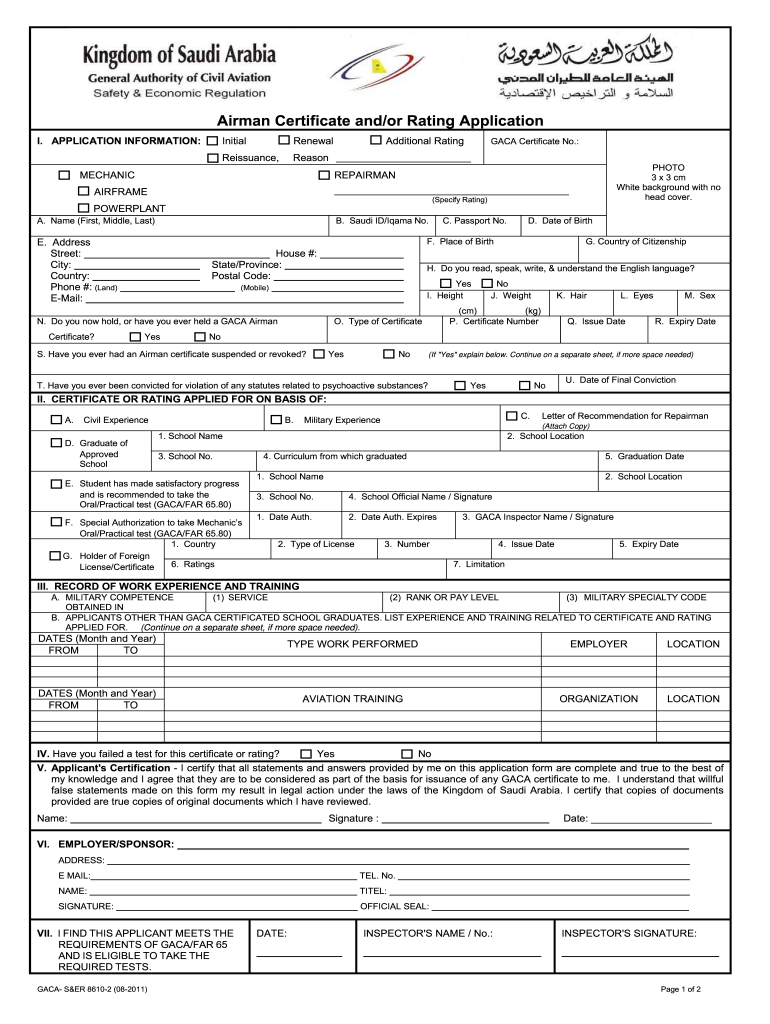

AE GACA-S&ER 8610-2 2011-2024 free printable template

Show details

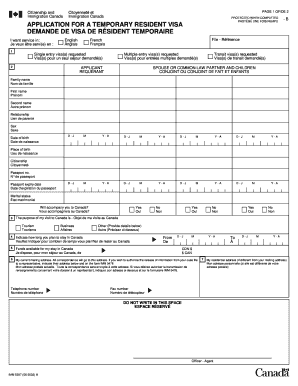

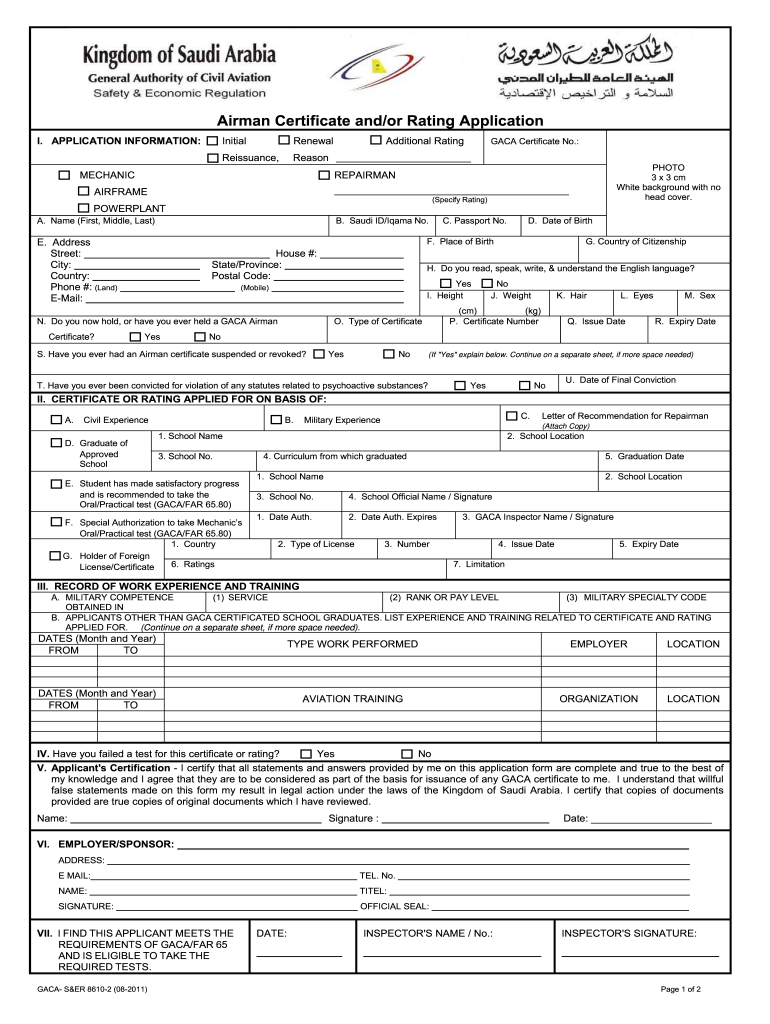

I. APPLICATION INFORMATION: MECHANIC Airman Certificate and/or Rating Application GAZA Certificate No.: Initial Renewal Additional Rating Re issuance, Reason REPAIRMAN AIRFRAME PowerPoint (Specify

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gaca forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gaca forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gaca forms online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gacca form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

How to fill out gaca forms

How to fill out gacca?

01

First, gather all the necessary information and documents that you will need to complete the gacca form.

02

Start filling out the form by providing your personal details such as your name, address, contact information, and any other required information.

03

Follow the instructions carefully and provide accurate and complete information in each section of the form.

04

If there are any specific guidelines or requirements mentioned, make sure to adhere to them while filling out the form.

05

Review your answers and double-check for any errors or omissions before submitting the completed gacca form.

Who needs gacca?

01

Individuals who are planning to apply for a specific program or service that requires the completion of a gacca form.

02

Organizations or companies that need to gather information from individuals for various purposes such as registration, membership, or enrollment.

03

Government agencies or departments that require specific information from individuals for official documentation or record-keeping purposes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gacca?

There is no widely recognized term or definition for "gacca." It might be a word that is specific to a certain region, context, or slang. Without further information, it is not possible to determine its meaning.

Who is required to file gacca?

The Gramm-Leach-Bliley Act (GLBA) does not require individuals to file anything called "GACCA." However, the GLBA imposes certain requirements on financial institutions, including banks, securities firms, insurance companies, and other financial service providers. These institutions are required to safeguard customers' personal financial information, provide privacy notices to customers, and allow customers to opt out of sharing their information with certain third parties.

What information must be reported on gacca?

GACCA, or the Global Anti-Corruption and Compliance Association, is an independent professional association focused on anti-corruption and compliance matters. Although the specific reporting requirements may vary depending on the context and purpose, here are some common types of information that may need to be reported to GACCA:

