Phone : +32.50.908.4244 FAX : +32.50.910.

Get the free TO BE SEND TO

Show details

REGISTRATION FORM TO BE SEND TO affair. Europa ice.it Before 28/03/2011 SEMINAR: European Union Energy Policy And The Global Challenges Future actions and opportunities on Low Carbon Energy Technologies

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your to be send to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your to be send to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit to be send to online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit to be send to. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

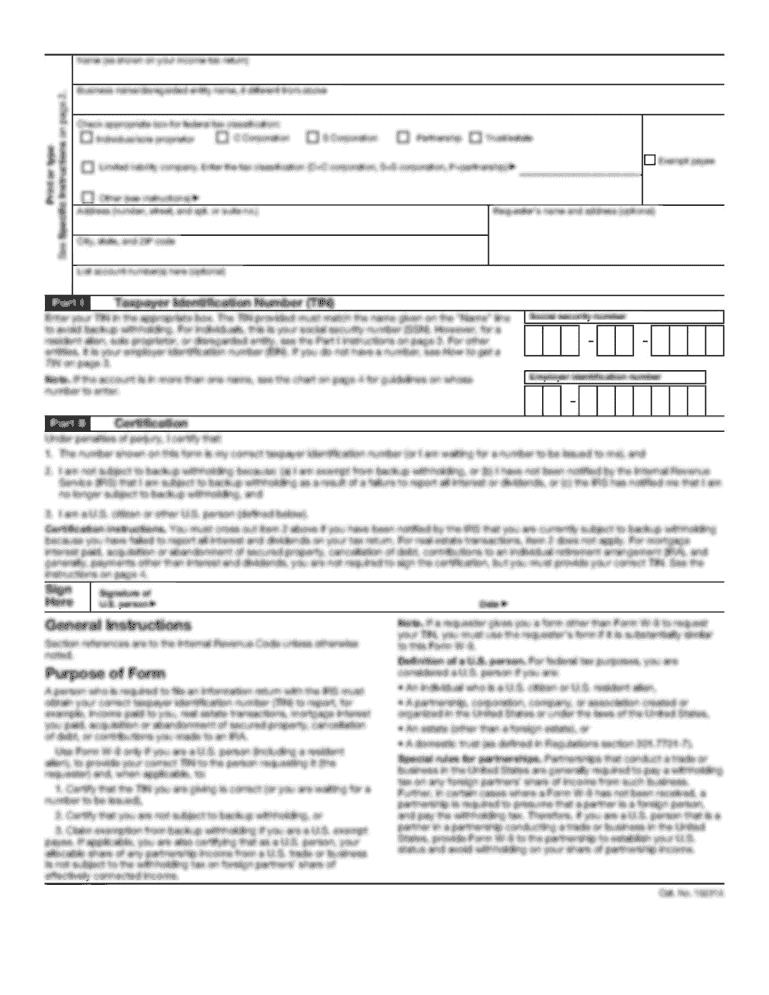

What is to be send to?

The document to be sent is usually a form or a report.

Who is required to file to be send to?

The person or entity who is responsible for the information or report being sent is usually required to file it.

How to fill out to be send to?

The form or report should be filled out according to the instructions provided by the recipient or the governing authority.

What is the purpose of to be send to?

The purpose of sending the document is to provide necessary information, comply with regulations, or fulfill reporting requirements.

What information must be reported on to be send to?

The specific information that must be reported on the document depends on its purpose and the requirements set by the recipient or governing authority.

When is the deadline to file to be send to in 2023?

The deadline to file the document in 2023 may vary depending on the specific document and the regulations associated with it. It is advisable to consult the instructions or the governing authority for the accurate deadline.

What is the penalty for the late filing of to be send to?

The penalty for late filing of the document may vary depending on the regulations and the governing authority. It can include fines, interest charges, or other penalties as specified by the applicable laws.

How do I modify my to be send to in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your to be send to along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send to be send to to be eSigned by others?

When you're ready to share your to be send to, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in to be send to without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your to be send to, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Fill out your to be send to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.