Get the free Form 706-D (Rev. December 2008) - IRS

Show details

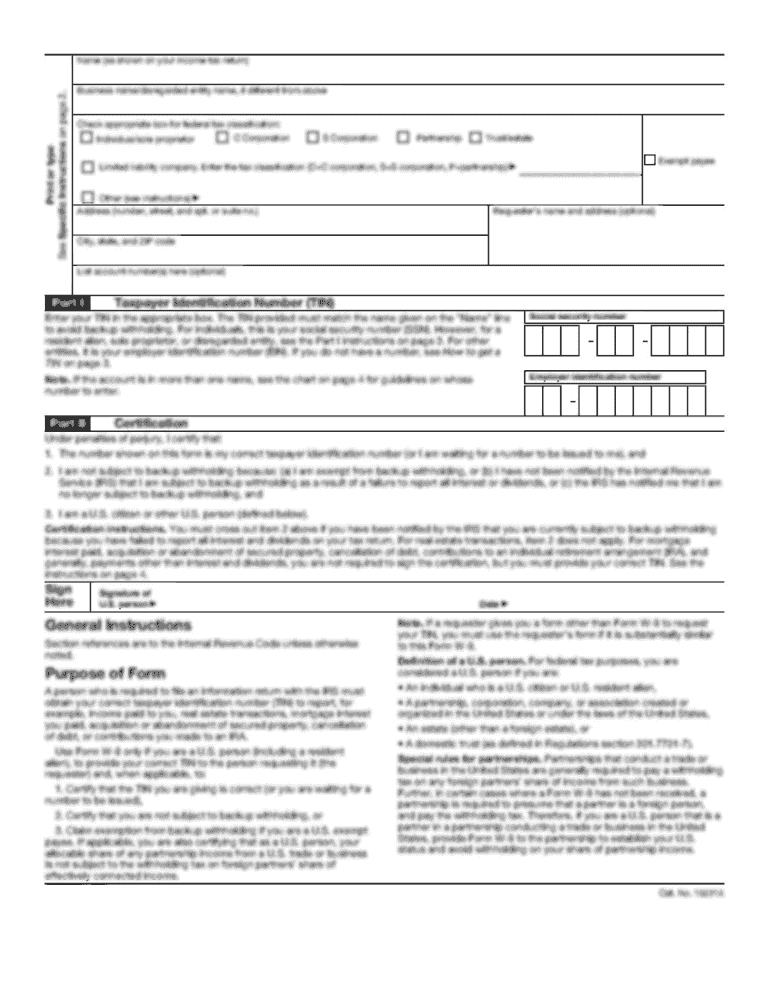

Form 706-D (Rev. December 2008) Department of the Treasury Internal Revenue Service United States Additional Estate Tax Return Under Code Section 2057 2 OMB No. 1545-1680 Part I 1a General Information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 706-d rev december form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 706-d rev december form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 706-d rev december online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 706-d rev december. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

How to fill out form 706-d rev december

How to fill out form 706-d rev december:

01

Begin by entering the name of the decedent in the designated space on the form.

02

Provide the decedent's Social Security number next to their name.

03

Include the date of the decedent's death.

04

Fill in the decedent's address at the time of death.

05

Indicate whether the decedent was a U.S. citizen or resident.

06

Complete the sections related to the decedent's spouse, if applicable.

07

Provide details about the decedent's property, such as real estate, stocks, and businesses.

08

Calculate the total value of the decedent's gross estate and report it on the form.

09

Report any deductions or expenses related to the decedent's estate.

10

Calculate the taxable estate by subtracting the deductions from the gross estate.

11

Determine the applicable federal estate tax and report it on the form.

12

Sign and date the form.

13

Submit the completed form to the appropriate tax authority.

Who needs form 706-d rev december:

01

Executors or administrators of an estate

02

Individuals responsible for filing the decedent's federal estate tax return

03

Those who are required by the IRS to file this specific form for tax purposes

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 706-d rev december?

Form 706-D Rev December is a form used to provide a detailed listing of all the property reported on Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return.

Who is required to file form 706-d rev december?

Any person who is required to file Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return must also file Form 706-D Rev December if there is any property to be reported on it.

How to fill out form 706-d rev december?

To fill out Form 706-D Rev December, you need to provide detailed information about each item of property, including its fair market value, location, and certain other specific details. The form also requires information about the decedent and the executor or personal representative.

What is the purpose of form 706-d rev december?

The purpose of Form 706-D Rev December is to provide additional information about the property reported on Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return. It helps the Internal Revenue Service (IRS) assess the correct estate tax liability.

What information must be reported on form 706-d rev december?

Form 706-D Rev December requires information such as the description of property, fair market value, location, date of death value, and other specific details for each item of property to be reported. It also requires information about the decedent and the executor or personal representative.

When is the deadline to file form 706-d rev december in 2023?

The deadline to file Form 706-D Rev December in 2023 is typically nine months after the decedent's date of death. However, it is always advisable to consult the latest instructions provided by the IRS or a tax professional for accurate and up-to-date information.

What is the penalty for the late filing of form 706-d rev december?

The penalty for the late filing of Form 706-D Rev December can vary depending on the specific circumstances. It is generally determined based on a percentage of the unpaid tax, with the percentage increasing for each month or fraction thereof that the return is late. It is advisable to consult the latest instructions provided by the IRS or a tax professional for the accurate and up-to-date penalty information.

How do I execute form 706-d rev december online?

Completing and signing form 706-d rev december online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I sign the form 706-d rev december electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your form 706-d rev december in seconds.

How do I complete form 706-d rev december on an Android device?

On an Android device, use the pdfFiller mobile app to finish your form 706-d rev december. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your form 706-d rev december online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.