Get the free Form 4797 - Internal Revenue Service - irs

Show details

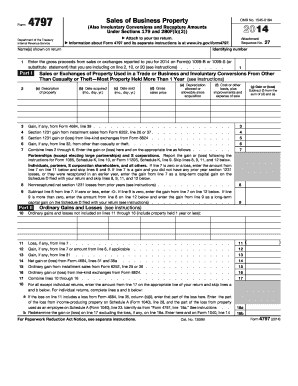

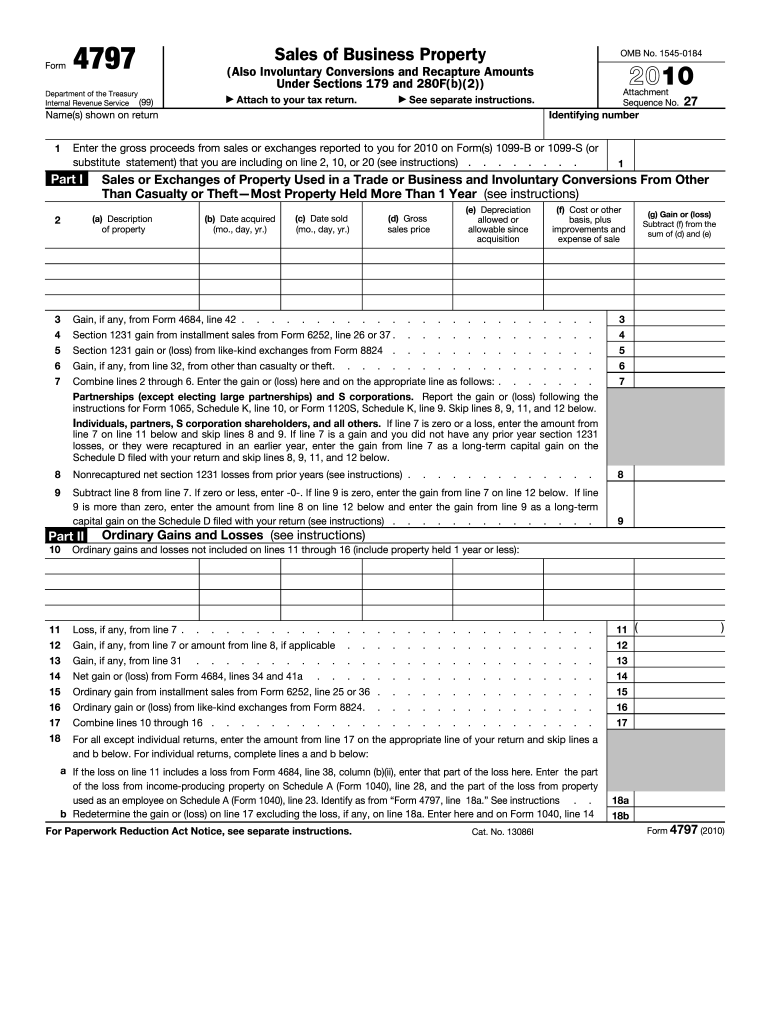

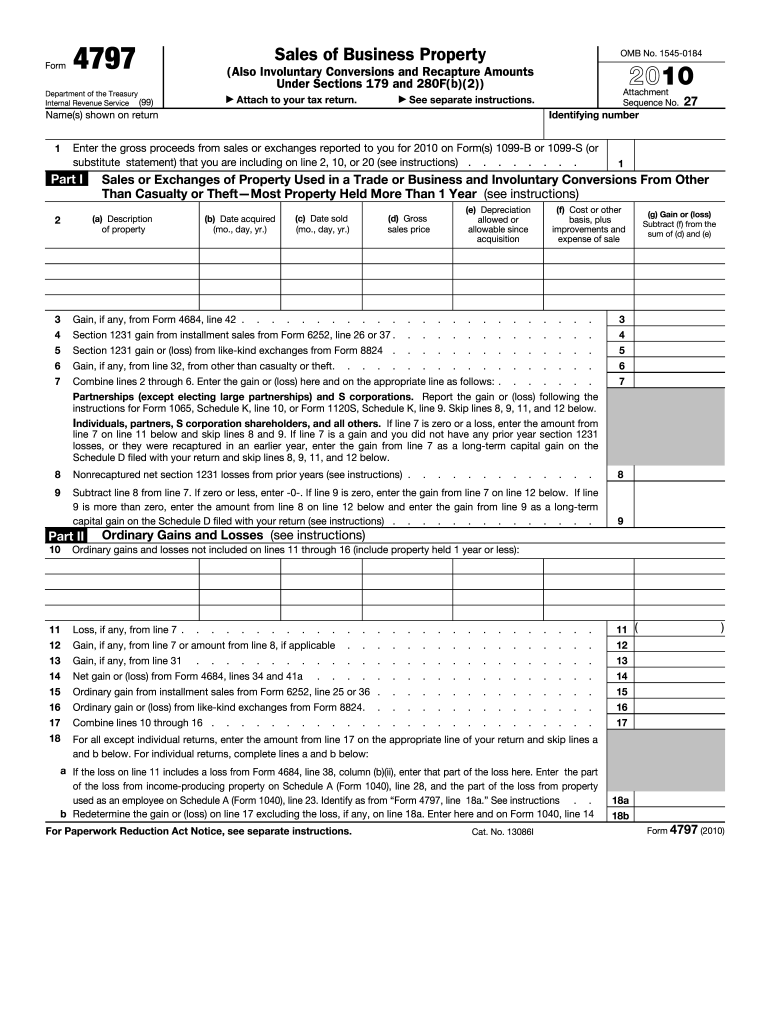

Cat. No. 13086I 18a 18b Form 4797 2010 Page 2 Gain From Disposition of Property Under Sections 1245 1250 1252 1254 and 1255 see instructions day yr. Identify as from Form 4797 line 18a. See instructions. b Redetermine the gain or loss on line 17 excluding the loss if any on line 18a. Enter here and on Form 1040 line 14 For Paperwork Reduction Act Notice see separate instructions. Enter here and on line 13. other than casualty or theft on Form 479...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 4797 - internal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 4797 - internal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 4797 - internal online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 4797 - internal. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

How to fill out form 4797 - internal

How to fill out form 4797 - internal?

01

Start by gathering all the necessary information and supporting documents. This may include details about the property or asset being reported, such as its purchase price, date of acquisition, and cost of any improvements made.

02

Then, identify the type of property being reported on form 4797 - internal. This form is typically used to report the sale or exchange of business assets, such as real estate, vehicles, or equipment. Make sure you have the correct form for the specific type of property you are dealing with.

03

Next, complete the top section of the form, which includes personal information such as your name, social security number, and address. Double-check this information for accuracy.

04

Proceed to the main part of the form where you will report the details of the sale or exchange. Provide the date of the transaction, along with the gross proceeds received and any expenses or deductions related to the sale.

05

If the property was held for more than one year, indicate whether it qualifies for long-term capital gains treatment. This will determine the tax rate applicable to the transaction.

06

