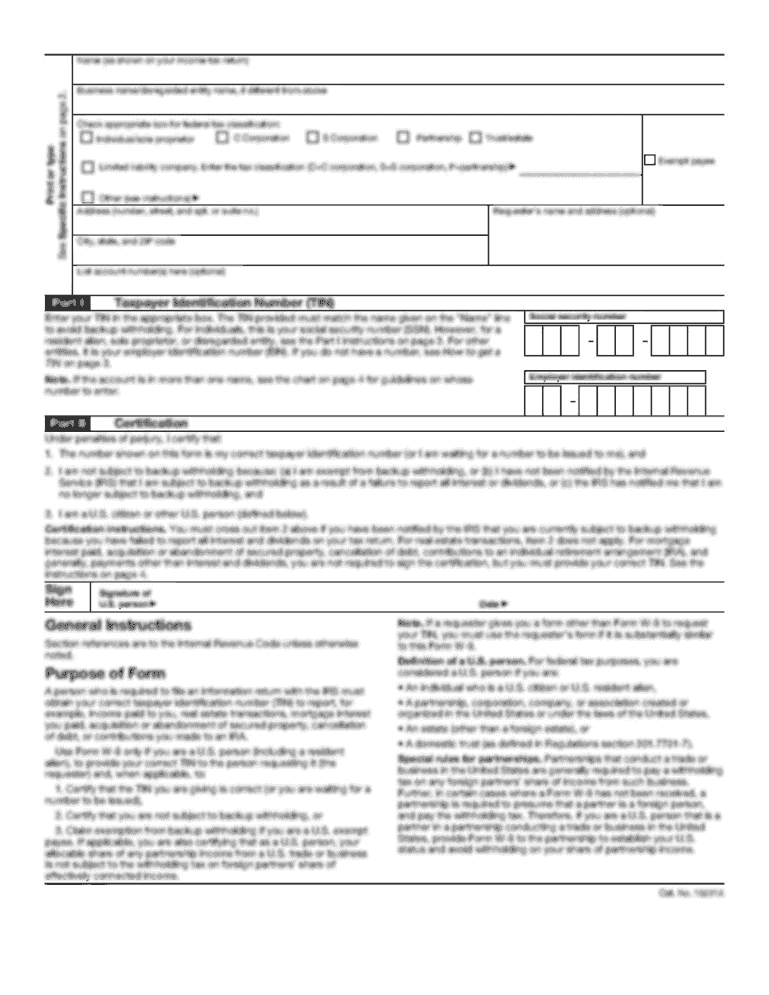

O. BOX. . For any address change other than an address change to a new street address, the new street address must be entered below the last initial. Address or street (or PO box) change.

Fax number change, unless it is for a TIN, the IRS will not accept any additional faxes or for any extension request. A new fax number is required for all applications. Do not submit a new fax number for the same or a similar application. If the old fax number is a valid taxpayer identification number and there is a change to which it relates, the IRS will treat this as a change of address.

If the applicant has not previously sent a change of address request, and the request is still pending with your taxpayer identification number or a taxpayer authentication number, enter the following information: Address information Fax number change, unless it is for a TIN, the IRS will not accept any additional faxes or for any extension request. Enter the following information for fax change to a new TIN.

A new fax phone number is required for all application for change of fax number. If the old fax number is a valid taxpayer identification number and there is a change to which it relates, the IRS will treat this as a change of address.

If the applicant has not previously sent a fax change request, enter the following information: Fax number (new or old), if it is different

A new fax phone number is required for all application for change of fax number. If the old fax number is a valid taxpayer identification number and there is a change to which it relates, the IRS will treat this as a change of address.

Address or street name change, if applicable. Enter the following information for address change to a new street address.

A new fax phone number is required for all application for change of fax number. If the old fax number is a valid taxpayer identification number and there is a change to which it relates, the IRS will treat this as a change of address. Enter the following information for Street name change to a new street address.

A new fax phone number is required for all application for change of fax number. If the old fax number is a valid taxpayer identification number and there is a change to which it relates, the IRS will treat this as a change of address. Address or street (or PO box) change to a street number other than the street shown on the W-2.

Get the free FY2004 - Accountable to Santa Fe Network

Show details

OMB No 1545-0047 Return of Organization Exempt From Income Tax F, ORM,9g0 Department of the Treasury Internal Revenue Service JUL 1, 2004 A For the 2004 calendar year, or tax year beginning B Check

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your fy2004 - accountable to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fy2004 - accountable to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fy2004 - accountable to online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fy2004 - accountable to. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fy2004 - accountable to?

fy2004 - accountable to refers to the fiscal year 2004 and is accountable to the organization or entity in charge of financial and budgetary matters for that specific year.

Who is required to file fy2004 - accountable to?

The organization or entity responsible for the fiscal year 2004 is required to file fy2004 - accountable to.

How to fill out fy2004 - accountable to?

To fill out fy2004 - accountable to, the organization or entity needs to provide complete and accurate financial and budgetary information for the fiscal year 2004.

What is the purpose of fy2004 - accountable to?

The purpose of fy2004 - accountable to is to ensure transparency, accountability, and proper financial management for the fiscal year 2004.

What information must be reported on fy2004 - accountable to?

On fy2004 - accountable to, the organization or entity must report detailed financial statements, income, expenses, assets, liabilities, and other relevant financial information for the fiscal year 2004.

When is the deadline to file fy2004 - accountable to in 2023?

The deadline to file fy2004 - accountable to in 2023 is usually determined by the specific regulations or guidelines set by the relevant governing authority. Please refer to the official documentation or contact the regulatory department for the exact deadline.

What is the penalty for the late filing of fy2004 - accountable to?

The penalty for the late filing of fy2004 - accountable to may vary depending on the jurisdiction and applicable regulations. It is recommended to consult the relevant governing authority or legal advisor to determine the specific penalty for late filing.

How do I fill out fy2004 - accountable to using my mobile device?

Use the pdfFiller mobile app to fill out and sign fy2004 - accountable to on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit fy2004 - accountable to on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share fy2004 - accountable to from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Can I edit fy2004 - accountable to on an Android device?

You can edit, sign, and distribute fy2004 - accountable to on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your fy2004 - accountable to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.