Get the free Form 8082 (Rev. January 2000). Notice of Inconsistent Treatment or Amended Return - irs

Show details

Form 8082 (Rev. January 2000) Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR) (For use by partners, S corporation shareholders, estate and domestic trust beneficiaries,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 8082 rev january form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8082 rev january form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 8082 rev january online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 8082 rev january. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

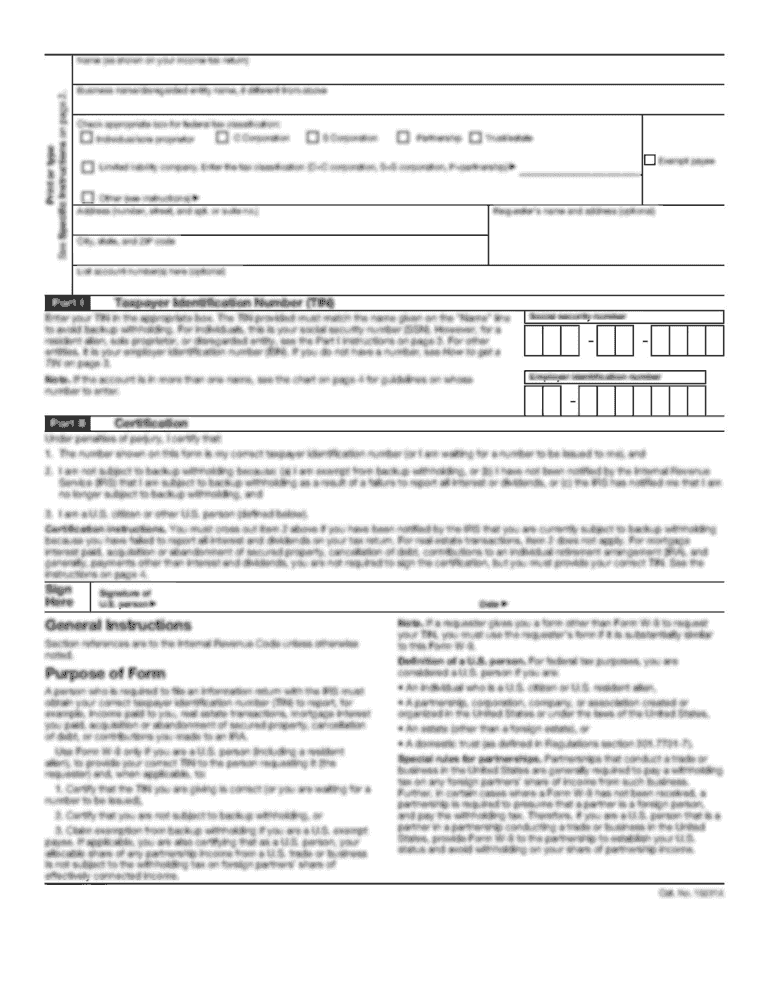

How to fill out form 8082 rev january

How to fill out form 8082 rev January:

01

Gather all necessary information and documents required to complete form 8082 rev January, such as your personal information, tax identification numbers, and any supporting schedules.

02

Start by filling out the top section of the form, including your name, address, and taxpayer identification numbers. If you are completing the form on behalf of someone else, provide their information instead.

03

Proceed to Part I of the form, where you will need to provide information about the partnership or S corporation that is required to file form 8082 rev January. This includes their name, address, and taxpayer identification number.

04

In Part II, provide details about the tax years for which you are filing the form. Indicate the beginning and ending dates of the tax year and specify whether it is an initial, amended, or final return.

05

Move on to Part III and answer the questions as they pertain to your specific circumstances. These questions will determine whether you are filing the form due to a notice from the IRS, if you are electing to apply the transitional tax relief provisions, or if there are any issues with your partner's or shareholder's tax filing.

06

If necessary, complete Part IV of the form, which relates to changes in entity classification and ownership. This section asks for information about certain transactions or elections related to the partnership or S corporation.

07

Finally, review the completed form 8082 rev January for accuracy and make sure all relevant sections have been filled out correctly. Attach any supporting schedules or documents as instructed in the form's instructions.

Who needs form 8082 rev January:

01

Partnerships and S corporations who have received a notice from the IRS requiring them to file form 8082 rev January.

02

Partnerships and S corporations who are electing to apply the transitional tax relief provisions as outlined by the IRS.