Finally, review all the information you have entered on the form to ensure it is accurate and complete. Sign and date the form before submitting it to the appropriate tax authorities.

Who needs form 4797 - internal?

01

Individuals or businesses who have sold or exchanged business assets, such as real estate, vehicles, or equipment, may need to file form 4797 - internal to report the transaction. This form is used to calculate and report any gains or losses from the sale or exchange of these assets.

02

Taxpayers who have engaged in a like-kind exchange, also known as a Section 1031 exchange, may also need to file form 4797 - internal. This type of exchange allows for the deferral of capital gains taxes when certain criteria are met. Reporting the exchange on form 4797 - internal ensures compliance with tax regulations.

03

It is important to consult with a tax professional or refer to the IRS guidelines to determine if you are required to file form 4797 - internal based on your specific circumstances. The requirements may vary depending on factors such as the type and value of the asset, the duration of ownership, and the purpose of the transaction.

Fill form : Try Risk Free

People Also Ask about form 4797 - internal

Where does sale of rental property go on 4797?

What transactions are reported on form 4797?

Who has to fill out form 4797?

What is the form 4797 for sale of rental property?

Do I use form 4797 or 8949 for sale of rental property?

What is IRS form 4797 used for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 4797 - internal?

Form 4797 - Internal is not an official tax form or document recognized by the Internal Revenue Service (IRS) in the United States. It appears to be an unofficial or internal reference to a form used within a specific organization or company.

Who is required to file form 4797 - internal?

Form 4797 is required to be filed by individuals, partnerships, corporations, and other entities that have disposed of property used in a trade or business or held for the production of income at a gain or loss. Therefore, anyone who has sold or disposed of such property may be required to file Form 4797.

How to fill out form 4797 - internal?

