Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Form can have multiple meanings depending on the context, but in general, the term "form" refers to:

1. A physical shape or structure: It pertains to the outward appearance or arrangement of an object, organism, or entity. For example, the form of a car, the form of a human body, etc.

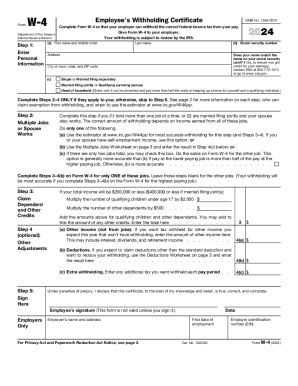

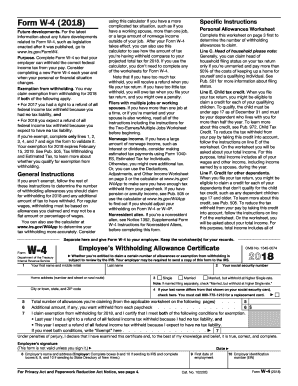

2. A document or template: It refers to a document or form that includes empty fields or spaces to be filled in with specific information or data. For instance, a job application form, an insurance claim form, etc.

3. A method or manner of doing something: In this sense, form represents a particular procedure, process, or way of carrying out an action or task. For example, a technique or style in sports, a method of solving a problem, etc.

4. In art and design: Form refers to the visual elements of an artwork, such as its shape, volume, structure, or composition, that contribute to its overall aesthetic or expression. It can be two-dimensional (e.g., shapes in a painting) or three-dimensional (e.g., the structure of a sculpture).

5. In linguistics: Form refers to the structure or arrangement of words, phrases, or sentences in a language. It involves analyzing the grammatical patterns, word order, and inflections to understand how the language functions.

These are just a few examples of the various meanings of "form" depending on the specific context it is used in.

Who is required to file form?

There are several different types of forms that may be required to be filed depending on the specific situation. Some common types of forms that individuals may be required to file include:

1. Individual Income Tax Return (Form 1040): This form is filed by individuals to report their annual income and calculate the amount of tax they owe or the refund they are entitled to.

2. Corporate Income Tax Return (Form 1120): This form is filed by corporations to report their annual income and calculate the amount of tax they owe.

3. Partnership Income Tax Return (Form 1065): This form is filed by partnerships to report their annual income and allocate it among the partners.

4. S Corporation Income Tax Return (Form 1120S): This form is filed by S corporations to report their annual income and allocate it among the shareholders.

5. Estate and Gift Tax Return (Form 706): This form is filed to report the transfer of property upon someone's death or to report gifts made during one's lifetime.

6. Foreign Bank Account Report (FinCEN Form 114): This form is filed by U.S. taxpayers who have a financial interest in or signature authority over foreign financial accounts.

7. Estimated Tax Payments (Form 1040-ES): This form is used to make quarterly estimated tax payments by individuals who expect to owe tax on income not subject to withholding.

It is important to consult with a tax professional or refer to IRS guidelines to determine which forms need to be filed in each individual situation, as the requirements can vary depending on factors such as the individual's income level, business structure, and financial activities.

1. Read the instructions: Make sure you understand the purpose of the form and any specific requirements or guidelines mentioned in the instructions provided.

2. Gather required documents: Collect all necessary documents or information that may be needed to complete the form accurately. This may include personal identification documents, financial records, or any other supporting materials mentioned in the instructions.

3. Start with personal information: Begin by providing your personal details such as your full name, address, contact information, date of birth, and social security number (if required).

4. Follow the sequence: Most forms are organized in a specific sequence, so fill out each section in the order prescribed. This will help ensure that you do not miss any important fields.

5. Provide accurate information: Double-check the accuracy of the information you enter. Avoid any guesswork and make sure to use correct, up-to-date details.

6. Use appropriate format: Follow the prescribed format for date, time, currency, or any other specific formatting requirements mentioned on the form.

7. Be concise and specific: Answer any questions or prompts on the form briefly and to the point. Avoid using unnecessary words or providing additional information that is not requested.

8. Check for completeness: Review the form once completed to verify that all the necessary fields are filled in. Ensure that you haven't missed any sections and that the required supporting documents are attached, if applicable.

9. Review and proofread: Read through the filled-out form carefully to spot any errors or inconsistencies. Correct any mistakes or typos before submitting the form.

10. Submit as instructed: Follow the instructions on where and how to submit the form. This may involve mailing it to a specific address, submitting it online, or delivering it in person.

Remember that the process of filling out a form can vary depending on its purpose and complexity. Always refer to the specific instructions provided with the form to ensure accurate completion.

What is the purpose of form?

The purpose of a form is to collect and organize information in a structured manner. Forms allow individuals or organizations to gather data, receive input or feedback, and make informed decisions based on the collected information. Forms can be used in various contexts such as surveys, applications, registrations, questionnaires, order placements, feedback collection, and more. They provide a standardized way to gather information and facilitate communication between the form creator and the respondent.

What information must be reported on form?

The specific information that must be reported on a form can vary depending on the type of form and its purpose. However, there are some common elements that are typically required:

1. Personal information: This includes details such as full name, address, contact information (phone number, email), date of birth, and Social Security number.

2. Identification: Forms often require some form of identification, such as a driver's license number, passport number, or other government-issued ID.

3. Financial information: Certain forms may require disclosure of financial information, such as income, assets, liabilities, and tax-related details.

4. Employment information: Forms related to employment may ask for information like job title, employer name and address, duration of employment, and salary or compensation details.

5. Health information: Some forms may require disclosure of health-related information, such as medical history, current medications, and allergies.

6. Consent and authorization: Forms may include sections where the individual provides their consent for certain actions or authorizes the release of information to specific parties.

7. Signatures: Most forms require the individual to sign and date the document to indicate their agreement or affirmation of the information provided.

It is important to carefully read the instructions on each form to ensure that all required information is accurately provided.

When is the deadline to file form in 2023?

I apologize, but without more specific information about the form you are referring to, I am unable to provide an accurate deadline. Please provide more details about the form you are interested in, and I'll do my best to assist you.

What is the penalty for the late filing of form?

The penalty for late filing of a form can vary depending on the specific form and the governing jurisdiction. In general, late filing penalties may include late fees, interest charges, and potential legal consequences. It is important to check the specific guidelines and regulations set by the relevant authority to determine the exact penalty for late filing of a particular form.

How can I modify 2012 form without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including 2012 form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an eSignature for the 2012 form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your 2012 form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the 2012 form form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign 2012 form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.