Get the free united methodist church audit forms

Show details

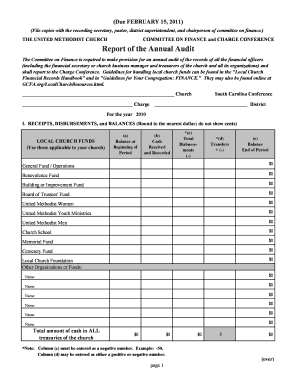

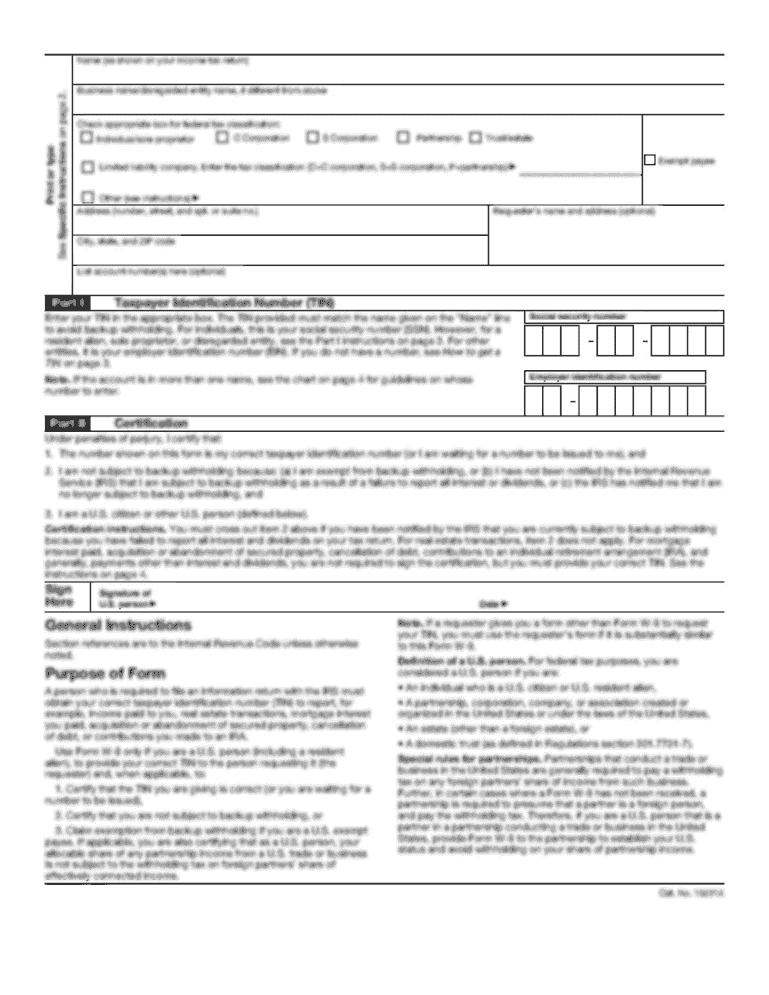

RECEIPTS DISBURSEMENTS AND BALANCES Round to nearest dollar Balance at Beginning Cash Received Balance Plus FUND of Period Receipts General Fund Total Disbursements enter with - Benevolence Fund Building/Improvement Fund Board of Trustees Church School Name OTHER ORGANIZATIONS OR FUNDS TOTAL amount of cash in all treasuries of the church Names and data for additional organizations or funds are to be listed on the back of this form or additional copies of this form. 2012 Annual Audit...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your united methodist church audit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your united methodist church audit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing united methodist church audit forms online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sample church audit checklist form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out united methodist church audit

How to fill out united methodist church audit?

01

Start by gathering all necessary financial documents related to the church's income, expenses, and assets.

02

Carefully review the audit form provided by the United Methodist Church and become familiar with the specific requirements and sections.

03

Begin filling out the audit form by providing basic information about the church, including its name, address, and contact details.

04

Proceed to document the church's financial activities by accurately recording income sources, such as donations, grants, and fundraisers.

05

Detail all expenses incurred by the church, including salaries, utilities, maintenance, and any other relevant costs.

06

Maintain proper documentation and receipts for each financial transaction to ensure accuracy and transparency.

07

Include any additional information requested by the audit form, such as notes and explanations for specific entries or financial discrepancies.

08

Double-check all completed sections for accuracy and completeness before submitting the audit form.

Who needs united methodist church audit?

01

United Methodist churches are typically required to conduct audits to ensure financial accountability and transparency.

02

The need for a church audit may vary based on regional and denominational policies, but it is generally encouraged for all Methodist churches.

03

Church members, leaders, and those responsible for financial oversight should prioritize conducting regular audits to safeguard the church's financial integrity and maintain the trust of its congregation.

Fill church audit report template : Try Risk Free

People Also Ask about united methodist church audit forms

What will the new Methodist denomination be called?

Do churches need to have an audit?

What is the audit process step by step?

What is involved in a church audit?

How often should a church do an audit?

How much does a church audit cost?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file united methodist church audit?

