Get the free Notice 931 (Rev. November 2009). Deposit Requirements for Employment Taxes

Show details

Use rid: PAGER/XMLFileid:DID noticeLeadpct: 4×Pt. Size: 8.5Page 1 of 2DraftOk to Print(Unit. & date)...4jcbdocumentsepicfilesNotice 931Oct 2009N931.XML 111609.xml13:36 24NOV2009The type and rule

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your notice 931 rev november form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice 931 rev november form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice 931 rev november online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit notice 931 rev november. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out notice 931 rev november

How to fill out notice 931 rev november:

01

Gather all necessary information and documentation required to complete the notice.

02

Carefully read the instructions provided with the notice to understand the specific requirements and guidelines.

03

Begin by entering your personal information, such as your name, address, and contact details.

04

Provide relevant details regarding the subject of the notice, such as the purpose or reason for filing.

05

Fill in any specific information requested, such as identification numbers or dates.

06

Review all the information you have entered to ensure accuracy and completeness.

07

Sign and date the notice as required.

08

Submit the completed notice to the appropriate recipient or authority, following any additional submission instructions provided.

Who needs notice 931 rev november:

01

Individuals or entities who are required by law or regulation to file this specific notice.

02

Those who have received explicit instructions or notifications advising them to complete and submit this notice.

03

Individuals or entities involved in a particular legal process or transaction that necessitates the filing of notice 931 rev november.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

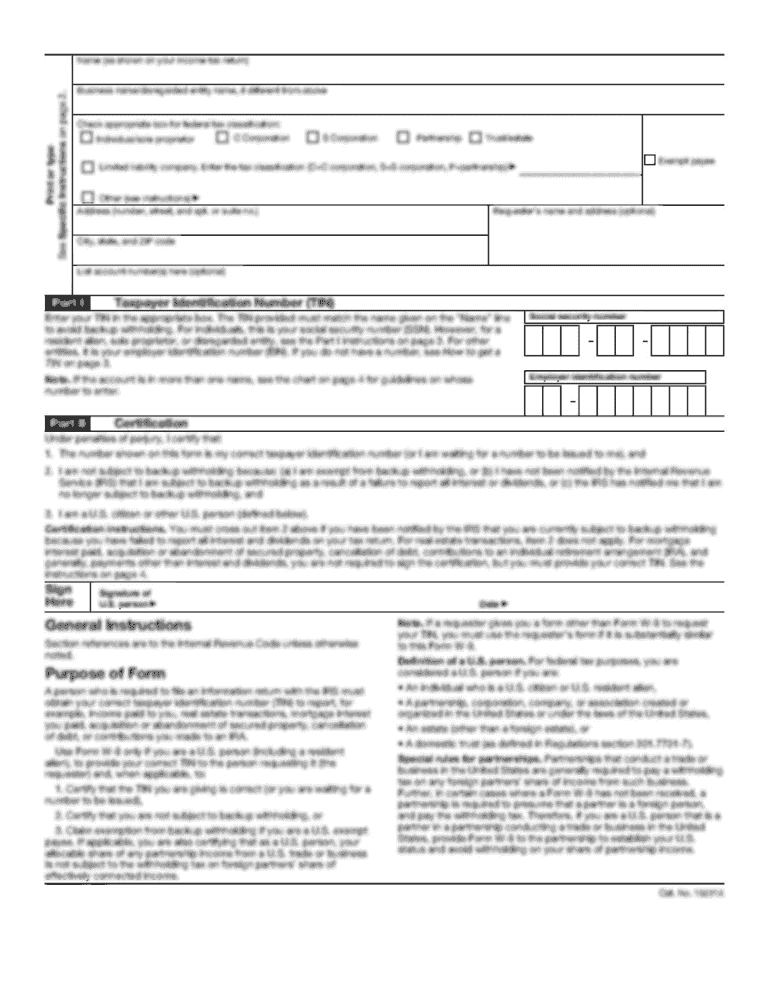

What is notice 931 rev november?

Notice 931 rev November is a form used to report certain types of income and payments made to foreign persons.

Who is required to file notice 931 rev november?

Any U.S. person who made certain payments to foreign persons during the tax year is required to file notice 931 rev November.

How to fill out notice 931 rev november?

To fill out notice 931 rev November, you need to provide information about the types of payments made, the amount, and the recipients. It is recommended to carefully review the instructions provided with the form.

What is the purpose of notice 931 rev november?

The purpose of notice 931 rev November is to report income and payments made to foreign persons for tax purposes.

What information must be reported on notice 931 rev november?

Notice 931 rev November requires reporting of various information including the types of payments made, identification of the foreign persons, and the amount of payments.

When is the deadline to file notice 931 rev november in 2023?

The deadline to file notice 931 rev November in 2023 is usually on March 15th.

What is the penalty for the late filing of notice 931 rev november?

The penalty for the late filing of notice 931 rev November varies depending on the circumstances. It is recommended to consult the IRS guidelines or a tax professional for specific information.

How do I modify my notice 931 rev november in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign notice 931 rev november and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send notice 931 rev november for eSignature?

Once you are ready to share your notice 931 rev november, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in notice 931 rev november?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your notice 931 rev november to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Fill out your notice 931 rev november online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.