of credit that comes with a capped limit and can be used up until you reach the predetermined threshold. Installment. Open Credit. Questions. Answers. Additional Resources.

What are the different types of credit application?

Types of credit application forms include consumer credit applications for personal loans or credit cards, commercial credit applications for businesses seeking trade credit, and mortgage loan applications for real estate purchases.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

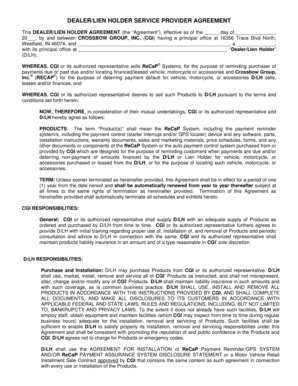

What is Confidential Application for COMMERCIAL Credit?

A Confidential Application for COMMERCIAL Credit is a document used by businesses to apply for credit while ensuring that sensitive financial information is protected and only disclosed to relevant parties.

Who is required to file Confidential Application for COMMERCIAL Credit?

Businesses seeking to obtain commercial credit or financing typically need to file a Confidential Application for COMMERCIAL Credit, particularly if they want to keep their financial details secure.

How to fill out Confidential Application for COMMERCIAL Credit?

To fill out a Confidential Application for COMMERCIAL Credit, businesses should provide accurate financial information, details about the business structure, and any required documentation, ensuring all information is complete and truthful.

What is the purpose of Confidential Application for COMMERCIAL Credit?

The purpose of the Confidential Application for COMMERCIAL Credit is to allow businesses to apply for credit or loans while protecting sensitive financial information from unauthorized disclosure.

What information must be reported on Confidential Application for COMMERCIAL Credit?

The information required on a Confidential Application for COMMERCIAL Credit typically includes business details, financial statements, credit history, and other relevant information that lenders need to assess the creditworthiness of the applicant.

Fill out your confidential application for commercial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Confidential Application For Commercial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.