1. Anti-corruption policies and procedures: Organizations may need to report on the development, implementation, and effectiveness of their anti-corruption policies and procedures. This can include sharing information about the scope, objectives, and key elements of their compliance programs.

2. Compliance training and education: Companies often have to report on the training and education programs they have in place to ensure employees understand anti-corruption laws and regulations. Information on topics covered, training methods, and participation rates may be required.

3. Internal controls and risk assessments: Organizations may need to report on their efforts to establish internal controls to prevent corruption and conduct periodic risk assessments to identify and mitigate corruption risks. This can include information on control measures implemented and risk analysis findings.

4. Due diligence processes: Reporting on due diligence processes related to business partners, vendors, and other third parties can be required. This includes sharing information on the procedures followed, assessments conducted, and any remedial actions taken based on the results.

5. Incident reporting and investigation: Organizations are often expected to report incidents of corruption, bribery, or other compliance violations that occur within their operations. This can involve sharing details about the nature of the incident, parties involved, actions taken, and outcomes of investigations.

6. Reporting on financial transactions: Organizations may need to disclose information related to financial transactions and activities that raise suspicions of corruption or money laundering. This can include reporting on flagged transactions, know-your-customer (KYC) processes, and adherence to relevant financial regulations.

7. Cooperation with authorities: Organizations may be required to report on their cooperation with authorities during investigations or enforcement actions related to corruption or compliance violations. This can include sharing information on the steps taken to assist authorities, such as providing evidence, facilitating interviews, or implementing recommended improvements.

It is important to note that the exact reporting requirements may differ depending on the jurisdiction, industry, and specific regulations applicable to the organization.

How can I modify gaca forms without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like gacca form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send gaca forms form to be eSigned by others?

Once your gacca form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get gacca health form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific rampari gaca form and other forms. Find the template you need and change it using powerful tools.

Fill out your gaca forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gaca Forms Form is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.