Get the free etf application form sinhala

Show details

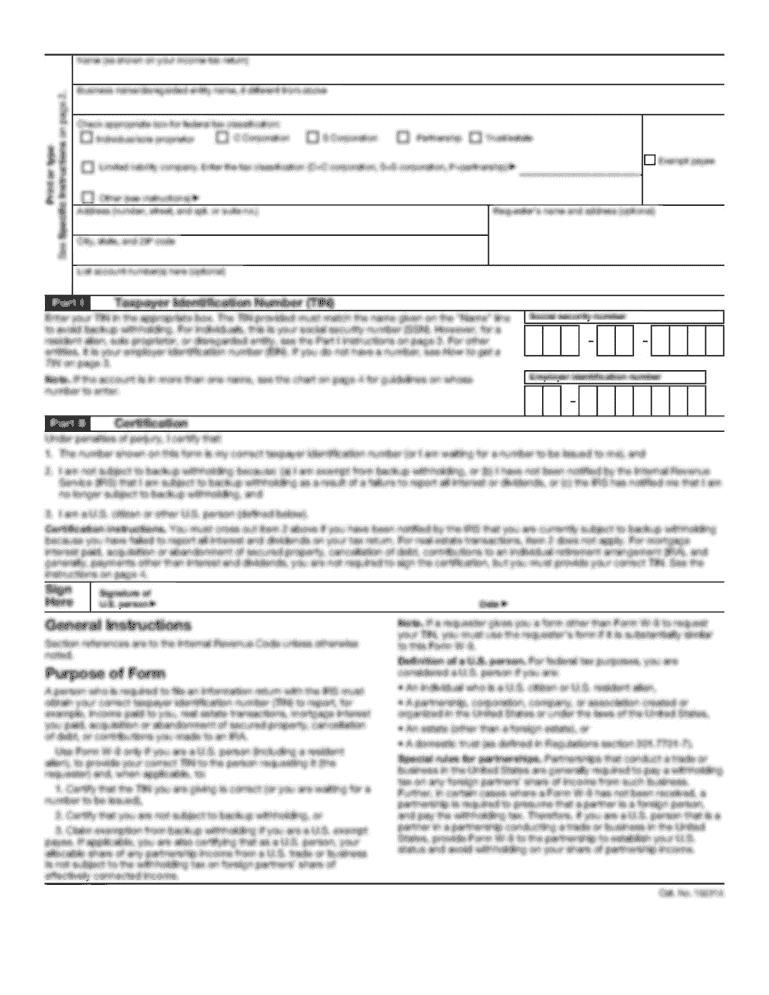

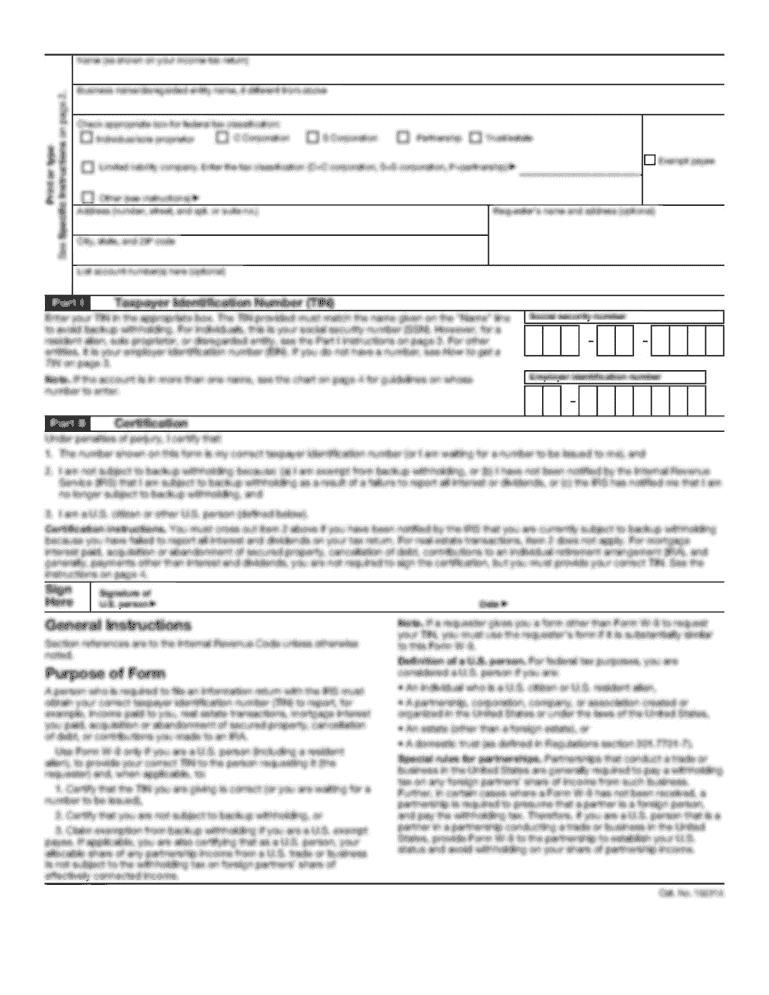

Form No. VI INSTRUCTIONS FOR COMPLETION OF THE CLAIM APPLICATION (FORM VI) ISSUED FREE OF CHARGE This form is also available in Inhale and Tamil 1. For office use only A member is entitled to withdraw

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your etf application form sinhala form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your etf application form sinhala form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing etf application form sinhala online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit etf claim form sinhala pdf download. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

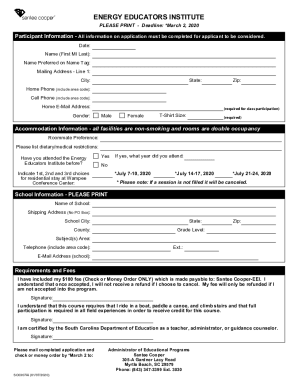

How to fill out etf application form sinhala

How to fill out etf claim form:

01

Gather all relevant information and documentation, such as your account details, transaction history, and any supporting documents related to the claim.

