76 THE BOARD OF TRUSTEES OF THE NATIONAL BANK OF CHINA, THE BO.

Get the free Annual Reports and Accounts for the period ending - Ingenious VCTs

Show details

ABC Entertainment VCT 1 annual report & accounts For the year ended 31 December 2010 We Are ABC ENTERTAINMENT VCT 1 CONTENTS CORPORATE INFORMATION 1 CHAIRMAN S STATEMENT 2 MANAGER S REVIEW 4 BOARD

We are not affiliated with any brand or entity on this form

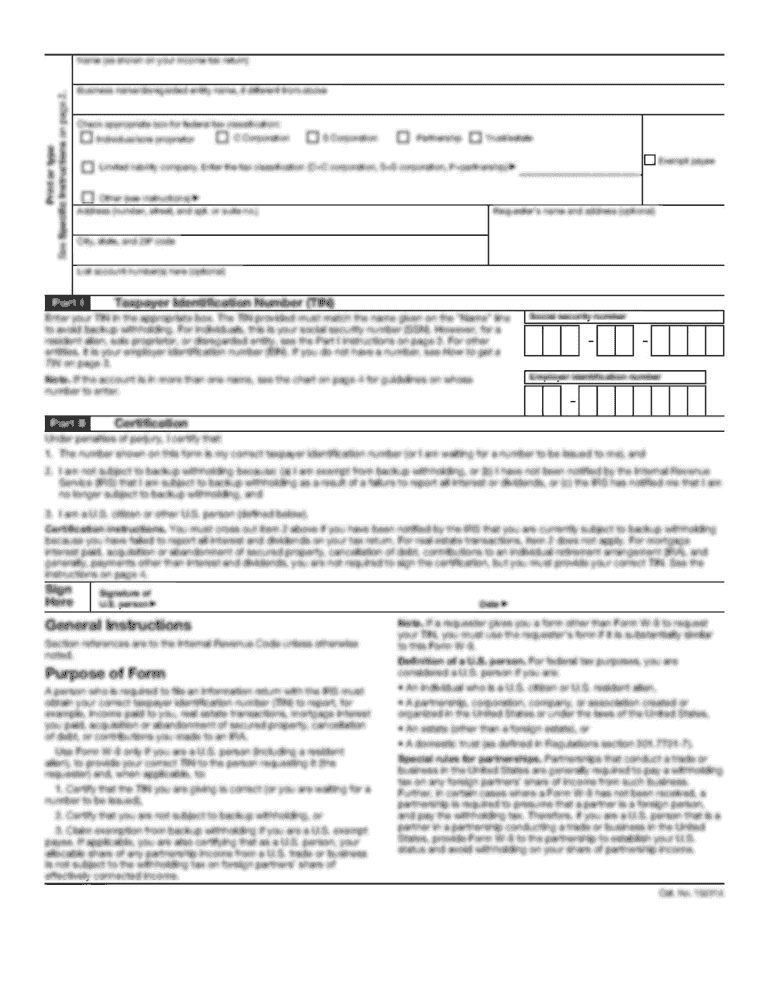

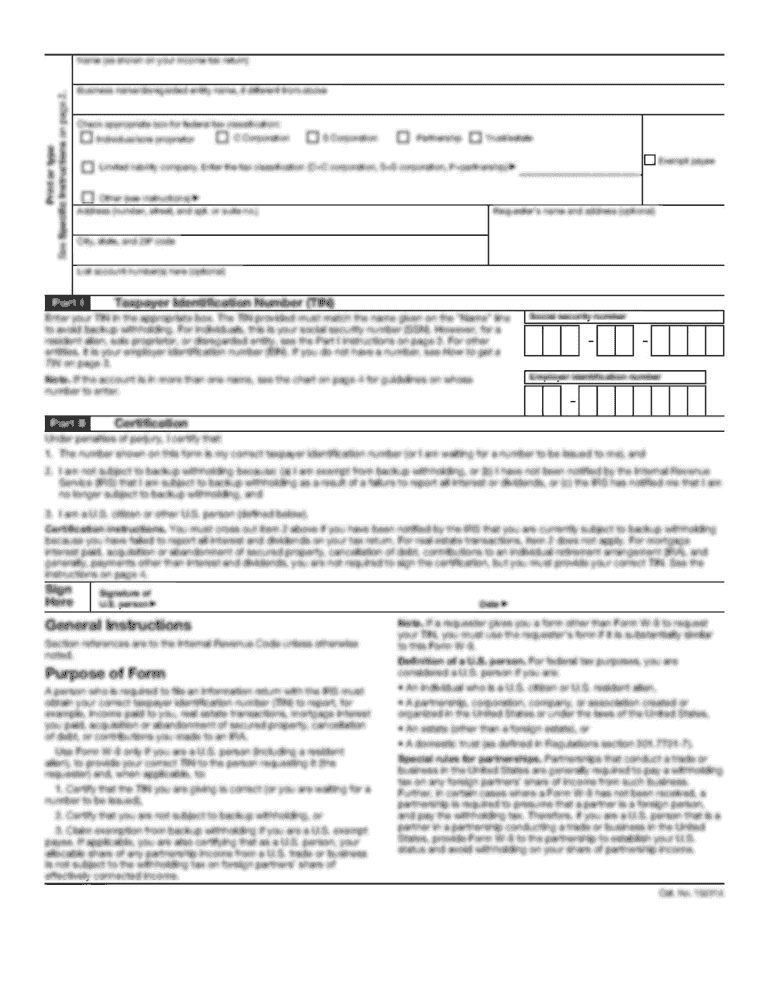

Get, Create, Make and Sign

Edit your annual reports and accounts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual reports and accounts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual reports and accounts online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit annual reports and accounts. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is annual reports and accounts?

Annual reports and accounts are a set of financial statements that provide information about a company's financial performance and activities over the course of a year.

Who is required to file annual reports and accounts?

Most companies, including limited companies, are required to file annual reports and accounts with the relevant regulatory authorities in their jurisdiction. The specific requirements may vary depending on the country and the type of company.

How to fill out annual reports and accounts?

Filling out annual reports and accounts involves compiling financial information, such as balance sheets, income statements, and cash flow statements. This information is usually prepared by the company's accountants or financial team according to accounting principles and standards applicable in their jurisdiction. Once prepared, the reports and accounts are submitted to the regulatory authorities through the designated filing mechanism.

What is the purpose of annual reports and accounts?

