Get the free With the Changing Tax Landscape - nhbar

Show details

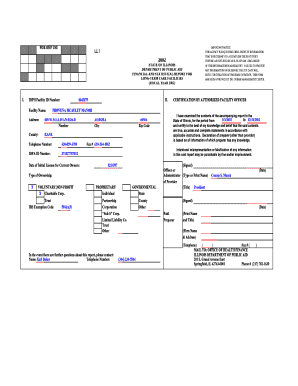

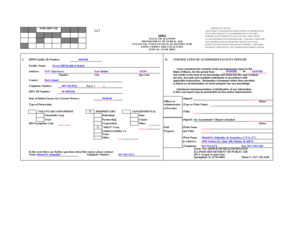

Registration Form $219* (per registrant) Concord, NH 03301 PR SRT STD U.S. Postage PAID Permit # 1229 28th Annual Tax Forum *Price includes continental breakfast, lunch, refreshments and written materials.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your with form changing tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your with form changing tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit with form changing tax online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit with form changing tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out with form changing tax

How to fill out with form changing tax:

01

Gather all the necessary documents, such as your income statements, receipts, and any other relevant financial records.

02

Carefully read the instructions provided on the form, paying attention to any special requirements or additional documents that may be needed.

03

Begin by filling out your personal information, including your name, address, and social security number.

04

Proceed to the sections related to your income, deductions, and credits. Provide accurate and detailed information in these sections, ensuring that you have the necessary supporting documents to validate your claims.

05

Double-check your entries for any errors or missing information. It's crucial to be thorough and precise when dealing with tax forms.

06

Sign and date the form, certifying that the information you have provided is accurate to the best of your knowledge.

Who needs with form changing tax:

01

Individuals who have experienced significant life changes, such as marriage, divorce, or the birth of a child, may need to fill out a form changing tax to reflect these changes and ensure they receive the appropriate deductions or credits.

02

Business owners or self-employed individuals who have made changes to their company's structure or financial operations may also require a form changing tax to update their tax information.

03

Anyone who has discovered errors or omissions on a previously filed tax return may need to fill out a form changing tax to correct these mistakes and avoid any potential penalties or audits.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is with form changing tax?

The form changing tax refers to the tax that is imposed when changes are made to a tax form.

Who is required to file with form changing tax?

Any taxpayer who makes changes to their tax form after it has been submitted is required to file the form changing tax.

How to fill out with form changing tax?

To fill out the form changing tax, taxpayers must provide the details of the changes made to their tax form and calculate the corresponding tax liability for these changes.

What is the purpose of with form changing tax?

The purpose of the form changing tax is to ensure that taxpayers pay the appropriate tax amount for any changes made to their initially filed tax form.

What information must be reported on with form changing tax?

The form changing tax requires taxpayers to report the details of the changes made to their tax form, including any adjustments to income, deductions, or credits.

When is the deadline to file with form changing tax in 2023?

The deadline to file the form changing tax in 2023 is April 15th.

What is the penalty for the late filing of with form changing tax?

The penalty for the late filing of the form changing tax is $205 or 100% of the unpaid tax, whichever is greater.

How do I edit with form changing tax online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your with form changing tax and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I fill out with form changing tax on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your with form changing tax. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit with form changing tax on an Android device?

The pdfFiller app for Android allows you to edit PDF files like with form changing tax. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your with form changing tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.