03

Partnerships and S corporations who have encountered issues with their partner's or shareholder's tax filing and need to address them through form 8082 rev January.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

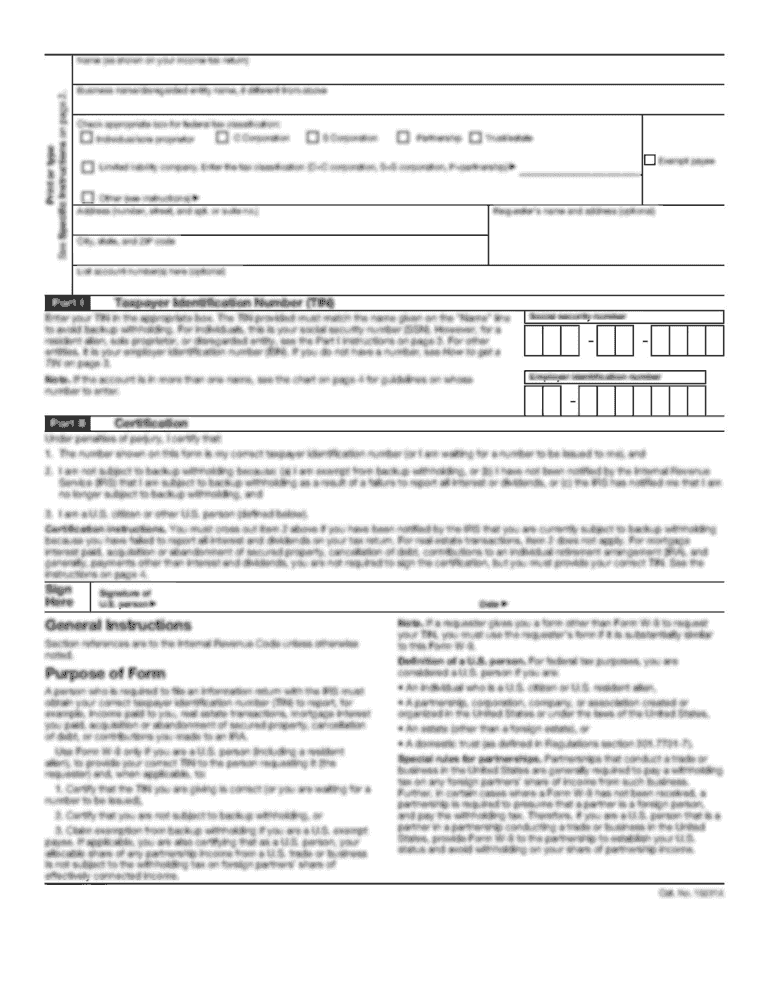

What is form 8082 rev january?

Form 8082 rev January is a tax form used by partnerships to notify the Internal Revenue Service (IRS) of any inconsistent reporting by partners on their individual tax returns.

Who is required to file form 8082 rev january?

Partnerships are required to file form 8082 rev January if any of their partners have reported inconsistent information on their individual tax returns.

How to fill out form 8082 rev january?

To fill out form 8082 rev January, partnerships need to provide their identifying information, the names of the partners who reported inconsistent information, the type of inconsistency, and an explanation or correction for the inconsistency.

What is the purpose of form 8082 rev january?

The purpose of form 8082 rev January is to allow partnerships to report and explain any inconsistencies in reporting by their partners on their individual tax returns.

What information must be reported on form 8082 rev january?

On form 8082 rev January, partnerships must report their identifying information, the names of partners with inconsistent reporting, the type of inconsistency, and an explanation or correction for the inconsistency.

When is the deadline to file form 8082 rev january in 2023?

The deadline to file form 8082 rev January in 2023 is typically March 15th, but it is always recommended to verify with the latest IRS guidelines for any potential changes.

What is the penalty for the late filing of form 8082 rev january?

The penalty for the late filing of form 8082 rev January is generally $195 for each month or part of a month the form is late, up to a maximum of 12 months. However, the penalty amount may vary depending on the circumstances, so it is advisable to consult the IRS guidelines or a tax professional for specific penalty calculations.

How can I manage my form 8082 rev january directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your form 8082 rev january along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit form 8082 rev january from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your form 8082 rev january into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for signing my form 8082 rev january in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your form 8082 rev january and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your form 8082 rev january online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.