Generally, United Methodist Church (UMC) congregations that receive more than $250,000 in total receipts during a fiscal year are required to have an audit. This requirement is set forth in the Book of Discipline. Congregations may also choose to conduct an audit if their total receipts are less than $250,000.

What is the purpose of united methodist church audit?

The purpose of a United Methodist Church audit is to provide assurance that the church’s financial statements are accurate, complete, and in compliance with established financial policies and procedures, as well as applicable laws and regulations. The auditor’s report should provide an opinion as to whether the church’s financial statements present fairly its financial position, financial performance, and cash flows in accordance with generally accepted accounting principles.

What information must be reported on united methodist church audit?

1. The financial statements of the church, including any reports of independent certified public accountants.

2. An analysis of the church's compliance with applicable accounting principles and legal requirements, including an assessment of internal controls.

3. The results of any tests of compliance with applicable laws and regulations.

4. A review of the church's investments and the management of its assets.

5. A review of the church's procedures and controls to ensure proper stewardship of financial and other resources.

6. A review of the church's procedures for safeguarding resources and preventing fraud and misappropriation of funds.

7. An assessment of the church's risk management practices.

8. A review of the church's insurance policies and coverage.

9. An assessment of the church's compliance with the financial standards of The United Methodist Church.

When is the deadline to file united methodist church audit in 2023?

The exact deadline for filing a United Methodist Church audit in 2023 will depend on the particular church's bylaws and the requirements of their regional or conference office. Generally speaking, churches should aim to complete their audit by no later than December 31, 2023.

What is united methodist church audit?

A United Methodist Church audit is a financial review process that ensures the accurate recording and reporting of the church's financial transactions and activities. It is conducted by an independent auditor or auditing firm to provide an objective assessment of the church's financial statements, internal controls, and compliance with relevant laws and regulations.

The audit typically includes examining the church's financial records, such as bank statements, income and expense statements, balance sheets, payroll records, and donation records. The auditor assesses the accuracy and completeness of these records and verifies that the church's financial transactions are properly recorded and reported.

The purpose of conducting a United Methodist Church audit is to promote transparency and accountability in financial management, safeguard church assets, and provide assurance to stakeholders, such as church members, donors, and the wider community, that the church's financial statements are reliable and trustworthy. The audit findings are usually summarized in an audit report, which may include recommendations for improving financial controls or internal processes if any deficiencies or areas of concern are identified.

What is the penalty for the late filing of united methodist church audit?

The United Methodist Church does not have a specific penalty for the late filing of an audit. However, each annual conference within the United Methodist Church may have its own policy regarding late filing of audits. Consequently, penalties or consequences for late filing may vary depending on the specific conference's policies. It is advisable to consult with the appropriate authorities or governing bodies within the conference to determine the specific repercussions for late filing.

How to fill out united methodist church audit?

Filling out a United Methodist Church audit involves gathering financial information, reviewing accounts, and documenting various expenses and revenues. Here is a step-by-step guide to help you:

1. Start by familiarizing yourself with the audit requirements of the United Methodist Church. Obtain a copy of the specific audit form or template provided by the denomination or conference.

2. Gather all relevant financial documents, including bank statements, receipts, invoices, and financial reports for the period being audited. Ensure that you have complete records for income, expenses, assets, and liabilities.

3. Review the audit form or template thoroughly, understanding the different sections and fields that need to be completed. This may include general information, income and offerings, expenses, financial assets, membership statistics, and more.

4. Begin filling out the basic information section, which typically includes the church's name, address, conference affiliation, audit period, and the names of key individuals involved in the audit process (e.g., treasurer, finance committee chair).

5. Move on to the income and offerings section. Record all sources of income received during the audit period, such as regular contributions, special offerings, rental income, and any other revenue streams. Ensure that each source is accurately documented and supported by adequate financial evidence, such as bank deposit slips or giving records.

6. Proceed to the expense section. Here you will list and categorize all the expenses incurred by the church during the audit period. Common categories include salaries and benefits, utilities, rent/mortgage payments, program expenses, office supplies, maintenance, and others. Ensure that each expense is properly documented with invoices or receipts for verification.

7. Complete any additional sections relevant to your church's financial situation or specific requirements outlined by the United Methodist Church. Examples might include information on investments and endowments, property and equipment, or membership statistics.

8. Review all the information you have entered for accuracy and completeness. Double-check calculations and ensure that all required fields have been filled out.

9. Once you are satisfied with the accuracy of the audit form, obtain any necessary signatures from key individuals, such as the senior pastor, treasurer, or finance committee chairperson.

10. Finally, submit the completed audit form to the appropriate party within the United Methodist Church, such as the conference treasurer or auditor, according to the designated deadlines or instructions.

Remember, it is important to maintain transparency and accuracy throughout the audit process. If you have any doubts or questions, consult with the denomination or conference's financial office for guidance and support.

How can I send united methodist church audit forms for eSignature?

When you're ready to share your sample church audit checklist form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit church audit template in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your church audit report, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I sign the church audit checklist electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your church audit report sample form in seconds.

Fill out your united methodist church audit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Church Audit Template is not the form you're looking for?Search for another form here.

Keywords relevant to united methodist women forms

Related to united methodist church annual audit form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.