Get the free oe1a form - rrb

Show details

2012 Railroad Retirement Reporting Summary National Railway Labor Organizations Tax Rate Base Who Reports Form OE-1a Locals Yes CT-$1110,100 for the year System Units Yes CT-1 Grand Lodge Yes BA-3

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your oe1a form - rrb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oe1a form - rrb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oe1a form - rrb online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit oe1a form - rrb. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out oe1a form - rrb

How to fill out OE1A form:

01

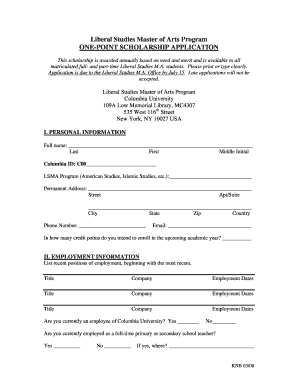

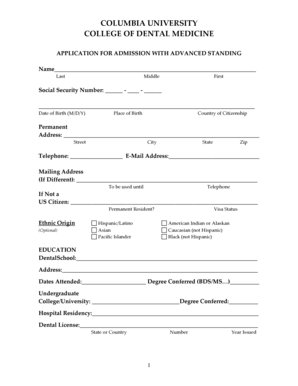

Research and gather all the necessary information required to complete the OE1A form. This may include personal details, contact information, employment history, educational background, and any other relevant information.

02

Carefully read through the instructions on the form to understand the specific requirements and sections that need to be filled out.

03

Start by providing your personal details such as your full name, date of birth, address, and contact information in the designated sections.

04

Fill out the employment history section by providing details of your past and current employment. Include the companies you have worked for, job titles, dates of employment, and a brief description of your responsibilities and achievements.

05

If applicable, fill out the education section by listing your educational qualifications, including the schools or universities you attended, degrees or diplomas earned, and dates of attendance.

06

Depending on the purpose of the form, you may need to provide additional information such as references, licenses or certifications, language proficiency, or any other relevant details.

07

Review your completed form to ensure all sections are filled out accurately and completely. Check for any errors or missing information.

08

Sign and date the form as required. Keep a copy of the completed form for your records.

09

Submit the OE1A form as instructed, either by mail or electronically, depending on the submission method specified.

Who needs OE1A form:

01

Individuals who are applying for specific jobs or positions may be required to fill out an OE1A form as part of the application process. It helps employers gather relevant information about the applicants' qualifications, experience, and suitability for the role.

02

Applicants seeking certain licenses or certifications in certain industries or professions may also be required to complete an OE1A form to provide necessary details about their qualifications and experience.

03

Students applying for educational programs or scholarships may need to fill out an OE1A form to provide information about their educational background, achievements, and personal details.

04

In some cases, government agencies or organizations may request individuals to complete the OE1A form for statistical or administrative purposes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is oe1a form?

OE1A form refers to a specific tax form used for reporting income and deductions for individuals.

Who is required to file oe1a form?

Individuals who meet certain income and filing status requirements are required to file OE1A form.

How to fill out oe1a form?

To fill out OE1A form, you need to provide accurate and complete information regarding your income, deductions, and personal details as requested on the form. It is recommended to consult a tax professional or refer to the form's instructions for guidance.

What is the purpose of oe1a form?

The purpose of OE1A form is to report and calculate an individual's tax liability based on their income and deductions.

What information must be reported on oe1a form?

OE1A form requires individuals to report various aspects of their income, including wages, dividends, rental income, and self-employment earnings. Additionally, deductions such as expenses, credits, and adjustments may also need to be reported.

When is the deadline to file oe1a form in 2023?

The deadline to file the OE1A form for the tax year 2023 is generally April 15th.

What is the penalty for the late filing of oe1a form?

The penalty for the late filing of the OE1A form can vary depending on the individual's circumstances and the tax authority's regulations. It is important to review the specific guidelines and consult a tax professional for accurate information.

How do I make changes in oe1a form - rrb?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your oe1a form - rrb to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I sign the oe1a form - rrb electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your oe1a form - rrb.

How do I fill out oe1a form - rrb using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign oe1a form - rrb. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Fill out your oe1a form - rrb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.