Form 4797 is used to report gains or losses from the sale, exchange, or involuntary conversion of business property. Here are the steps to fill out Form 4797:

1. Gather information: Collect all the necessary information related to the sale, exchange, or involuntary conversion of business property, such as the date of sale, purchase price, and proceeds received.

2. Enter personal information: Start by entering your name and Social Security number (or employer identification number) at the top of the form.

3. Complete Part I: In Part I, you will report the details of the property involved in the sale or exchange. You will need to provide information about the type of property, date of purchase, date of sale or exchange, and cost basis.

4. Complete Part II: Part II is used to calculate your gains or losses from the sale or exchange of the property. You will need to provide the selling price, expenses of sale, and any adjustments to the basis of the property.

5. Complete Part III: Part III is used to report any gains or losses from the involuntary conversion of property (property that is destroyed, stolen, or condemned). Use this section if applicable and provide relevant details.

6. Complete Part IV: Part IV is used to report any installment sales or like-kind exchanges. If you have engaged in such transactions, provide the necessary information here.

7. Complete Part V: Part V allows you to report any recapture of depreciation or section 179 deductions. If applicable, enter the necessary details.

8. Complete the rest of the form: There are a few other sections on the form that may or may not be applicable to your situation. Review the instructions for Form 4797 to determine if you need to complete these sections.

9. Calculate your totals: Once you have filled out all the applicable sections, calculate the totals for each category and transfer them to the appropriate lines on your tax return.

10. Sign and date: Sign and date the form before submitting it with your tax return.

It is important to note that these instructions are just a general guide, and it is recommended to consult with a tax professional or refer to the instructions for Form 4797 provided by the Internal Revenue Service (IRS) to ensure accurate completion of the form based on your specific circumstances.

What is the purpose of form 4797 - internal?

Form 4797 - Internal Revenue Service (IRS) is used by taxpayers to report the sale or exchange of business property. The purpose of this form is to provide information about the gains or losses from the sale, exchange, or involuntary conversion of assets used in a trade or business. This form helps taxpayers determine the amount of taxable gains or losses from such transactions. It also helps the IRS track and verify the taxpayer's income and deductions related to the sale or exchange of property used in a trade or business.

What information must be reported on form 4797 - internal?

Form 4797 is used to report the sale, exchange, or involuntary conversion of certain business property, such as real estate or depreciable property. The following information must be reported on Form 4797 - Internal:

1. Identification information: Taxpayer's name, taxpayer identification number, address, and date of sale or disposition.

2. Description of property: Provide a detailed description of the property or assets involved in the sale or exchange, including the date of acquisition and original cost.

3. Sales proceeds: Report the total amount received from the sale, exchange, or disposition of the property.

4. Adjusted basis: Determine the adjusted basis of the property by subtracting accumulated deductions and depreciation from the original cost or basis.

5. Depreciation: Report any depreciation claimed on the property, including the method used and the recovery periods.

6. Gain or loss: Calculate the gain or loss by subtracting the adjusted basis from the sales proceeds.

7. Section 179 deduction: If a Section 179 deduction was claimed on the property, provide the details of the deduction taken.

8. Recaptured depreciation: If there is any recaptured depreciation, report the amount and include it in the calculation of gain or loss.

9. Installment sales: If the sale is structured as an installment sale, report the details of the sale and any subsequent payments received in future years.

10. Like-kind exchanges: If the sale or exchange is a like-kind exchange, provide the details of the property received in the exchange.

11. Section 1231 assets: If the property being sold is a Section 1231 asset, report the details of the asset and any net Section 1231 gain or loss.

It is important to consult the instructions and guidelines provided by the Internal Revenue Service (IRS) when completing Form 4797 as specific reporting requirements may vary depending on the circumstances of the transaction.

What is the penalty for the late filing of form 4797 - internal?

The penalty for the late filing of Form 4797, which is used for reporting the sale of business property, generally depends on the amount of tax owed and the length of the delay. As of 2021, the penalty for late filing can be calculated as 5% of the unpaid tax for each month or partial month the return is late, up to a maximum penalty of 25%. However, if the filing is more than 60 days late, the minimum penalty is the smaller of $435 or 100% of the tax required to be shown on the return.

It's important to note that the specific penalties can vary depending on individual circumstances, so it is recommended to consult with a tax professional or refer to the official IRS guidelines for accurate and up-to-date information.

How do I make edits in form 4797 - internal without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your form 4797 - internal, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my form 4797 - internal in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your form 4797 - internal and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit form 4797 - internal on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute form 4797 - internal from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your form 4797 - internal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.