Get the free FORM PA-A05-001

Show details

This form is used to claim for injuries or illnesses covered under an insurance policy, providing details about the insured person, the incident, and any previous claims or insurances.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form pa-a05-001

Edit your form pa-a05-001 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form pa-a05-001 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form pa-a05-001 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form pa-a05-001. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form pa-a05-001

How to fill out FORM PA-A05-001

01

Begin by downloading FORM PA-A05-001 from the official website.

02

Read the instructions carefully before starting to fill it out.

03

Provide your personal details in the specified sections, including your name, address, and contact information.

04

Fill out the date of birth and any relevant identification numbers as requested.

05

Complete the sections regarding the purpose of the form, providing clear and concise information.

06

Review the checklist provided at the end of the form to ensure that all sections have been completed.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the form according to the instructions, whether by mail, online, or in person.

Who needs FORM PA-A05-001?

01

Individuals applying for a specific government program or assistance.

02

Businesses seeking permits or licenses that require this form.

03

Community organizations helping clients to complete the application for benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is a Schedule A on inheritance tax return in PA?

Schedule A: Real Estate • This is where you list all real estate owned by the decedent. You should list the address of the property that you are living in/plan to live in inherited from the decedent and its assessed value in the year the decedent died. Schedule E: Cash, Bank Deposits, & Misc.

Can you file PA state taxes for free?

You can prepare and submit your Pennsylvania personal income tax return for free. E-file for free: A safe, convenient online filing option available from reputable vendors.

Is there an actual free way to file taxes?

IRS Free File lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software. It's safe, easy and no cost to you. Those who don't qualify can still use Free File Fillable Forms.

How do I file state taxes for free in PA?

myPATH: A secure, state-only electronic filing system. myPATH is a service offered exclusively through the Department of Revenue. You can prepare and submit your Pennsylvania personal income tax return for free.

Is it free to file state taxes with H&R Block?

H&R Block Online Free vs. TurboTax Free Edition: What are free forms? What do we mean by forms for free? For starters, you can use H&R Block Free Online to file a simple federal return and state return for $0.

Is PA state tax free?

Overview. Pennsylvania personal income tax is levied at the rate of 3.07 percent against taxable income of resident and nonresident individuals, estates, trusts, partnerships, S corporations, business trusts and limited liability companies not federally taxed as corporations.

How to avoid PA underpayment penalty?

Underpayment of Employer Withholding Tax Include the amount of the underpayment on Line 2, Total PA Withholding Tax, of the quarterly withholding return. Important: To avoid the 5 percent per month underpayment penalty, the amendment must be made on the quarterly return for the period of the under remittance.

Who qualifies for PA tax forgiveness?

Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven. For example, a family of four (couple with two dependent children) can earn up to $34,250 and qualify for Tax Forgiveness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

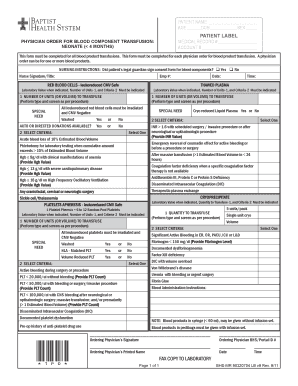

What is FORM PA-A05-001?

FORM PA-A05-001 is a specific official document required for reporting certain financial information, typically used in Pennsylvania for various compliance purposes.

Who is required to file FORM PA-A05-001?

Entities or individuals that meet specific criteria set by the relevant authority in Pennsylvania, such as businesses or organizations engaged in particular activities, are required to file FORM PA-A05-001.

How to fill out FORM PA-A05-001?

To fill out FORM PA-A05-001, you must accurately provide the requested financial and operational information in the designated fields, ensuring that all required data is complete and correct before submission.

What is the purpose of FORM PA-A05-001?

The purpose of FORM PA-A05-001 is to collect specific financial information from reporting entities to ensure compliance with state regulations and to assist in the monitoring of financial activities.

What information must be reported on FORM PA-A05-001?

Reported information on FORM PA-A05-001 typically includes details about revenue, expenses, assets, liabilities, and any other data relevant to the financial health and activities of the reporting entity.

Fill out your form pa-a05-001 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Pa-a05-001 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.