IL VSD 609.3 2005-2024 free printable template

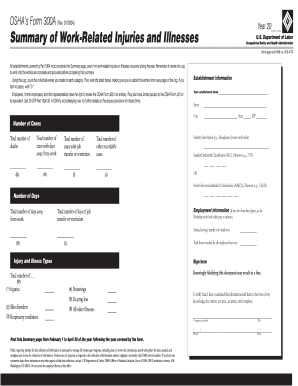

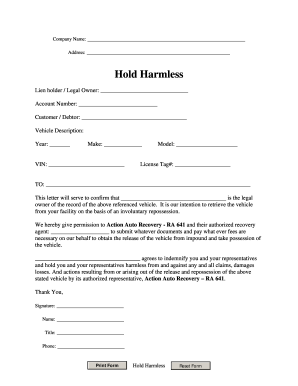

Get, Create, Make and Sign

Editing repossession illinois online

How to fill out repossession illinois form

How to fill out repossession illinois:

Who needs repossession illinois:

Video instructions and help with filling out and completing repossession illinois

Instructions and Help about repossessed affidavit illinois form

Music hey guys thank you so much for watching this video please give us a call if you guys are looking to improve your credit score lower your car payment buy a car trade in a car if you're looking to purchase your first home if you're looking to purchase of rental property we can help you give us a call today eight seven two zero five seven seven seven one talk to you guys soon and thanks again hello everyone this is Calvin Russell CEO and founder of Anthony Club credit consultation I hope everyone is doing well today we're gonna talk about what to do right after a repossession I'm talking about the right away steps that you need to do immediately after having a repossession okay so number one do not panic it's not the end of the world there are some legal ramifications that most definitely can take place but the very thing that you need to be focused on is deciding if you want to get another car or not okay a lot of times people don't lose their cars because of financial situations a lot of times you know they're tired of putting you know a certain amount of work and I might say that this it that it makes sense to have that type of repossession where your car gets taken away because you simply do not want to keep putting money into a vehicle that needs more repairs, and you're making you know the repairs as well as making the monthly payments I'm not saying that it makes sense to do that by any means what I am saying is that if you've already made that decision clearly it's too late plus to backtrack and instead of me trying to beat you up about it let's just go ahead and come up with a game plan so number one it doesn't panic it's not the end of the world, but there are some legal ramifications that you need to be well aware of okay and some of those legal ramifications are number one you can be taken to court because technically here's a problem a lot of you don't understand how a repossession process works so for example when you purchase the vehicle from the dealership or wherever you got it from the bank the people that you're paying every single month your lender they've already paid the dealership, so now the dealership is done okay now you have now a relationship an obligation to pay the actual lender that pay the dealership okay because the dealerships done now if you say hey come pick up my car and that's another thing a voluntary repossession and an involuntary repossession it's the exact same thing I'm sorry it's not the same thing, but the result is going to be the same on your credit report they're just gonna change no it's just going to be in the remarks section whether it was voluntary or involuntary as a matter of fact if it's involuntary they don't even put the remarks there it just says repossession but at the same time if it's voluntary they put that there, but again banks don't care about what a remark says okay as far as the impact on your credit report is going to be the exact same whether you give it back or whether...

Fill illinois repossession form : Try Risk Free

People Also Ask about repossession illinois

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your repossession illinois form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.