02

Carefully read through the instructions provided on the etf claim form to ensure you understand each section and requirement.

03

Begin by filling out your personal information, including your full name, address, contact details, and any other requested information.

04

Provide specific details about the claimed ETF, such as the fund name, ticker symbol, and the reason for your claim.

05

If applicable, include the date and amount of the transaction you are disputing or requesting reimbursement for.

06

Attach any supporting documents that validate your claim, such as receipts, statements, or communication records.

07

Review the completed form for accuracy and completeness, making any necessary corrections or additions.

08

Sign and date the form, acknowledging that the information provided is true and accurate to the best of your knowledge.

09

Submit the completed etf claim form and all accompanying documents to the appropriate authority or organization as indicated on the form.

Who needs etf claim form:

01

Investors who have experienced an issue, such as an error, discrepancy, or unauthorized transaction, related to their ETF investment.

02

Individuals who wish to request a refund or reimbursement for a specific ETF transaction.

03

Anyone who has been directed to complete an etf claim form by the relevant authority or organization handling ETF claims.

Fill etf claim form pdf : Try Risk Free

People Also Ask about etf application form sinhala

How many years does it take to be vested in the Wisconsin retirement system?

How can I claim ETF?

When can we claim ETF?

How do I contact an ETF?

When can ETF be withdrawn?

How do I claim ETF?

Can I take money out of my Wisconsin retirement account?

How do I get 30% ETF?

How do I get my 30% ETF?

What is ETF benefits for Grade 5 scholarship?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is etf claim form?

An ETF (Exchange-Traded Fund) claim form refers to a document that investors can use to make a claim regarding their investment in an ETF. This form is usually provided by the ETF issuer or the relevant regulatory authority and is used to initiate a process for addressing investor complaints, disputes, or issues related to the ETF. The claim form typically requires the investor to provide details such as their personal information, investment details, reasons for the claim, and any supporting documentation. It is an important tool for investors to seek resolutions or remedies for any grievances they may have regarding their ETF investments.

Who is required to file etf claim form?

The entity or individual that is required to file an ETF (Early Termination Fee) claim form may vary depending on the specific circumstances and agreements involved. Generally, it is the person or business entity that believes they have been wrongly charged an Early Termination Fee by a service provider or company. This could be a customer or client who is disputing the fee and seeking reimbursement or waiver. It is advisable to refer to the specific terms and conditions of the service agreement or contract to determine the procedures and requirements for filing an ETF claim form.

How to fill out etf claim form?

Filling out an ETF (Exchange-Traded Fund) claim form typically involves the following steps:

1. Obtain the claim form: Contact the relevant financial institution or brokerage firm that handles your ETF investment and request a claim form. They may provide it in physical or digital format.

2. Personal information: Fill out your personal details accurately, including your full name, address, contact details, and any account information related to the ETF investment in question.

3. Claim details: Provide the necessary information related to the claim, such as the name and ticker symbol of the ETF, the specific transaction(s) involved, and the reason for filing the claim (e.g., errors in trade execution, unauthorized transactions, misrepresentation, etc.). Clearly and concisely explain the issue.

4. Supporting documentation: Gather any relevant supporting documents that substantiate your claim. This may include trade confirmations, account statements, communication records, receipts, or any other evidence that supports your case. Make copies of these documents and attach them to the claim form. Ensure that the copies are clear and legible.

5. Sign and date: Review the claim form thoroughly before signing and dating it. By signing, you certify that all the information provided is accurate and true to the best of your knowledge. Be sure to also check for any additional signature requirements, such as a witness or notary.

6. Submit the claim: Follow the instructions provided by the financial institution for submitting the claim. This may involve mailing the form and supporting documents to a specific address or submitting them electronically through an online portal or email.

7. Follow up: After submitting the claim, keep a copy of the filled-out form and all supporting documents for your records. Track the progress of your claim by reaching out to the financial institution or brokerage firm periodically to inquire about the status and any additional steps required.

Note: The specific requirements and processes may vary based on the institution and country. Always refer to the instructions provided with the claim form or consult with the financial institution directly for any specific guidelines or assistance.

What is the purpose of etf claim form?

The purpose of an ETF (Exchange Traded Fund) claim form is to initiate and request a redemption or sale of ETF units. When an investor decides to sell their ETF units or redeem their investment, they need to fill out the ETF claim form provided by the fund manager or financial institution. This form typically includes details such as the investor's name, contact information, account number, the number of units to be sold or redeemed, and any specific instructions regarding the redemption process.

By filling out the claim form, investors are formally instructing the fund manager to proceed with the sale or redemption of their ETF units. This form is essential for ensuring accurate and efficient processing of the investor's request and acts as a legal document to authorize the redemption or sale of the ETF units.

What is the penalty for the late filing of etf claim form?

The penalties for the late filing of an ETF (Early Termination Fee) claim form may vary depending on the specific terms and conditions of the contract or agreement you have with the company. It is best to review the terms and conditions provided by the company or consult with their customer service to determine any applicable penalties.

How can I send etf application form sinhala to be eSigned by others?

Once you are ready to share your etf claim form sinhala pdf download, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I edit etf claim form on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing epf claim application form sinhala.

How do I edit how to fill etf claim form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign etf form pdf sinhala on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your etf application form sinhala online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Etf Claim Form is not the form you're looking for?Search for another form here.

Keywords relevant to etf form download

Related to epf application form sinhala

If you believe that this page should be taken down, please follow our DMCA take down process

here

.