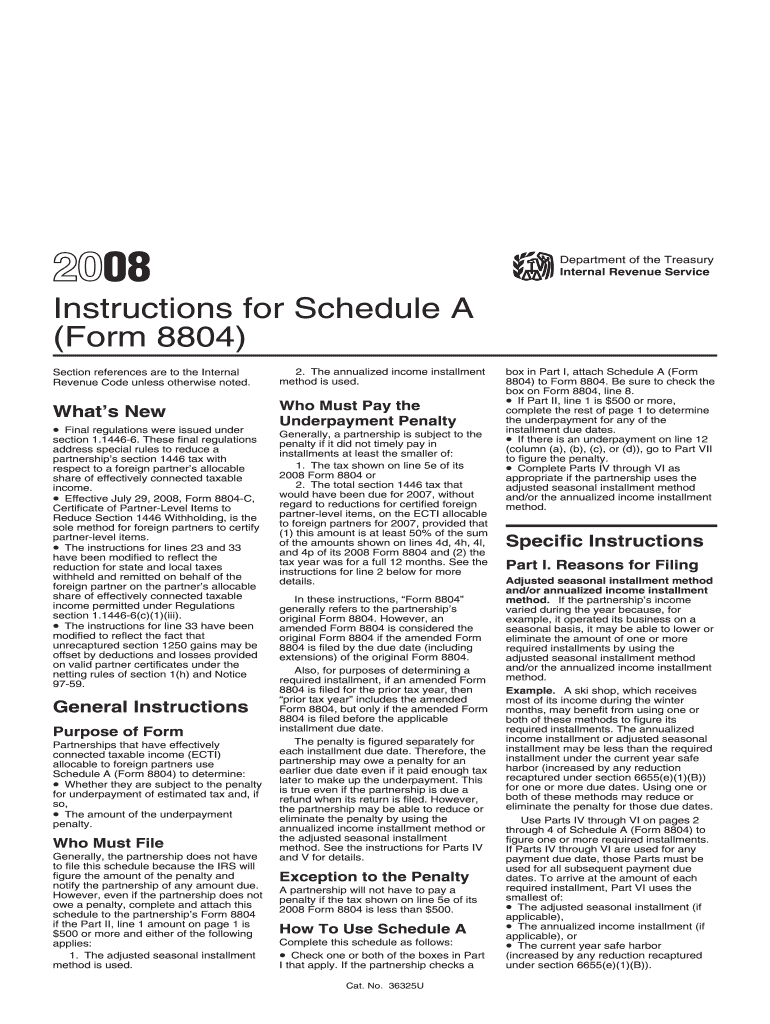

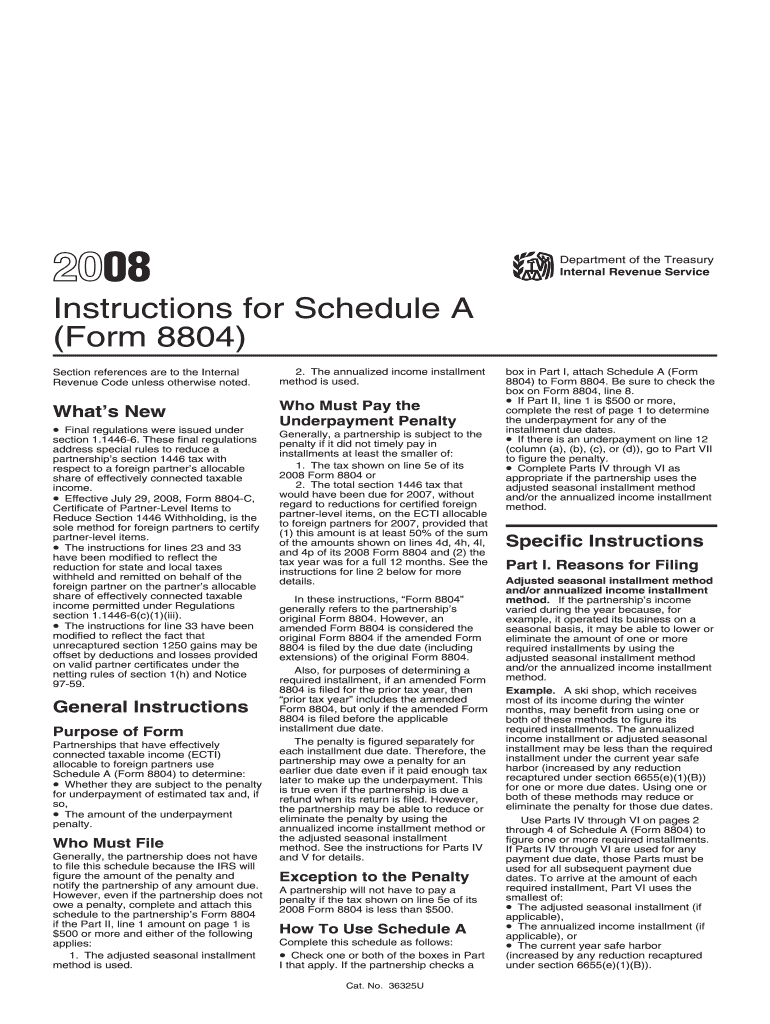

Get the free Instructions for Schedule A (Form 8804) - irs

Show details

Das Dokument enthält Anweisungen zur Ausfüllung von Schedule A (Form 8804), einschließlich der Anforderungen für Partnerschaften, die effektiv verbundene steuerpflichtige Einkünfte an ausländische

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign instructions for schedule a

Edit your instructions for schedule a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your instructions for schedule a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing instructions for schedule a online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit instructions for schedule a. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out instructions for schedule a

How to fill out Instructions for Schedule A (Form 8804)

01

Gather necessary documents including partnership tax information and income details.

02

Obtain a copy of Schedule A (Form 8804) from the IRS website.

03

Review General Instructions for Form 8804 to understand the context and requirements.

04

Complete Part I by reporting the applicable amounts of foreign partners and their respective income.

05

Proceed to Part II to calculate the total payments made on behalf of the foreign partners.

06

Fill out Part III, detailing any adjustments or additional claims.

07

Review your entries for accuracy and compliance with IRS guidelines.

08

Sign and date the form before submission, ensuring all required information is included.

Who needs Instructions for Schedule A (Form 8804)?

01

Partnerships that have foreign partners and need to report tax liabilities.

02

Tax professionals assisting clients with foreign partner tax reporting requirements.

03

Businesses that are required to make tax payments on behalf of foreign partners.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file form 8805?

Understanding Form 8805 Each foreign partner receives a copy of Form 8805, which details their share of the ECTI and the tax withheld on their behalf. Key information required on Form 8805 includes: The foreign partner's name, address, and identification number.

What is for 8804?

Form 8804, Annual Return for Partnership Withholding Tax (Section 1446). The withholding tax liability of the partnership for its tax year is reported on Form 8804. Form 8804 is also a transmittal form for Forms 8805.

What is the difference between final withholding tax and creditable withholding tax?

A: A final tax represents the full and final payment of the income tax that is due from a taxpayer. Thus, the taxpayer is no longer required to file a tax return for the income where a final tax had been withheld. A creditable tax is a preliminary payment of the tax liability of the taxpayer.

