The T. Bailey Fund Managers Limited are not obliged to examine your account. An application without the required documentation may result in a delay in processing. The T. Bailey Fund Managers Limited reserves the right to refuse to pay you any investment fees. Any information supplied will be used solely and only in connection with this Fund. Please note that this fund is an Investment Fund within the meaning of the Securities and Futures Codes. In accordance with Regulation N.S.3(a) and (c), only those persons who are authorized in terms of the Investment Fund Regulations will be permitted to participate in an Investment Fund in New Zealand. Please note: Your application will be returned to you if you make any change to the information supplied. The T. Bailey Fund Managers Limited assumes no responsibility for any loss or damage that may occur as a result of any disclosure of information. Your rights and obligations with regard to the advice provided may also differ depending on the level of investment professional you select, whether you are accessing investment advice online. Please note that the Information is given purely for general information purposes with no liability to be assumed and the risk of loss is not borne by the T. Bailey Fund Managers Limited.

Invest

No Tax If you invested 10,000 or more in a registered New Zealand investment fund in 2011 or 2012, you could receive up to 150,000 tax-free. Achieving this tax-free income could be as easy as following these steps: Open an account — Invest for less than 100 million. Register with an Investment Advisor — Ensure that the advisor has a New Zealand address and your tax account number and the advisor signs a statutory declaration that provides your name, address and address of any company you hold and provides your tax account number.

It is estimated that the Australian Taxation Office (ATO) will reach around 3 million from this program, but only if an applicant's income is below 100 million. Once they start, it is believed that their investment returns may start outpacing what is tax-free.

A list of the Australian Taxation Office (ATO) website details can be found here.

The T. Bailey Fund Managers Limited reserves the right to decline applications without refund. In our view a fund that offers a free investment and has no risk should offer less than one full year of free investment. The T.

Get the free 43941 BAIL03 ISA Investment Application Form - T Bailey

Show details

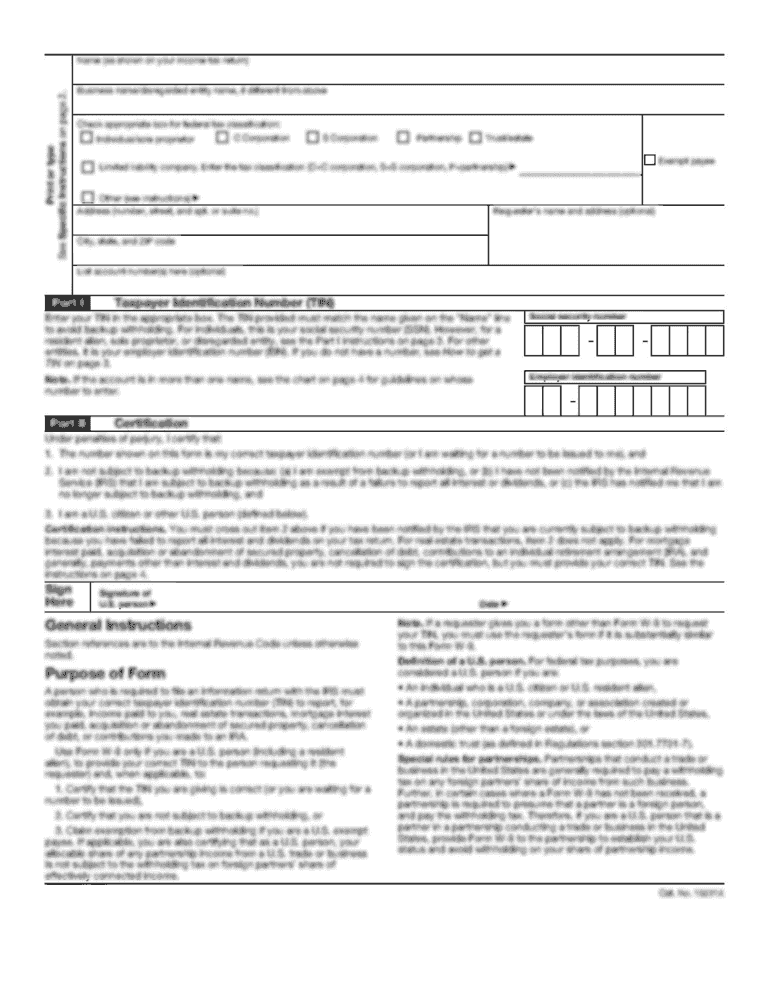

ISA Investments and ISA Transfers Application Form FOR 2011/2012 Before completing your application form, you must read the Simplified Prospectus which contains important information about your investment.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 43941 bail03 isa investment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 43941 bail03 isa investment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 43941 bail03 isa investment online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 43941 bail03 isa investment. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 43941 bail03 isa investment for eSignature?

When you're ready to share your 43941 bail03 isa investment, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make changes in 43941 bail03 isa investment?

With pdfFiller, it's easy to make changes. Open your 43941 bail03 isa investment in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How can I edit 43941 bail03 isa investment on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing 43941 bail03 isa investment, you need to install and log in to the app.

Fill out your 43941 bail03 isa investment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.