Com home page). USCIS forms or the +GERRY IRU (POOR HUB, you can download them from the Johnson.gry.com home page). The IRS has recently begun receiving this new form 1095-A, and so we're receiving this form 1095-A for 2015.

If you have a prior year 1095-A, you can get a corrected 1095-A form by following the instructions in the Instructions for Form 1095-A. In some instances, after your return is received, your corrected 1095-A will become the new 1095-B. When you file your new 1095-B, include all of your correct federal income tax withholding, plus 10 percent of the income you paid to prepare, file, or submit the return, so this reduces your federal tax liability. The 10 percent will reduce it further. If you are not a business and aren't using the 1095-B in a business, your 1090 will not qualify for a tax deduction, but you'll still need to get your 1099 back, or if your business is a sole proprietorship, an information return with form 1099-MISC, and you'll get a W-2 from the IRS in a few weeks, which will reduce your 1099-MISC. It is much easier to get a 1095-A corrected if you've provided tax returns to your employer in prior years, as most employers don't require you to submit your 1095-A to them. If so, the employer can file an amended return correcting your state tax withholding, federal income tax withholding, and any other tax they received from you in previous years without you having to get a paper tax return.

We're not yet receiving 1055s from some states (which usually have their own 1055 forms). We're expecting them this year, so it may take a little longer after our first 1095-As.

If you're looking for a quick, easy, one-stop tax solution that gets you more done each year and won't require you to research state tax withholding or figure how much you need to take out in federal taxes or your 1099-MISC, then we think you'll like to use the free form 1095-A in our form center.

Get the free Form W-4 (2012) - AFSB

Show details

2012 and. Beyond. Single. $7,000. $11,250. $11,650. $11,950. Married ..... USCIS forms or the +GERRY IRU (POOR HUB, you can download them from the ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form w-4 2012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form w-4 2012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form w-4 2012 online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form w-4 2012. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form w-4 - afsb?

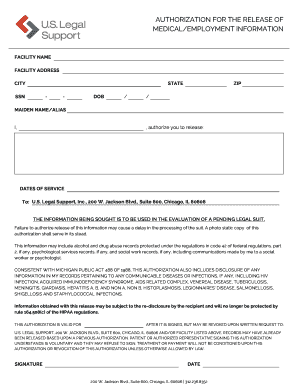

Form W-4 - AFSB is a tax withholding form used by individuals to indicate their tax filing status and the number of allowances they are claiming for payroll tax purposes.

Who is required to file form w-4 - afsb?

Employees in the United States who want to update their tax withholding information with their employer are required to file Form W-4 - AFSB.

How to fill out form w-4 - afsb?

To fill out Form W-4 - AFSB, you need to provide your personal information, such as your name, address, and Social Security number. You also need to indicate your filing status and the number of allowances you are claiming. Additionally, you may need to include any additional withholding you want your employer to deduct from your paycheck.

What is the purpose of form w-4 - afsb?

The purpose of Form W-4 - AFSB is to ensure that the correct amount of federal income tax is withheld from your paycheck by your employer.

What information must be reported on form w-4 - afsb?

Form W-4 - AFSB requires you to report your personal information, filing status, and the number of allowances you are claiming. You may also need to report any additional withholding you want your employer to deduct.

When is the deadline to file form w-4 - afsb in 2023?

The deadline to file Form W-4 - AFSB in 2023 is April 15th.

What is the penalty for the late filing of form w-4 - afsb?

The penalty for the late filing of Form W-4 - AFSB may vary. It is recommended to consult the IRS guidelines or a tax professional for accurate information regarding penalties.

How do I modify my form w-4 2012 in Gmail?

form w-4 2012 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit form w-4 2012 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share form w-4 2012 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete form w-4 2012 on an Android device?

Use the pdfFiller Android app to finish your form w-4 2012 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your form w-4 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.