Can form 8804 be filed electronically?

Any forms filed to the IRS separately from Form 1065, such as Form 8804, aren't included in the electronic file and need to be filed on paper.

What is the difference between Form 8804 and 8805?

Use Form 8804 to report the total liability under section 1446 for the partnership's tax year. Form 8804 is also a transmittal form for Form(s) 8805. Use Form 8805 to show the amount of ECTI and the total tax credit allocable to the foreign partner for the partnership's tax year.

What is the difference between withholding tax and extended withholding tax?

Withholding taxes can be calculated and posted at different stages depending on local requirements - either at payment, invoice posting, or partial payment. Extended withholding tax in SAP supports both invoice posting and payment-based tax calculation.

Does form 8804 require a separate extension?

If you need more time to file Form 8804, you may file Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, to request an extension. Form 7004 does not extend the time to pay the tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Instructions for Schedule A (Form 8804)?

Instructions for Schedule A (Form 8804) provide guidance on how to report and compute the tax liability for U.S. partnerships that have effectively connected income.

Who is required to file Instructions for Schedule A (Form 8804)?

U.S. partnerships that have effectively connected income and are required to pay a withholding tax on behalf of foreign partners must file Instructions for Schedule A (Form 8804).

How to fill out Instructions for Schedule A (Form 8804)?

To fill out Instructions for Schedule A (Form 8804), partnerships must provide details of the effectively connected income, calculate the tax owed, and report foreign partner tax withholding amounts as per IRS guidelines.

What is the purpose of Instructions for Schedule A (Form 8804)?

The purpose of Instructions for Schedule A (Form 8804) is to ensure that partnerships correctly report tax obligations and withholding requirements for foreign partners, facilitating compliance with U.S. tax laws.

What information must be reported on Instructions for Schedule A (Form 8804)?

Instructions for Schedule A (Form 8804) require reporting of effectively connected income, details of foreign partners, the amount withheld for taxes, and calculations for any applicable deductions or credits.

Fill out your instructions for schedule a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Instructions For Schedule A is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.