The main purpose of annual reports and accounts is to provide transparency and accountability to shareholders, investors, and other stakeholders. These documents allow interested parties to assess a company's financial performance, stability, and potential risks. Annual reports and accounts also serve as a tool for regulatory compliance, tax assessment, and decision-making by management and stakeholders.

What information must be reported on annual reports and accounts?

Annual reports and accounts generally include financial statements such as the balance sheet, income statement, cash flow statement, and statement of changes in equity. Additionally, they may contain management discussions and analysis, notes to the financial statements, auditor's report, and other relevant disclosures. The specific information required to be reported may vary depending on the accounting standards and regulations applicable in the jurisdiction.

When is the deadline to file annual reports and accounts in 2023?

The deadline to file annual reports and accounts in 2023 may vary depending on the country and jurisdiction. It is recommended to refer to the regulatory authorities or consult a legal or accounting professional to determine the specific deadline.

What is the penalty for the late filing of annual reports and accounts?

The penalty for the late filing of annual reports and accounts can vary depending on the jurisdiction and the specific circumstances. Penalties may include monetary fines, suspension of certain privileges or benefits, or other legal consequences. It is advisable to check the applicable laws and regulations or seek professional advice to understand the potential penalties for late filing.

How can I send annual reports and accounts for eSignature?

When you're ready to share your annual reports and accounts, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit annual reports and accounts in Chrome?

annual reports and accounts can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I complete annual reports and accounts on an Android device?

On an Android device, use the pdfFiller mobile app to finish your annual reports and accounts. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your annual reports and accounts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.